NN IP: Preference for risky assets remains in place

We expect a further rise in bond yields, driven by strong macro data and changing Fed expectations. Additionally, the risk of positive inflation surprises seems bigger than the opposite.

30.11.2017 | 15:52 Uhr

Government bonds at risk

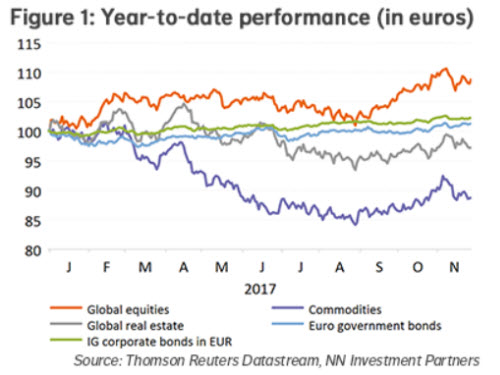

Over the past trading days, risky assets witnessed a modest recovery after the position-driven sell-off of mid-November.

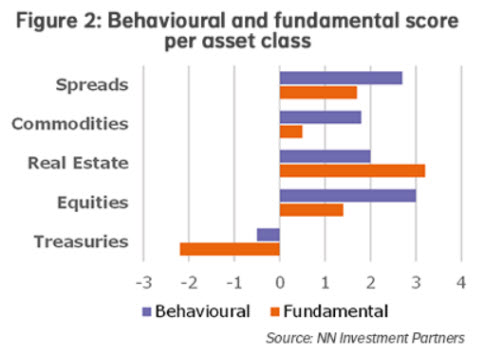

The fundamentals remain strong, combining good macro and earnings data, gradual central banks and, in the case of equities, an attractive risk premium. This is also reflected in our scorecards, where the fundamental and behavioural data continue to point into the same direction. This is illustrated in Figure 2.

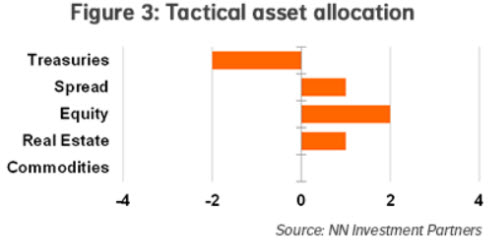

Last week, we cut our underweight in treasuries one notch further to a medium underweight. Since then government bonds have moved rather sideways until yesterday (10-year German Bund yield are 5bps up). From here, we expect a further rise in bond yields driven by strong macro data and changing Fed expectations, despite the German yield curve being relatively steep. Additionally, the risk of positive inflation surprises seems bigger than the opposite. We also believe that at these levels the downside protection provided by German Bunds is limited.

Equities remain our preferred asset class within risky assets. We hold on to a medium overweight for this asset class while leaving both spreads and real estate at a small overweight.

Diesen Beitrag teilen: