NN IP: A Christmas present from Congress

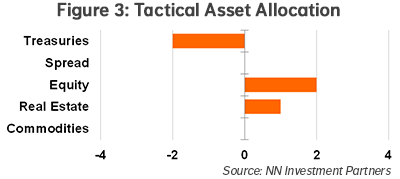

In 2017 we climbed the wall of worry to reach a “goldilocks” environment. We make no changes to our tactical asset allocation and enter 2018 with a moderate risk-on stance.

22.12.2017 | 16:40 Uhr

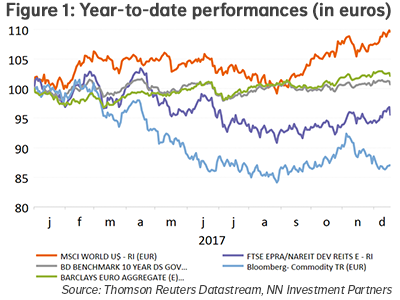

This is the final weekly Houseview of this year and we can look back to a good year that surpassed our initial expectations. Currency weakness, specifically the 11% depreciation of the USD against the EUR, was the biggest headwind and kept the euro-based return in real estate and commodities in negative territory.

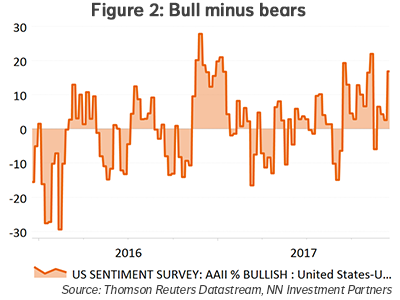

Indeed, while scaling the wall of worry in 2017 we came close to a “goldilocks” scenario. Macro data improved, earnings growth was strong, business and consumer confidence soared and the lack of inflation kept central banks on a very gradual tightening path. The Eurozone Political overcame political hurdles and the US government delivered its first big election promise: a USD 1.4 trillion tax cut boosting corporate profits. The real economic impact remains to be seen, but we do not expect a big growth push. Despite all this, investors remained relatively cautious and signs of exuberance were not widespread.

We will enter 2018 with a moderate risk-on stance. Equities are a medium overweight and real estate is a small overweight. German Bunds remain our least preferred asset class with a medium underweight.

Diesen Beitrag teilen: