NN IP: Positive news on trade front spurs rise in asset prices

We downgrade commodities and remain underweight on equities as fundamentals look weak.

15.02.2019 | 10:22 Uhr

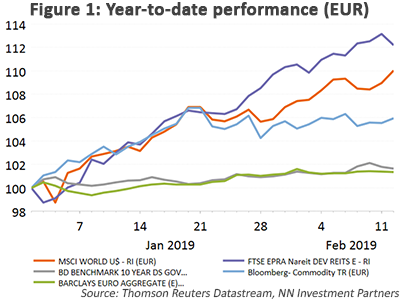

The rise in asset prices continued over the past week as risky assets received support from encouraging news on the trade front: President Trump is willing to extend the deadline for US-China trade talks beyond 1 March if there is scope for a comprehensive deal shortly thereafter. In addition, the risk of another US government shutdown looks to be averted for now. This is a reminder that political risks can go both ways.

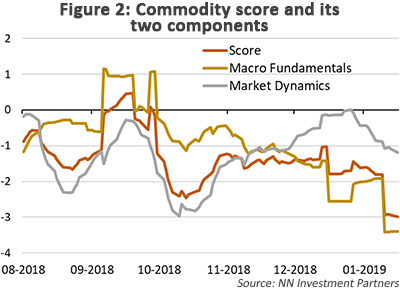

This week, we changed our tactical asset allocation in commodities from a neutral position to a small underweight. Our quant signal has deteriorated significantly over the past two weeks to reach a -3 score. The behavioural component of our signal has continued to deteriorate, while the macro-economic fundamentals of commodities showed no sign of improvement. In particular, the oil-related fundamental indicators weakened as a result of higher inventory levels.

We kept a small underweight in our equity allocation. The macro-economic and earnings fundamentals remain weak. We see some improvement for behavioural dynamics, primarily driven by price momentum and sentiment. Our short-term market reversal indicator still points towards an equity market that is being overbought. We can draw a similar conclusion from the bull-to-bear indicator, which points to very positive investor sentiment and is close to contrarian levels.

On the other hand, institutional cash holdings are high and the results of Bank of America Merrill Lynch’s most recent investor survey pointed towards institutional investors being on the cautious side. This money on the sidelines may prevent a big market correction unless the macro-economic fundamentals deteriorate sharply or (geo)political risks worsen.

Diesen Beitrag teilen: