NN IP: A tug-of-war between sentiment and fundamentals

For spreads, the gap between investor sentiment and fundamentals will close, but in which direction?

07.02.2019 | 10:45 Uhr

Global equity and credit markets continued to rally this week, boosted by the dovish shift in the Fed’s monetary stance. Last Wednesday, Powell not only highlighted the high likelihood of a prolonged pause in rate tightening, he also suggested that the runoff of the Fed balance sheet may end earlier than planned, given the Federal Open Market Committee’s decision to operate with a relatively large balance sheet. Over the past week, this “Powell Put” has more than offset disappointing earnings on equity and spread performance.

Despite this positive change in the global monetary environment, we remain cautious on global equities. After six straight weeks of positive returns, with US January performance being the best month since 1987 and the December losses now fully recouped, we think the equity market has room to consolidate this month.

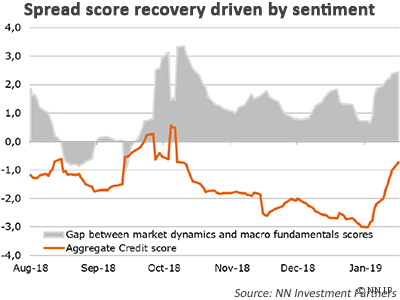

We are more constructive on credit, as we upgraded our spread position to neutral from a small underweight this week. The dovish Fed triggered a significant decline in global sovereign yields, which is a positive development for spreads. Still, we are not overweight, given the widening gap between our market sentiment and macro fundamental scores (Figure 1). In short, the recent spread tightening has been driven more by improving sentiment (flows and liquidity) than by better fundamentals.

The main question now is how the gap will be closed. Will sentiment be revised down to match the poor macro momentum, or will fundamentals catch up to investors’ upbeat mood?

If the gap is closed by stronger fundamentals amid fading political risks, there is a risk that the Fed policy stance will be repriced toward a more hawkish tone. After all, Powell was pretty clear about the data-dependency of the future monetary stance. But this is not a short-term risk, given his latest strong statement. Thus, any mild improvement in fundamentals over the coming weeks should support credit performance.

The story will be significantly different if the gap is closed by weakening sentiment. Figure 1 shows that the magnitude of the gap is nearly comparable to that reached before the October correction. We know what happens thereafter!

Diesen Beitrag teilen: