Janus Henderson: Where and when to go active

In part one of this two-part mini-series, Nick Watson, portfolio manager with Janus Henderson’s UK-based Multi-Asset Team, discusses the roles that both active and passive investing can play. He argues why it is crucial to consider questions of ‘where’ and ‘when’ when making allocation decisions.

11.04.2018 | 12:13 Uhr

Allocation considerations

As a portfolio manager on the Multi-Asset desk at Janus Henderson, I can find myself occasionally in an awkward position when it comes to the active versus passive debate. As a team, we are responsible for actively managed portfolios so, of course, I see the benefits of this approach. Equally, like all investors, we want to carefully balance the trade-off between fees and potential performance when deciding between active funds and passive instruments within our portfolios.

As a portfolio manager on the Multi-Asset desk at Janus Henderson, I can find myself occasionally in an awkward position when it comes to the active versus passive debate. As a team, we are responsible for actively managed portfolios so, of course, I see the benefits of this approach. Equally, like all investors, we want to carefully balance the trade-off between fees and potential performance when deciding between active funds and passive instruments within our portfolios.

Central to our approach is the belief that active managers do add value – just not in every market environment. Just as an asset allocator aims to add value by navigating between asset classes, regions, and investment styles throughout the course of a market cycle, blending active managers with passive instruments to different ratios at different times also has the ability to enhance client returns.

Historical data indicates that active management adds value (and becomes increasingly important as a proportion of total returns) in lower return environments, while raging bull markets suit passive exposure as fundamentals recede and intra-market correlations rise.

Given our view of current market conditions – elevated valuations, uncomfortable markets levels, the maturing of the economic cycle, and the withdrawal of the quantitative easing (QE) punch bowl – we see a sustained lower return, higher volatility environment ahead. As such, we are tilting our instrument selection towards active managers across equities and fixed income.

Regional variations: weighing risks and opportunities

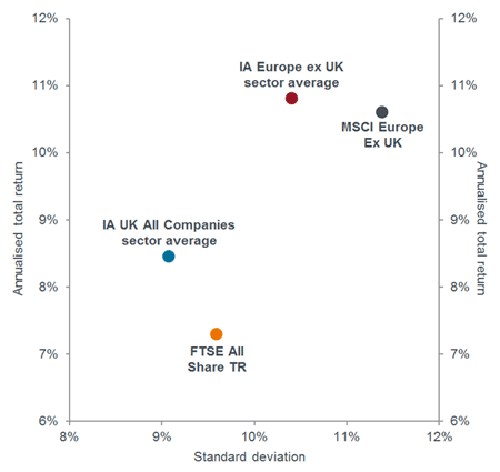

There are some areas and asset classes in which active investing comes more to the fore, specifically when the investment opportunity-set provides plenty of scope for active stock pickers to add value in a range of market environments. As a case in point, data indicates that the average manager in UK or European equities has offered investors improved outcomes in terms of lower risk and enhanced returns over the medium run. Chart 1 indicates that this has been the case for certain Investment Association (IA) groups in relation to the FTSE All-Share and MSCI Europe ex-UK Indices over the past five years.

Chart 1: UK and Europe: active has delivered enhanced returns and lower risk

(Source: Morningstar Direct, monthly data net of fees from 1 March 2013 to 28 February 2018, in sterling terms. UK and European Investment Association (IA) sector averages and UK FTSE Total Return (TR) and MSCI Europe ex-UK indices are shown here for illustrative purposes. Their use does not constitute investment advice. Past performance is not a guide to future performance.)

From a fund selector or asset allocator perspective, there is a broad universe of talented active managers from which to select and add a level of alpha. There are many compelling examples of long-term fund managers, who have added alpha over the long run despite dramatically different investment styles and philosophies. The skill when selecting these is identifying the alpha generators who genuinely add value and then blending them to suit one’s overall top down view.

Areas such as emerging markets (EM) and Asia present a different, but still constructive, dynamic, where active managers generally lag strong markets, but have been able to smooth volatility and deliver improved risk-adjusted outcomes for their clients. Over long time periods, such an approach has outperformed the wider EM Index on a total returns basis but with considerably lower levels of volatility. Passives can, of course, be used in these instances; however one can argue the opportunity for better risk-adjusted returns is lost.

US: an alpha drought?

Active is a complex creature, though, and the benefits from an active approach are not a universal phenomenon. In some markets, notably US equities, active managers have historically struggled to add value over the long run. The arguments for this are well-established, that the US large-cap market is the most researched in the world and markets are so efficient that any new information is immediately priced in. This lack of inefficiencies can limit the scope for an active manager to consistently generate alpha.

It has been argued that this ‘drought of alpha’ has been amplified by the impact of QE and extraordinary monetary policy, which has pushed markets to all-time highs and focused investor attention further away from fundamentals.

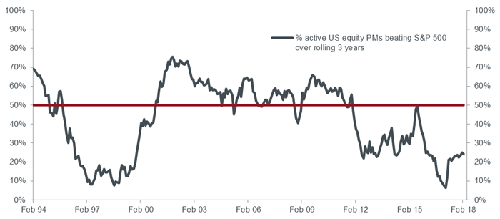

This environment has left active managers seeking to justify inflated company valuations that have, in some instances, become divorced from corporate realities. This tidal wave of cheap money generated some challengingly negative relative outcomes for active managers in the US as correlations between companies spiked and market volatility collapsed. Morningstar data reveals that roughly 75% of active US large-cap managers have underperformed the S&P 500 Index over the past three years, a narrative that has been in place since the initiation of QE (see chart 2).

Chart 2: US large-cap active approach struggling in recent years

(Source: Morningstar Direct as at February 2018. Morningstar large-cap funds, S&P 500 Index, monthly performance data since February 1991, rolling three-year data, net of fees. PM = portfolio manager. Red line = 50%. This section of the US market is shown here for illustrative purposes, and does not constitute investment advice. Past performance is not a guide to future performance.)

At this point, you might assume that we would choose to go fully passive for US equities. The reasoning being that the opportunity cost of active management appears too great in this region (as markets are so efficient) and the scope for bottom-up analysis to add value is negative.

Not so. In reality, we are moving in the opposite direction by fading out of passive equity exposure in favour of active managers. This is because timing is also a crucial consideration for active and passive investment. There is a time and a place for active managers – and we think that time is now.

Active: Why now?

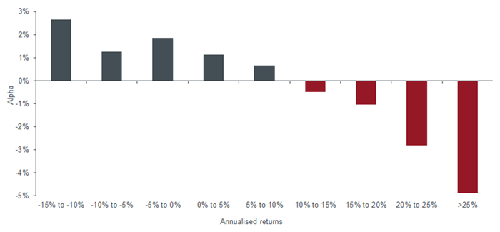

Active US managers have historically lagged raging bull markets. As market returns strengthen, this active underperformance dynamic becomes more unpalatable for fund selectors. In periods where the S&P 500 delivered 25% annualised over a three-year period, active managers underperformed on average by around -4% per annum (see chart 3).

Chart 3: Active US managers have lagged raging bull markets

(Source: Morningstar Direct, data from February 1991 to February 2018. Morningstar large-cap funds, S&P 500 Index, performance net of fees, annualised returns and alpha, rolling three-year basis. US data is used for illustrative purposes only and does not constitute investment advice. Past performance is not a guide to future performance.)

By contrast, in a more modest return environment where the S&P 500 Index returns under 10% per annum on a rolling three-year basis, US active managers have generated alpha net of fees over the most efficient market in the world. This leads us to the uncomfortable question facing all investors – what returns can clients reasonably expect over the medium term?

Fertile hunting ground

All investors have benefited from the fantastic investment environment of the past eight years, with low but improving growth expectations, muted inflation, cautious positioning, and QE depressing volatility and supercharging investment returns across all asset classes. However, the tone of this market rally is changing. Interest rates are going up, inflation is rumbling in the background, investors remain exuberant, and the era of extraordinary monetary policy is coming to an end. When the shifts in these macro factors are assessed against a backdrop of elevated valuations and historically high levels of corporate profitability in the US, it is easy to formulate an outlook of lower returns going forward.

We believe that this environment should suit active managers in all asset classes, as fundamentals return to the fore and beta is less of a driver of returns. It is this environment that presents a more fertile hunting ground for active managers to add alpha – alpha that is going to become increasingly valuable.

To the second part: Janus Henderson: Where and when to go active (part 2)

Glossary:

Alpha = alpha is the difference between a portfolio's return and its benchmark’s return after adjusting for the level of risk taken. A positive alpha suggests that a portfolio has delivered a superior return given the risk taken.

Diesen Beitrag teilen: