BNP Paribas: EM equity markets have remained under pressure

Emerging market assets have been under pressure for several months. Initially, this was triggered by higher US interest rates and a stronger USD. This was exacerbated by concerns about external fragility, notably in Argentina and Turkey, and the resulting outflows from the asset class.

05.07.2018 | 12:34 Uhr

The hallmark of Q2 has been the progressive economic divergence between the US and the rest of the world. This has been fuelled by several key elements. In the US, stimulus from the tax cut boosted economic activity and consumer confidence. This positive development could have benefited the global economy and financial markets. However, President Trump’s protectionist agenda got on the way. The implementation of several import tariffs alongside aggressive rhetoric on trade unsettled investors and accentuated the divergence by hurting export-oriented economies such as emerging markets and developed countries such as Germany.

The divergence is evident in monetary policy: the US Federal Reserve continues steadily on its normalisation path, while the ECB has remained cautious to avoid a financial taper tantrum with investors still digesting slowing economic activity in Europe and rising political risk. The Bank of Japan is still committed to its unconventional loose policy and the Bank of England is striving to keep the UK economy stable amid uneasy Brexit negotiations.

In Europe, the resurgence of political risk (notably in Italy) dragged down equity markets and ‘peripheral’ bonds. The main stress factor was the nomination of the new ruling Italian coalition of far-right and farleft parties, both giving a cold shoulder to European institutions when it comes to immigration or fiscal policies. Hardest-hit were European banks as well as Italian sovereign bonds (BTPs), down 6.9% and 8.5% respectively. Elsewhere, in Germany, cracks started to appear in the grand coalition over immigration policy, endangering the CDU/CSU alliance.

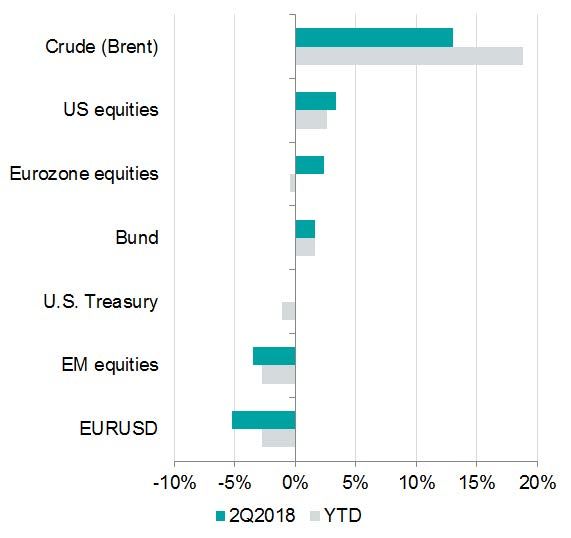

Figure 1: US equities

and crude oil outperformed in Q2 2018

Source: Bloomberg, BNPP AM; data as of 03.07.18

A stronger US dollar and higher US yields were a strong headwind for emerging markets. EM fundamentals are still solid, but the speed of losses in some EM currencies as well as protectionist worries led to outflows from EM assets. More recently, concerns over Chinese growth, protectionism and the risk of capital outflows led to CNY depreciation and further worries about EM outflows.

In this choppy environment, worries over softer global growth weighed on industrial metals, with copper down by more than 3% from early April. Crude oil was one of the best-performing assets, partly due to OPEC’s decision to increase production by less than market participants expected. Gold’s 6% underperformance over the quarter reflects higher US real yields and the stronger dollar.

Summer reversals

In a recent Asset Allocation Flash – entitled Mid-year reversals – we said that we expected a pause and potentially a reversal in some of the trends that have been prominent in recent months. In particular, we expect UST yields and the USD to stabilise in the near term.

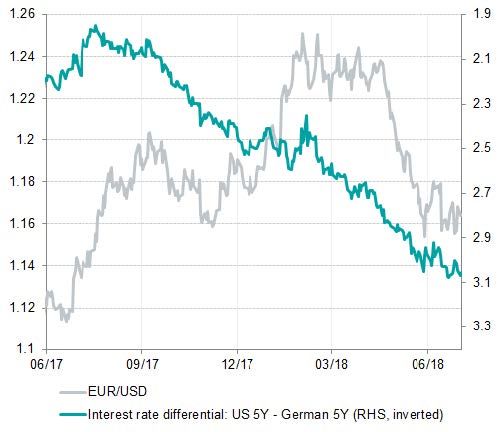

Figure 2: EUR/USD should stabilise as the interest-rate differential narrows

Source: Bloomberg, BNPP AM; data as of 03.07.18

Admittedly, both UST yields and the USD already

started stabilising in June. UST yields have priced in good news on growth, inflation and Fed tightening. By contrast,

the eurozone economy

has slowed and Italian political risk rose, pushing

yields on core eurozone bonds down. While the ECB has

signalled its intention to end its asset purchase programme by the end of 2018, it does not expect to raise interest

rates until well into 2019. We therefore expect the spread between UST versus German yields to fall and the USD to weaken versus the EUR (see figure

2).

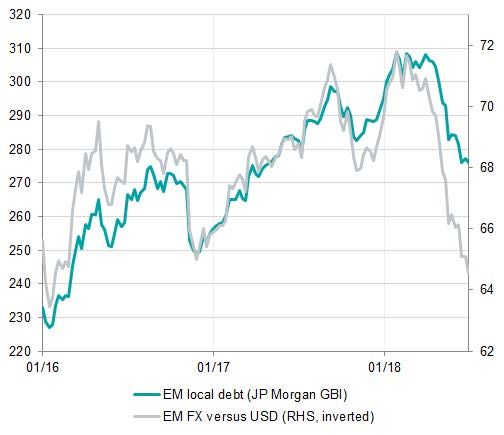

A weaker USD should help stabilise EM currencies and EM local debt (see figure 3). Two additional factors should support EM currencies:

(i) the restoration of EM rate differentials as EM central banks raise interest rates or sound more hawkish, and (ii) the fact that growth and external fundamentals are stronger than five years ago when growth in China was slowing rapidly, commodity prices were in a bear market and countries such as Brazil and Russia were in recessions.

Figure 3: A USD stabilisation should help EM debt in local currency

Source: Bloomberg, BNPP AM; data as of 03.07.18

The recent trend in crude oil can also reverse. Crude was one of the few risky assets that has rallied since the beginning

of the year, by close to 15%. In our view, in late May, too much good news on demand, supply and geopolitics was priced in. After a brief fall, oil prices have rallied again recently to close to highs for the year due to

(i) concerns that supply increases by OPEC as a whole will not be enough to offset falling supplies of some members, and (ii) much bigger-than-expected falls in US inventories.

There are two drivers that could help crude oil weaken: (i) a reassessment of global demand. Most risky assets have already incorporated some bad news in terms of the growth prospects, but not crude. (ii) Most of the focus is on OPEC supply, but US supply remains strong, registering a record high in Q2. Lower or more stable oil prices should help stabilise US breakeven inflation and therefore UST yields.

China and EM under pressure

Emerging market assets have been under pressure for several months. Initially, this was triggered by higher US interest rates and a stronger USD. This was exacerbated by concerns about external fragility, notably in Argentina and Turkey, and the resulting outflows from the asset class.

More recently, concerns have risen further, but this time due to worries over Chinese growth and the risk of capital outflows. The latest activity data on China came in softer-than-anticipated. For example, industrial production growth retreated to 6.8% from 7.0%, while retail sales growth slowed to 8.5% year-on-year.

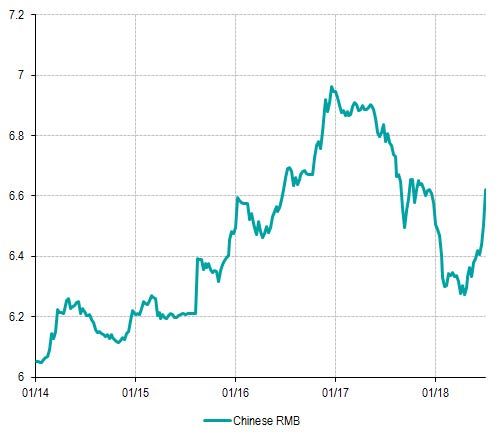

The Chinese authorities have opted to allow their currency to weaken as a way of easing monetary conditions and support the economy. CNY weakness could also reflect posturing by the authorities over US trade tariffs. The CNY lost 5.5% during Q2 2018 relative to the USD. This rekindled investor memories of the damage that a material devaluation did to markets in 2015 (see figure 4). As a result, Chinese and other EM equity markets have remained under pressure.

Figure 4: Chinese CNY depreciation is comparable to 2015 move

Source: Bloomberg, BNPP AM; data as of 03.07.18

Admittedly, allowing the currency to weaken can mitigate the pressure from capital outflows and restore competitiveness relative to other Asian currencies that have already slipped. However, the Chinese authorities likely want to strike a balance between supporting the economy via some monetary easing, including currency weakness, and investor concern over a rapidly weakening CNY.

So far, the authorities have struck the right balance and markets have been calmer than in the last few weeks.

Asset allocation

Despite uneasy markets in Q2 2018, we have confidence in our medium-term view of continued growth and muted inflation, which should benefit equities, especially in the eurozone and Japan where we forecast positive surprises on earnings growth. Notwithstanding our optimistic roadmap, we have had to deal with the resurgence of political risk, trade protectionism and softer global growth. This required swifter portfolio adjustments and more tactical positions.

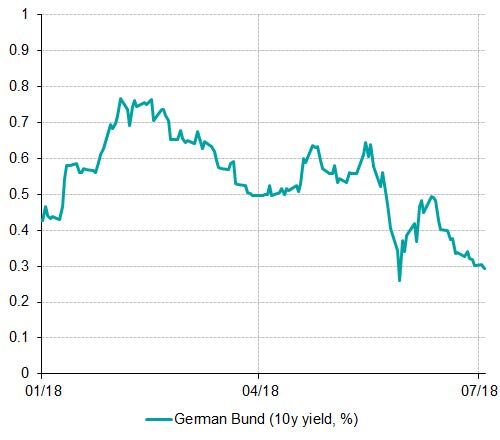

In Europe, we addressed the resurgence of political risk by reducing our underweight duration position temporarily at the end of May. Indeed, political risk in Italy triggered a rotation from ‘peripheral’ countries towards safe-haven core countries such as Germany. After the rally in German Bunds, we chose to return to our longer-term view of rising yields and reopened our underweight position. We also implemented a relative value trade: long US Treasuries versus short German bonds (in 5 year maturities) after the spread widened significantly. We expect it to progressively tighten as the ECB heads towards policy normalisation (see figure 5).

Figure 5: German Bund rallied due to political stress in Europe

Source: Bloomberg, BNPP AM; data as of 03.07.18

We took advantage of the rising yield environment by investing in US banks. This also allowed us to diversify our equity position geographically.

In EM, we continue to look for opportunities to add long EM FX exposure, for example, by adding to our existing long EM local currency debt position. Our view on EM remains constructive. We believe that market participants have now discounted most of the bad news and that there are now more elements for positive rebound.

Our market dynamics analysis (including technical, sentiment and liquidity conditions) had already flagged a more challenging environment early in 2018. We are maintaining our positive view on risky asset

in Q3, but we continue to monitor market movements

closely.

For the full report please click here.

Diesen Beitrag teilen: