Morgan Stanley IM: Private Markets Asset Allocation Framework

This paper introduces our proprietary Private Markets Asset Allocation Framework (PMAAF), designed to help investors think about how to allocate their dry powder across private markets and cycles.

16.03.2023 | 08:54 Uhr

Here you can find the complete article

The private markets ecosystem has a wide variety of strategies, participants, assets and dynamics. We favor this space given the large alpha potential and certain diversification benefits relative to traditional public markets. However, the lack of public information, limited availability of private data, delayed valuations, illiquidity, wide dispersion of returns and behavioral biases all combine to create a challenge for an investor to determine:

- Asset allocation decisions and relative attractiveness across time periods.

- Portfolio construction decisions and relative attractiveness across asset classes and strategies.

- A consistent way to monitor the health and risks of private markets.

We approached this problem by creating a framework that builds from the systematic, objective and data-driven methodologies many investors use to determine allocations in public markets and complementing it with inputs dedicated to private markets

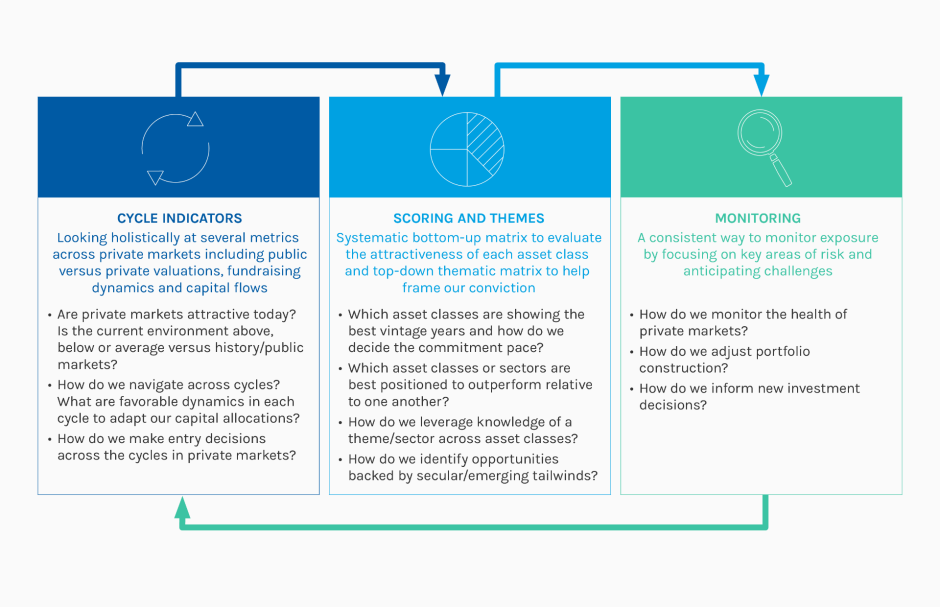

PMAAF is a process built on three pillars, outlined below

DISPLAY 1 Our Private Markets Asset Allocation Framework (PMAAF)

We believe that today a larger and more diverse allocation, with more asset classes now accepted as “core” alternatives, as well as an increasing number of new investors in private markets, requires a well-established, repeatable, objective and data-driven framework to support investment decisions. Our three-pillar framework, combining cycle indicators, quantitative fundamental scoring and qualitative thematic overlay, reinforced with an independent monitoring oversight process, could help investors navigate the challenges intrinsic to private markets.

Diesen Beitrag teilen: