NN IP: Growth assets get more support from fundamentals

Strong Q2 corporate earnings are overpowering trade fears. Our preference is for growth assets over yield assets; we have upgraded equities and spreads.

03.08.2018 | 12:12 Uhr

The fundamental background for risky assets continued to improve over the past week. US Q2 earnings are amongst the best reported in many quarters, with all sectors except energy beating on earnings. In addition, after the Juncker-Trump meeting it became clear that trade risks are two-sided, even if the agreement lacks details and could lead to a protracted period of negotiations. For the time being, the freezing of the implementation of tariffs on car imports in the US is positive. Another positive is the targeted policy easing in China to counterbalance the negative growth impact of trade tariffs. This has clearly changed our view on EM assets, equity as well as debt.

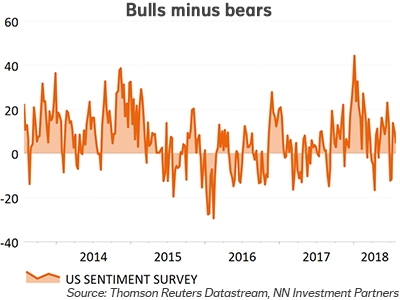

The market dynamics have also improved with strong price momentum and favourable liquidity and flow conditions in equities. Positioning is at the low end of the range according to both our DIPS indicator and the latest Fund Managers Survey. The bull-to-bear indicator continues to flip-flop around the neutral level.

As a consequence, we upgraded equities from a small overweight to a medium overweight. We also upgraded spreads from a small underweight to neutral. The market dynamics that were previously very negative have strongly improved. All subcomponents, i.e. price momentum, sentiment and flows, have risen. As is the case for equities, especially EMD, the environment has become more positive. This is also partially thanks to the Chinese easing measures. Finally, the economic and corporate fundamentals are supportive for the asset class (low default risk).

We made no changes in the other asset classes. Treasuries remain a small underweight. We are in the lower end of a trading range (25bp-75bp) and central banks are continuing the normalisation process. We expect two more Fed rate hikes this year, followed by another three next year and we expect the ECB to end its QE program by the end of this year. Over the past week, rumours popped up regarding a shift in the policy of the Bank of Japan, putting upward pressure on Japanese bond yields.

Commodities remain neutral. Chinese easing and a softening of the trade tensions are supportive for the cyclical commodities and Agriculture.

Finally, we maintain a neutral stance on real estate. It is vulnerable to a rise in bond yields and is coping with structural challenges (trend towards flex work and the shift towards online shopping). Positioning in real estate has also risen.

Diesen Beitrag teilen: