NN IP: Spike in volatility

Equities, spreads and commodities all had a bumpy ride downwards in the past week, with lots of intraday volatility.

14.12.2018 | 09:48 Uhr

It’s been another bumpy week in markets. Just when we were hoping for some calm with the closure of the US markets a week ago for the funeral of former President George H.W. Bush, equity markets sold off heavily in Asia and Europe on Thursday. Equities, spreads and commodities all had a bumpy ride downwards this week, with lots of intraday volatility.

A key reason for the spike in volatility was the news that, at the request of the US government, Canadian authorities had arrested Meng Wanzhou, Huawei CFO and daughter of the company’s founder, for alleged violations of Iranian sanctions. Following the news that a Canadian court had granted her bail Tuesday, Asian markets staged an overnight recovery.

In the last five days, equities lost between 1.5% and 5%, while high yield spreads widened more than 10bp and Bund 10-year yields fell back to 0.24%. Political events played a large role again in markets, overshadowing the economic data. To summarise:

- The Italian government has shown increased willingness to play by Europe’s rules.

- The vote on the Brexit deal has been postponed; Prime Minister Theresa May survived a confidence vote in Parliament yesterday

- The OPEC meeting resulted in oil-supply cuts that were close to expectations.

- The US is risking a government shutdown following yesterday’s confrontational meeting between President Donald Trump and leading Democrats in the White House.

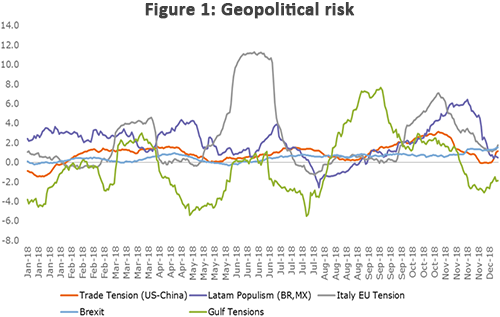

Our big data indicator, as presented in Figure 1, shows that geopolitical risk is rising again after a short period of stabilisation.

We maintain an underweight position in equities and remain neutral on duration for the moment. Both positions are supported by our signal set. We do notice clear signs of government bonds being overbought, so we are are closer to re-entering an underweight than last week, but are holding on for the moment.

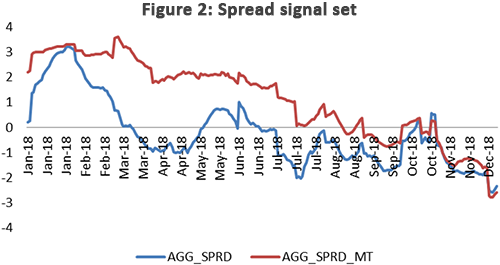

We decided to cut our spread allocation from neutral to a small underweight. Our top-down signal set deteriorated further, for both the short and medium term, due to a deterioration in investor sentiment. Rising corporate leverage, late-cycle behaviour and low liquidity are also headwinds for the asset class.

Diesen Beitrag teilen: