NN IP: Bottom-fishing bears

While equities continued their descent, sentiment data increasingly indicates an overreaction; we closed our underweights in equities and spreads.

05.11.2018 | 13:13 Uhr

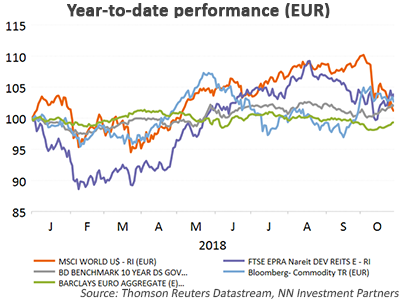

Risk aversion rose further this week. Global equities continued their descent, making the drop over the past three weeks one of the biggest since the global financial crisis. Meanwhile, commodities sold off driven by a decline in the oil price despite rising supply risks. Gold benefitted from the flight to safety and low speculative positioning, just like the week before. Spreads widened across the board, especially high yield. The only risky asset class that gained was real estate, benefitting from the flight to safety (defensive sector) and lower treasury yields.

Based on the performance of the past three weeks, one may conclude that we are on the verge of a serious growth and earnings slowdown. This conclusion is amplified by the relative performance of cyclical versus defensive sectors. However, the underlying fundamental picture has not materially changed. From a macroeconomic point of view, a consolidation phase with convergence within developed markets remains our base case even if risks on the European side have grown somewhat.

Corporate earnings are coming in strong, at least in the US. Q3 is shaping up as a robust earnings season across all sectors except telecom. Here, too, the European picture is less rosy with profits hurt by lower export numbers and the distorting impact of the new emission standards in the auto sector. We believe the latter factor will start to fade.

On the other hand, the behavioural picture has materially changed. When looking at sentiment data, whether they are market-based or survey-based, we see more and more indications of an overreaction. In addition, our proprietary market reversal indicator signals an oversold market in equities and in several fixed income spread products.

Given this apparent overreaction, we have decided to close the underweights in equities and spreads we had implemented in early October and move back to neutral on both asset classes. We maintain a small underweight in treasuries as we maintain our view of further monetary policy normalization, which in all likelihood will lead to gradually rising bond yields.

Commodities are a small overweight. Speculative positioning is low, EM macro surprises are improving, and the asset class may benefit from further Chinese stimulus. In oil, supply risks remain high. US sanctions on Iran will take effect starting 5 November. US oil takeaway capacity constraints in the Permian region could also suppress US oil production in the near term while Venezuelan supply is in structural decline and Nigeria is exposed to presidential election-related production outages early next year.

Diesen Beitrag teilen: