BNP Paribas AM: European small caps, onward and upward

European economies are participating fully in the synchronised pick-up in global growth. With economies in most European countries growing strongly, many smaller firms are showing they can grow and adapt faster; small-cap stocks have shown excellent long-term risk-adjusted returns.

29.03.2018 | 15:25 Uhr

Investors in small caps currently stand to gain from larger, cash-rich companies’ M&A ambitions. It is worth having in mind that taking over a small-cap stock is often a faster and more efficient way for many large companies to find new growth paths rather than achieving that goal organically, i.e. significantly more slowly. The prospect of acquisitions of small- and mid-size European companies by larger entities is therefore currently another compelling aspect in favour of European small caps, next to the economic uptick.

Small-capitalisation stocks are typically listed companies whose market capitalisation falls in the lower tier of the market cap range, the two other tiers being mid and large-cap stocks. In Europe, a common rule of thumb says that small caps have market capitalisations of up to around EUR 3 billion and account for about 15% of the free-float adjusted equity market capitalisation of the region.

The most important point, though, is that small caps are often companies in their pioneering or early growth phase. This is perhaps the best angle to approach this group as an investor since such stocks are a way to ‘play’ the superior growth investment theme.

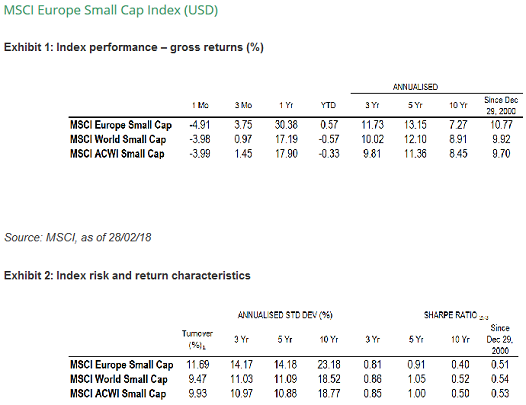

Financial studies assert that small-cap stocks in developed markets should outperform large caps over the long term, although their volatility can be somewhat higher.

Eugene Fama, a Nobel economics laureate in 2013, and Ken French produced what is regarded as the definitive study showing that over time, small-cap stocks unmistakably tended to outperform larger capitalisation companies. Other research supports the same conclusion, even when approaching the subject from different angles.

This seems to be a global pattern since only very rare exceptions invalidate this view, as shown by a study by Elroy Dimson and Paul Marsh, two London Business School academics. And when it does, it seems to be due to the widespread dominance of local oligopolies that leave no room for small caps even to exist, such as in Mexico or Malaysia.

In effect, past performance commonly shows that small-cap companies have generated significantly higher annualised returns than both their large-cap counterparts and the MSCI World Index, with only moderately higher volatility. In other words, not only has the absolute return been stronger for small-cap stocks, but the risk-adjusted performance (as measured by a Sharpe ratio for instance) has been superior as well.

What lies behind the outperformance of small caps in the long run?

Sales and earnings growth are key drivers of long-term performance for equities, and they happen to be often stronger for small-cap stocks than for larger listed companies. Part of the explanation for this is the fact that small caps often invest significantly more, relative to their size, than their larger counterparts. For instance, small caps often spend more on research and development (relative to sales) than large caps. Investing in small-cap stocks also coincides with capturing the returns from the early stages of new industries as they develop and benefit from the more entrepreneurial management and flexible business models inherent to their smaller size. Many such companies can indeed capture new market opportunities and adapt more quickly to changing trends, which is subsequently reflected in more robust sales and earnings growth.

Does the current environment favour European small caps?

Above-trend e conomic expansion is still underway in Europe (with GDP growth of above 2% expected by most strategists in 2017, 2018 and 2019). This is a favourable environment for small-cap companies whose revenues are less international and (by the same token) more regional than those of large-cap companies [1]. The other benefit of this “regional” characteristic is to make small-cap stocks relatively more immune than large-caps to protectionism (previously a low-probability risk but now a distinct possibility).

As we have already pointed out, given that growth is strong in Europe, large companies (notably from outside Europe) could find it attractive to capture market share within the European region through acquisitions of European small caps. Conditions currently look favourable for continued M&A activity at this stage of the economic cycle.

Why is stock selection so important for small caps?

Using analyst coverage data for small and large-cap stocks, i.e. the number of analysts providing at least one annual earnings forecast for a company, we find that small-cap companies on average attract nearly three times less research coverage than large caps. And that is unlikely to improve post MIFID II implementation. This lack of coverage can lead to significant inefficiencies and mispricing of small-cap equities, which can be exploited through a combination of solid proprietary company research and active portfolio management.

Ultimately, our view is that in the small-cap universe, alpha is best generated through a bottom-up approach. However, with around 1000 constituents in the MSCI Europe Small Cap index, how does a bottom-up fund manager narrow such a broad universe?

To make such a broad investment universe ‘manageable’, our six strong European small and mid-cap team – where each member combines analyst and portfolio manager responsibilities and has an average experience of 16 years – has developed powerful proprietary quantitative screening tools that reduce this vast investment universe to a more accessible size. Filters, such as superior balance sheet quality, growth potential and cash flow returns, are involved in this process.

The tool helps portfolio managers identify companies that score highly, and these are then subjected to further in-depth, inhouse research. The success of blending quantitative screening with subsequent qualitative research is reflected in the long-term performance of our European small-cap strategy.

Because of the importance of the stock selection process in delivering consistent alpha from this very dense investment universe, we believe that an assessment of the stock selection skills of the portfolio managers is a prerequisite to any investor’s decision to allocate to this rich, but broad European small-cap universe.

Diesen Beitrag teilen: