NN IP: Asset Allocation - Back to normal?

Market behaviour has normalized after the big correction two weeks ago. The fundamental strength continues to support the risk-on trade. Should one now prefer equity over other risk assets?

22.02.2018 | 12:32 Uhr

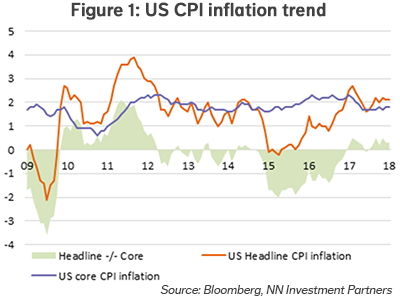

Markets have calmed down after the large sell-off two weeks ago. Equity and credit markets regained part of their losses and the VIX retraced from 35 to 20. The biggest surprise last week was the market response to the higher than expected US CPI numbers on Wednesday. Bonds sold off, as could be expected, but equity markets moved up with strong gains on the day for the S&P 500. This was counterintuitive as many market watchers had pointed to higher inflation as one of the triggers for the sell-off a week before. It seemed that investors were rather relieved that the report was out than worried about the actual level. Maybe they realize now that a little inflation is not that bad at all for stocks. After all, we still expect a gradual path for both inflation and Fed rate hikes. Or maybe the sell-off was simply too severe in view of the fundamental picture.

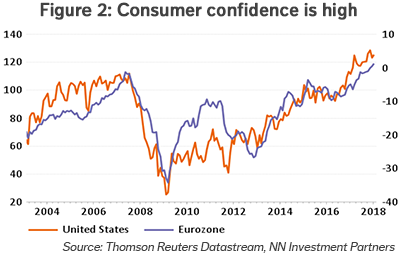

The positive fundamental backdrop is still very much in place, as illustrated by the very high levels of consumer confidence in both Europe and the US (see Figure 2). Also the corporate fundamentals have, if anything, continued to improve with 2018 earnings estimates being revised upwards following a strong earnings season.

Prefer equity over other risky assets

The strong fundamental picture still translates into positive fundamental TAA sig-nals for most risky asset classes and still supports a negative stance on government bonds. The decision to overweight equity and stay neutral for real estate, commodities and spreads is based on our behavioural and technical analysis. Equity scores more or less neutral on our behavioural indicators like sentiment, momentum, liquidity and flows, but is supported by short-term technical and positioning data. On short-term technical metrics equity moved very fast from being overbought to close to being oversold. The picture is somewhat different for real estate, where sentiment and momentum are clearly negative, or for spread products where the short-term flows have become a headwind at historically low levels of spread.

Diesen Beitrag teilen: