NN IP: Rally in risky assets losing steam

We retain our top-level allocation and project technical support for investment-grade financials in the coming months.

01.02.2019 | 12:15 Uhr

We did not change the top level of our Asset Allocation stance this week. We still have small negative stances on global equities and spread products. We remain neutral on European government bonds, commodities and real estate.

Performance of risky assets has been relatively flat over the past week, suggesting that the rally has been losing steam. This may appear surprising at first glance, given the clear dovish message sent by European Central Bank President Mario Draghi last Thursday, followed by an article in The Wall Street Journal highlighting the possibility that the US Federal Reserve may unwind its balance sheet earlier than expected. At the current juncture, new positive catalysts seem to be needed to further fuel the market rebound.

It is far from certain that any constructive news flows beyond some positive general headlines will come out of this week’s China-US trade negotiations in Washington. In short, we should not expect any deal, but rather positive broad rhetoric from both sides that a deal by 1 March may be likely. After all, it is in both parties’ interests to reach an agreement at some point.

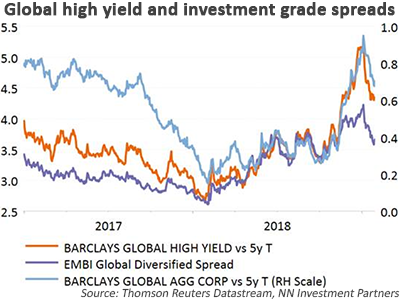

Within credits, we kept our positive tilt toward sovereign emerging market debt (EMD) in hard currency. But we moved from a short US investment grade (IG) versus long EMD position to a short US high yield versus EMD. The rationale behind this call is related to our view on financials. We see strong technical support for financials globally in the coming months. One such factor is the prospect of targeted long-term refinancing operations (TLTROs) in the Eurozone in response to deteriorating economic momentum in the region. New measures announced this week by the People’s Bank of China to stimulate bank loans to the private sector are also positive for IG financials.

Diesen Beitrag teilen: