NN IP: Emerging market performance affected by IT correction

The large weight of the IT sector in the EM equity benchmark explains most of the recent EM underperformance. Rising Fed rate expectations may also weigh on EM assets in the coming months. We have reduced EM equities from a small overweight to neutral.

08.12.2017 | 09:19 Uhr

The steady outperformance of EM equities this year has been interrupted in the past two weeks by the correction in global IT stocks. Since November 22nd, EM has underperformed DM by some 5%, thereby erasing two months of EM/DM outperformance. This correction is nothing dramatic though. We knew that EM equities had become highly sensitive to changes in sentiment about global IT, with IT representing almost 30% of the EM index after this year’s China Internet rally. This was the main reason why we only had a small EM overweight in the past months, despite good EM growth momentum and declining China system risk.

The steady outperformance of EM equities this year has been interrupted in the past two weeks by the correction in global IT stocks. Since November 22nd, EM has underperformed DM by some 5%, thereby erasing two months of EM/DM outperformance. This correction is nothing dramatic though. We knew that EM equities had become highly sensitive to changes in sentiment about global IT, with IT representing almost 30% of the EM index after this year’s China Internet rally. This was the main reason why we only had a small EM overweight in the past months, despite good EM growth momentum and declining China system risk.

Knowing that investor positioning in IT remains stretched and that we are in December, when investors will want to protect the gains made earlier in the year, we decided to neutralise our EM overweight all together. We prefer to sit out the IT correction for now at the sidelines. It is our intention to increase our exposure again once the dust has settled. By then, we also expect more attractive entry levels for the Chinese market. Let’s see how all this will play out, but the key observation to make here, in our view, is that EM equities are underperforming now mainly for technical reasons, related to the very strong performance of IT stocks in China.

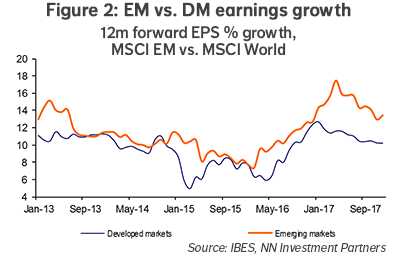

We do not think that the broader EM investment theme has changed materially. The EM domestic demand growth recovery is still ongoing, driven by a steady pick-up in EM credit growth (see Figure 1) and the industrial expansion sustained by strong global demand. The currency depreciation since 2013, the sharp growth slowdown in the years 2010-2015 and the resulting reduction in fiscal and external imbalances have created ample room for a recovery, both in economic growth and equity markets. Since 2016, we have seen a cautious widening again of the EM-DM GDP growth differential, something we think is required for a sustainable EM-DM outperformance trend in equities. Meanwhile, on a corporate earnings level, we are clearly seeing higher growth in EM relative to DM (see Figure 2).

EM financial conditions have become a bit less easy

While we say that the EM equity investment case remains intact, we cannot deny that in the margin the outlook for EM growth has deteriorated somewhat as a result of less easy financial conditions over the past few months. So far, the growth momentum has held up well. The November EM PMIs were even better than in the previous month. But the key attraction of EM equities in the medium to long term lies primarily in domestic demand growth. Hence, it is key to watch credit growth and the drivers of the recent EM credit recovery. Here the financial conditions become relevant.

Since early September, Fed expectations have started to move higher. Two additional rate hikes before the end of 2018 have been priced between September and today. This explains why emerging debt markets have been under some pressure and why within EM equities the markets with the largest external financing requirements, such as Turkey and Colombia, have been clear underperformers. The rising Fed expectations have caused a deterioration in our EM financial conditions indicator, which has moved from very easy to slightly easy. This should have some impact on credit growth in the coming months and therefore on the prospects for domestic demand growth.

We feel it is too early to get seriously worried about this. In the end, financial conditions are still not getting tighter and we do not expect more than three rate hikes by the Fed until the end of 2018 (the market has priced two now). But in an environment of sliding IT stocks and more geopolitical noise, a marginal deterioration in the EM domestic demand growth outlook, after more than a year of improving growth expectations, could create some additional headwinds for EM equities.

Our downgrade of EM equities to neutral was driven primarily by the concern that the IT correction could become more painful in the last few weeks of the year. In the background, the steady rise in the Fed funds futures and its impact on EM financial conditions have also made us feel less comfortable with an EM overweight.

Diesen Beitrag teilen: