NN IP: Growth assets receive support from fundamentals

Strong corporate earnings are getting the upper hand over trade fears, and we also note a preference for growth assets over yield assets. In our asset allocation, we cut real estate to neutral.

26.07.2018 | 13:35 Uhr

Despite continued fears of an escalation of the trade war between the US and its main trading partners, risky assets performed well over the past couple of days. Equities and commodities were both up, fixed income spreads tightened and bond yields rose. The rise in bond yields may be have been partially provoked by rumours concerning a change in the Bank of Japan’s yield curve control. Real estate, a bond proxy, lagged the risky assets universe. This may be a sign that the improvement in the underlying fundamentals, i.e., a strong start of the earnings season and decent macro-economic data, is providing enough counterweight to Trump’s threatening tweets. The fact that China is easing fiscal policy also provided some support.

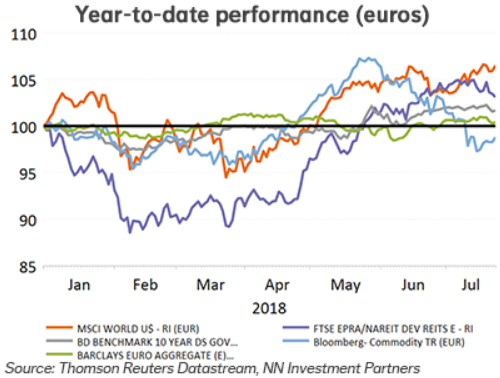

Year to date, all asset classes except commodities are up, led by equities. Yield-sensitive assets are underperforming growth assets. This trend is visible on the asset class level as well as within equities and may continue. In addition to the supportive fundamentals, behavioural elements are positive. The bull-to-bear ratio may have flipped back into positive territory, but it is by no means indicating over-optimism amongst investors. This is confirmed by our Dynamic Positioning Indicator and by the latest results of the BofA Fund Management Survey. Price momentum also remains positive.

Reduce real estate to neutral

In this more pro-growth environment we decided to cut our overweight in global real estate back to neutral. The top-down score has been on a weakening trend since mid-June, and the sensitivity to higher bond yields is the Achilles’ heel of this asset class. Positioning in the sector is off its lows, even if it stays underweight. In the longer term, the structural challenges caused by on-line shopping and flex-work remain. On the other hand, we must not turn overly bearish on the asset class. There is ample support from valuations and we do not expect a rapid rise in bond yields, only a gradual one.

We keep equities as a small overweight and spreads as a small underweight. Within spreads we became more constructive on EMD HC and downgraded high yield. Commodities remain neutral.

Diesen Beitrag teilen: