UBS: Global Multi Asset Perspectives

June was a mixed month for global equity markets. Japanese and Asian equity markets posted solid gains, while UK and European equity markets fell. Benchmark 10-year government bond yields rose across the developed world. The euro continued to strengthen following more positive economic data.

24.07.2017 | 13:57 Uhr

The month in review:

• Global equity markets had a mixed month in June with the FTSE All World Index rising 0.2% in local currency terms. European stock returns fell back from the peaks seen in May despite continued positive economic news. Japanese equities were the top performing major market in June, with business confidence bouncing back to its highest level since early 2014 as growth accelerates. Asian emerging markets also outperformed.

• June saw central bankers adopt an increasingly hawkish tone, bringing into further question how much longer the era of ultra-loose monetary policy has to run. The perceived shift was a key driver of fixed income markets for the month. Sharp rises in yields in the final days of June saw many major government bond markets finish down for the month. Within credit markets, prices for high yield and investment grade assets continued to rise with spreads further tightening during June.

• The US Federal Reserve again increased US interest rates in June, and indicated they are likely to hike rates once more this year on expectations that the tightness of the domestic labor market would help lift inflation. This boost has not materialized as of yet and Fed chair Janet Yellen chalked up the recent decline in inflation to one-off factors such as falling prices for cell phone service and prescription drugs. Inflation in the United Kingdom (UK), however, has surged due to the increase in imported goods prices thanks to a weak pound. This surge prompted three members of the Bank of England’s Monetary Policy Committee to vote for a rate hike in June, against five votes to leave policy unchanged. Only one committee member had voted for a rate increase at the Bank of England’s previous meeting.

• In currency markets the British pound endured a volatile month as investors digested the likelihood of an imminent rate hike and after a lacklustre election campaign saw Prime Minister May’s Conservative Party maintain power but with no overall majority, dramatically weakening her leadership and the UK’s Brexit negotiating position. Elsewhere the price of crude oil fell as US inventories remained high.

Outlook:

• While monetary policy in aggregate remains supportive to risk assets, the degree of accommodation is being slowly withdrawn. The speed of tightening relative to market expecta- tions and the outlook for fiscal policy in developed economies is likely to remain key to market prospects. Significant doubts remain around President Trump’s pro-growth policy agenda. Meanwhile, the ability of the Chinese authorities to modestly tighten credit conditions and rebalance the economy without sparking a large increase in debt defaults and a sharp slowdown in demand is also important for investor risk appetite globally. Current views

Asset allocation and currency attractiveness based on fundamental valuation and market behavior analysis

Asset Class Overall signal UBS Asset Management’s viewpoint

US Equities • Our analysis shows the broader US equity market as overvalued. The key question is whether the outlook for earnings has increased sufficiently to justify the post-election equity rally. Trailing earnings are no higher than they were two years ago and on a forward-look- ing basis we estimate US earnings to be above their cyclically adjusted normal levels. The answer, therefore, would appear to be that US equities are expensive at current levels and with expectations elevated, vulnerable to disappointment. The most obvious source of that disappointment is the inability of President Trump’s pro-growth policies to be enacted at the pace and to the scale already priced in to US equities. His administration is constrained by a small Senate majority and by the realities of Washington deal making with a determined opposition.

Global (Ex-US)

Equities • Outside of the US, we see attractive valuations and the improving growth backdrop as supportive to international equities. In Europe, we continue to believe that the European earnings recovery story is gathering momentum. Initially supported by the ECB’s loose policy and a weak euro, with bank balance sheet restructuring now largely over, we see the recovery as increasingly self-sustaining. Furthermore, we expect the political risk premium reflected in European equities for so long to partially unwind in the coming months. Also the economic recovery in Japan support a constructive view of Japanese equities.

Emerging Markets

Equities • Emerging market (EM) equities have looked attractively valued for some time.• We believe that post-US election fears about the impact of a stronger USD and wider trade protectionism risks have been overdone. Thus far at least, investors’ worst fears about Trump’s trade policy have not materialised. We see the USD as late cycle and do not believe that a strong USD will derail the improvement in overall demand momentum in EM or the earnings upgrade story.

• Moreover, we see the potential boost to developed world growth from an increase in infrastructure spending and lower tax rates as positives for demand growth in EM.

US Bonds

• We see nominal US treasuries as over-valued on a standalone basis. However, with the drop in oil prices, inflationary pressures have temporarily subsided and the market’s initial expectations on the pace and scale of President Trump’s change agenda and its impact on US growth and inflation appear overly optimistic. Moreover, we expect structural deflationary forces including aging populations continuing to act as a rebalancing mechanism to significant yield rises in the medium term.

• Thus, in relative terms globally, we see nominal US Treasuries as offering attractive carry, particularly versus German bunds.

Global (Ex-US) Bonds

• In aggregate, we see global bonds outside of the US as unattractive. German bunds are particularly expensive relative to their long- term history on our analysis.

• We have a preference for Canadian bonds which we see as an attractive hedge for lower oil prices given the importance of energy to the Canadian economy. We also believe that the Canadian economy has a long process of restructuring ahead as its reliance on the energy sector diminishes. In our view, the diverging fortunes of provinces make monetary policy very difficult for the Bank of Canada.

Investment Grade

Corporate Debt • Our positive view on investment grade (IG) bonds relative to developed world sovereign debt is largely predicated on the former’s attractive yield pick-up. We see global demand for yield continuing to support IG. With a sharp rise in defaults at the higher-quality end of corporate debt unlikely—given the improving demand backdrop, balance sheet strength and generally loose monetary policy, global IG corporates should continue to offer an attractive risk-and-return profile compared with government bonds.

High Yield Bonds • We see accelerating demand growth and deregulation in the US as positive for corporate cash-flows and balance sheets and therefore as positive for US High Yield. On a relative basis, we also believe that more domestically biased high yield issuers are greater beneficia- ries of the President’s pro-growth “America First” agenda than more internationally diverse US investment grade borrowers. However, lower oil prices and the recent rally in high yield don’t make this asset class as attractive as it was earlier in the year.

Emerging Markets Debt

US dollarLocal currency • We retain a neutral view of external emerging market government bonds. We have a more positive view of local currency EM debt and believe a subset of currencies within this broad universe now look attractive on a long-term basis. The improvement in current accounts and broader economic growth now broadly balance the risks from high debt levels.

Currency • Among developed market currencies we see long-term valuation support for the euro and expect the political risk premium to slowly fade over time. Elsewhere, we view the Swiss franc as among the most expensive currencies globally on our long-term analysis.

• In emerging markets we retain a constructive view on a number of EM currencies including the Indian rupee. We believe the NewZealand dollar is significantly overvalued in a long-term context.

Definitions of metrics:

1. Asset Class/Benchmark: All investment expectations displayed here are modeled from the discounted cash flows as replicated by the relevant publicly available index. This bears mentioning because these expectations are developed assuming no benefit from active management (i.e. security selection) within the asset classes themselves.

2. Price/Value: An intrinsic value based on the cash flows that an asset class provides—discounted at an appropriate rate of return (the required rate of return)—is identified for each of the asset classes listed. The cash flows would be those that would be expected to pass through to the asset holder; in the case of equities, the relevant cash flows are earnings and non-reinvested earnings (including, though not exclusively, dividends). That intrinsic value is then compared to the market price for the proxy index, and the degree of over- or undervaluation is thereby calculated in percent.

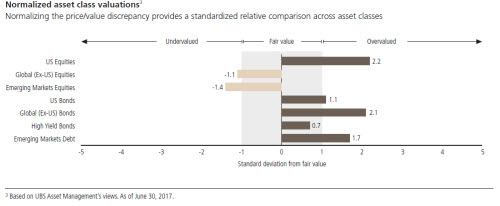

3. Normalized Price/Value: The normalized price/value represents the standard deviation, or dispersion, of the asset class from our estimate of fair value. Normalizing the price/value discrepancy provides a standardized relative comparison across asset classes. The normalized price/value is calculated by taking the price/value of an asset class and dividing it by the secular risk estimate of the same asset class.

Diesen Beitrag teilen: