UBS: Booming M&A - what’s the big deal?

Global M&A activity in the first three months of 2018 was the strongest on record. Investment Insights looks at the macroeconomic drivers to this boom in deals, whether they are likely to continue and what this says about the economic cycle.

26.07.2018 | 13:00 Uhr

– Global Merger & Acquisition (M&A) accelerating to record levels as cash-rich corporate balance sheets, strong corporate confidence, low borrowing costs combine with robust global growth backdrop to drive deal flow.

– Disruptive technologies, structural industry change are major factors in increasing corporate activity across telecoms, media, IT, healthcare, pharmaceutical and retail.

– Shareholder activism, private equity cash pile increasingly powerful long-term supports to M&A.

– Cross-border deal flow remains strong despite geopolitical risks as digital due diligence tools de-risk M&A and aid integration.

– 2007 revisited? We see structural and strategic motivations rather than synergy-led growth for growth’s sake as the major drivers to M&A. Scant evidence of late cycle excess to-date.

– Rising M&A likely to act as ongoing support to global equities.

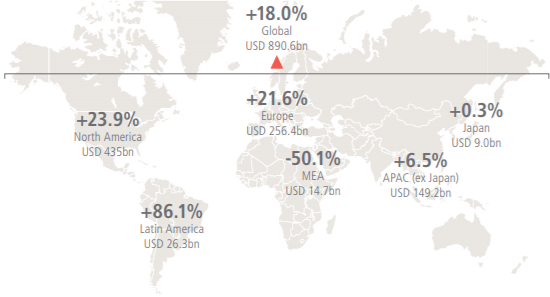

Exhibit 1: Global M&A Q1 2018 values, % change v Q1 2017.

Source: Mergermarket’s Global and Regional M&A Report Q1 2018

After an 18 month delay due to anti-trust objections raised by the US Department of Justice, the completion of the USD 85bn takeover of media group Time Warner by telecoms giant AT&T in June to create a ‘media vertical’ is seen by many as opening the floodgates to further major deals in the telecoms and media sectors. But if the blurring of the lines between traditional media and technology is likely to drive a swathe of other major content and distribution tie-ups, the two sectors are hardly alone in seeing an increase in corporate activity.

According to Mergermarket’s Global and

Regional M&A Report Q1 2018, the value

of M&A globally in the first three months

of the year was USD 890.6bn, up 18%

yoy and the strongest start to the year

since Mergermarket’s records began in

2001. With 14 ‘megadeals’ above USD

10bn across business services, energy,

construction, real estate and consumer

sectors, the figures are notable for their

breadth by sector and geography, as

well as for their scale. More recent

newsflow, including the AT&T/Time

Warner decision, suggests no let-up in

the pace of activity since the end of Q1.

The key question for investors is whether

this M&A boom is a short-term anomaly

or something more substantial and

sustainable that will influence markets

over a meaningful horizon. We believe it

is the latter. In truth, the case for

increasing M&A globally over the next

one to two years was already compelling

even before the US government’s

objections to the AT&T/Time Warner

deal were so comprehensively dismissed.

Backed by a perfect storm of strong

global growth, cash rich corporate

balance sheets, low borrowing costs,

high levels of corporate confidence and

technology-led structural change across

industries, 2018 was already shaping up

to be a record year of corporate activity.

Return of animal spirits

With global growth rates comfortably

above-trend and US economic momentum

particularly robust, the demand

backdrop certainly appears conducive to

deal making and, in our view, is likely to

remain so. Corporate confidence in this

environment remains high. According to

NFIB’s Small Business Optimism Index in

the US, confidence is at a 34-yr high—

helped by all-time highs in some index

components including expectations

for business expansion and positive

earnings trends.

In a recent survey by global consultancy

EY, (Global Capital Confidence Barometer,

April 2018), some 86% of the corporate

and private equity respondents said they

expected the overall M&A market to

improve over the next 12 months. Strong

corporate earnings, particularly in the

US, and a belief that credit availability

will remain strong are the key ingredients

here alongside the return of animal

spirits in corporate America. Doing deals

clearly involves risk. We therefore see

current high levels of corporate optimism

as an important support to M&A.

Tax cuts supporting

US deal flow

A key driver of US corporate confidence

comes from recent tax reform. Indeed,

the Tax Cuts and Jobs Act has changed

the tax landscape in a sufficiently

material way to be a driver of increased

M&A activity in itself. In simple terms,

the reduction in the federal corporate

income tax rate from 35% to 21%, the

introduction of a territorial tax system

(tax free dividends from overseas

subsidiaries), and the provisions for the

repatriation of cash held in overseas

subsidiaries by US corporates are in

aggregate likely to increase cash on

balance sheets immediately, in some

cases considerably. The tax reform

therefore provides additional firepower

for M&A deals as well as making

domestic US targets more attractive.

Diesen Beitrag teilen: