NNIP: Politics still moving the markets

While political news continues to move markets, there are reasons for optimism. Our allocation stance remains unchanged.

12.07.2018 | 13:35 Uhr

Markets continued to respond to the daily political news flow in the past week. In the UK, the Brexit drama took a new turn with the resignation of key cabinet members who favoured a hard Brexit. The market impact is thus fair fairly limited; the fear of an escalating trade war is still the more prominent theme. Last Friday, the US implemented tariffs on another USD 34 billion of Chinese goods, and an additional USD 16 billion is in the pipeline. On Tuesday, the situation deteriorated with the publication of a list of USD 200 billion in Chinese products to be hit by a 10% tariff. In addition, fears are still very much alive that the US will impose a tariff on European cars and force the EU to retaliate. As we noted last week, China’s statements that it will not use exchange rates as a tool to cope with trade conflicts have provided some relief for markets, especially in Asia, and helped stop further depreciation of the Chinese currency.

Investor sentiment becoming more constructive

There are still some fundamental and behavioural reasons for optimism. June US ISM manufacturing was stronger than expected, and we have seen surprise indicators reach a bottom, both in developed and emerging markets, which provides more evidence that global economic growth is stabilizing at a high level and that a period of weaker data is behind us. However, we do not yet see this improvement reflected in our own cyclical indicator, which measures changes to a broad set of leading indicators.

This week, the Q2 earnings season will kick off, and we expect a strong set of numbers. The important element, though, will be the guidance. How big an impact from the trade wars do companies expect to see on their business activity?

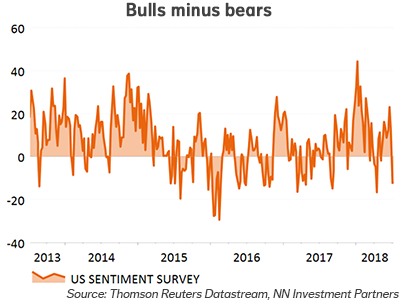

Investor sentiment also gives us reason to become more constructive on markets. Bull/bear and put/call ratios show that investors are already quite pessimistic. Dynamic positioning indicators show that investors hold a low beta positioning on average. Technical indicators are neutral for equities but indicate that treasuries are overbought.

Asset allocation unchanged

Balancing out the political uncertainty with hopeful fundamental data, we maintain our allocation stance. For fixed income we are keeping an underweight duration. Better economic data, higher commodity prices, fading political risks in Europe and readings on our short-term dashboard all support higher yields on the bund, which is currently trading at the bottom of its trading range. On spreads, technical trends are our main reason for staying underweight. We are more concerned about EM, where the fundamentals (dollar, oil prices, more rate hikes) provide reason for caution as well, whereas DM markets offer some more comfort on economic fundamentals.

Diesen Beitrag teilen: