Schroders: Global convertibles Outlook 2019

Convertible bonds currently appear fairly defensive relative to history with valuations looking particularly attractive in Asia.

18.12.2018 | 13:42 Uhr

- Overall market volatility will remain high and convertibles look prepared to protect against further set-backs in 2019

- Convertibles are fairly priced with attractive valuations in Japan and Asia ex-Japan

- Solid fundamentals and stable BBB+ credit rating puts convertible bond universe on solid footing against any pick-up in default rate

October 2018 clearly reminded equity investors of the risks in stock markets. After a prolonged period of abundant positive returns and low volatility, macro and political risks are again forefront of investors’ minds:

- US interest rates are higher and rising – negative outcomes are likely for bond investors. It’s not too surprising that 2018 has been one of the worst years for bond markets, in aggregate, since the mid 1970s.

- Higher US rates have had a strengthening effect for the US dollar, creating concerns for emerging market countries and companies with a large amount of dollar-denominated debt. This looks set to continue in 2019.

- The US anti-trade agenda and higher tariffs is now a firm fixture for markets. It has been, and will likely continue to be, a continual background noise nagging at investor sentiment. The hope is that, on balance, tensions are unlikely to escalate significantly, as both the US and China have threatened.

- Italy’s weak economy, problems for the country’s banks (surging "Target 2" balances particularly), Italian deficit “negotiation” tactics and a powerless “retaliation” by Brussels once again highlight the flaws with the current design of the euro single-currency system. On the other hand, neither ground-breaking reforms including Eurobonds or the mutualisation of debt, nor a break-up of the euro should be on the cards for 2019. It will likely prove to be another reason for further volatility though.

- An overall slowing down of economic growth led by fear of slower growth in emerging markets.

All these risk have one thing in common: they are known – and in fact have been around for months if not years.

What is going to change in 2019?

2018 marked a special occasion: the US equity market saw two set-backs of 10% losses for the first time since 1960. While history tells us this is unlikely to repeat next year, the easy part of any outlook for 2019 is to state that volatility will remain high.

Central banks are moving away from quantitative easing to a process of gradual tightening. The US Federal Reserve (Fed) has hiked eight times since late-2015. The likelihood is this will weigh on demand for bond investments. In addition, US companies will slow down their stock buyback programmes. In 2018 US businesses moved a vast amount of money back to the US due to incentives under the tax reform. This will slow down in 2019. Together these shifts could result in a buyers’ strike for bonds and equities and a serious shift in the demand and supply ratio.

Amid this changing backdrop, we see scope for convertible bonds to continue to assert the following core characteristics:

- Protection against sudden and volatile equity market set-backs. 2018 demonstrated the relative stability of convertibles once more. The overall level of volatility on the global equity markets rose to 10%, compared to 5% for convertible bonds, based on monthly observations of the MSCI World equity index and the Thomson Reuters Global Focus convertible bond index. Similar protection was seen in peak-to-trough downside participation where convertibles protected 57% of the equity losses in February, and 59% of the equity losses in October. The characteristics of the asset class suggest it can continue to provide a similar level of protection in 2019.

- Protection against credit blow-outs and possible jump in defaults. It will become more apparent that long-term ultra-low/zero interest rates have resulted in market inefficiencies, artificially low default rates, and zombification, allowing weak companies to survive. The default risks have been increased by large investment flows into exchange-traded funds (ETFs) and a potentially crowded trade in lower investment grade (IG) companies. Once companies face higher refinancing costs, they may be downgraded, triggering a vicious cycle of selling pressure and illiquidity. Convertible bonds are not immune to default risk, but the investable universe is dominated by strong companies with an implied IG rating.

In general, the degree of possible protection from convertible bonds depends on several factors: the amount of equity exposure, the distance to the bond floor (the safer fixed income element of convertible bonds), the credit risk or estimated risk the company will default and valuation.

The convertible universe currently exhibits notably protective characteristics compared to history. The overall equity exposure sits at a low 36% with a high 88% bond floor, the fixed income value of the convertible bond. Assuming the issuer survives and pays back at maturity, this is the protective element for the capital invested, and theoretically, the lowest market value the security can fall to. The overall credit rating is a stable BBB+ average (Thomson Reuters Global Focus Index) suggesting these companies can weather more difficult conditions.

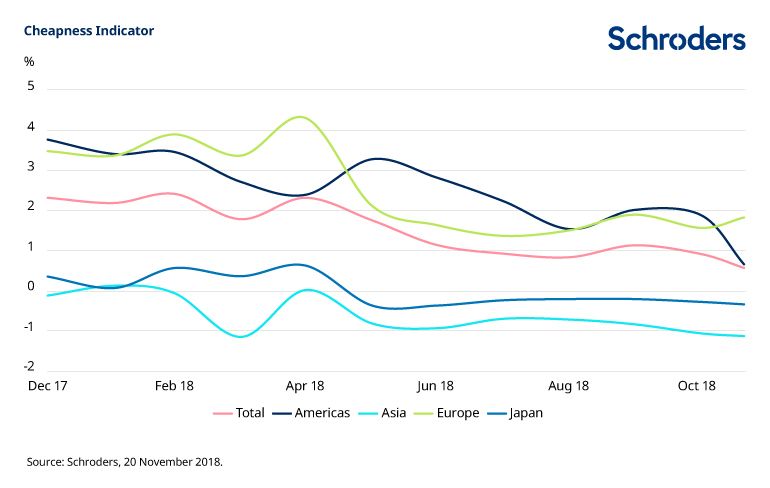

Crucially, the asset class is fairly-priced. The rich valuation levels in the US and in Europe have come down significantly while Japan and Asia ex Japan continue to offer discounts to fair value.

Valuations of convertible bonds

Finally, the market structure has changed following summer 2018 primary market issuance. Previously lacking interesting disruptive business models, the universe now offers highly balanced names with a dynamic growth tilt. IT remains the dominant sector, particularly cloud businesses, app services, and payment solutions providers. With the October set-back, many of these structures are trading much closer to par value with significant upside.

Given the current fundamentals of convertible bonds, we think the investment question for 2019 may not be whether to have an allocation to the asset class, but how much to allocate.

Die hierin geäußerten Ansichten und Meinungen stellen nicht notwendigerweise die in anderen Mitteilungen, Strategien oder Fonds von Schroders oder anderen Marktteilnehmern ausgedrückten oder aufgeführten Ansichten dar. Der Beitrag wurde am 16.12.18 auch auf schroders.com veröffentlicht.

Diesen Beitrag teilen: