Janus Henderson Investors: Back to business

Equity markets have bounced back from their lows, credit spreads have retreated from their wides in March and economies are, for the most part, gradually reopening. Markets are suggesting better times ahead. Credit portfolio managers James Briggs and Tim Winstone consider whether investors should be increasing their allocation to investment grade credit.

24.07.2020 | 12:25 Uhr

Key takeaways

- Credit spreads are at average levels, allowing potential room to tighten, but the current economic dislocation means they are likely to remain well above their lows.

- Defaults are not a big concern for investment grade corporate bonds but the markets may be getting ahead of themselves in terms of expectations for ratings downgrades.

- We may be heading into an environment where corporates are engaged in repairing their balance sheets, which has historically been a good period for excess returns on credit.

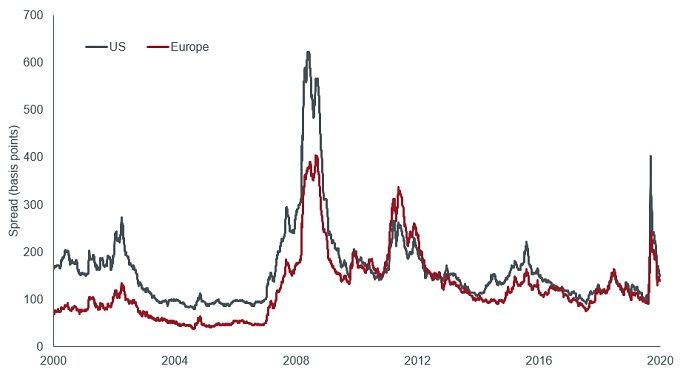

Credit markets have become distinctly average in recent weeks. Investment grade (IG) credit spreads in Europe (139 basis points at 14 July 2020) and the US (150 bps) are back around their 10-year averages, although they remain above their 5-year averages and well above their lows of the last 10 and 20 years, offering some potential for tightening.

Figure 1: Credit spreads on IG corporates over last 20 years

| Spread (basis points) | US | Europe |

|---|---|---|

| 14 July 2020 | 150 | 139 |

| 5-year average | 138 | 120 |

| 10-year average | 153 | 143 |

| 20-year average | 163 | 123 |

| Low in last 10 years | 90 | 74 |

| Low in last 20 years | 79 | 36 |

Source: Bloomberg, ICE BofA US Corporate Index, ICE BofA Euro Corporate Index, 14 July 2000 to 14 July 2020.

We have experienced one of the biggest economic dislocations of our lifetimes so we should expect credit spreads to be above their lows. The low point for spreads was reached in the mid noughties, which was notable for a decline in volatility in markets. Today, calmer market sentiment ensuing from progress in dealing with COVID-19, further evidence of economic recovery, and possibly lower levels of corporate bond issuance in the second half of 2020, offer the potential for spreads to continue to grind tighter.

Yields on corporate bonds are essentially a summation of the yield on the government bond of equivalent maturity plus the spread which incorporates a premium for the credit risk attached to the bond (expected and unexpected default loss), an illiquidity premium and residual factors (such as the taxation environment for credit or options for borrowers to redeem a bond early).

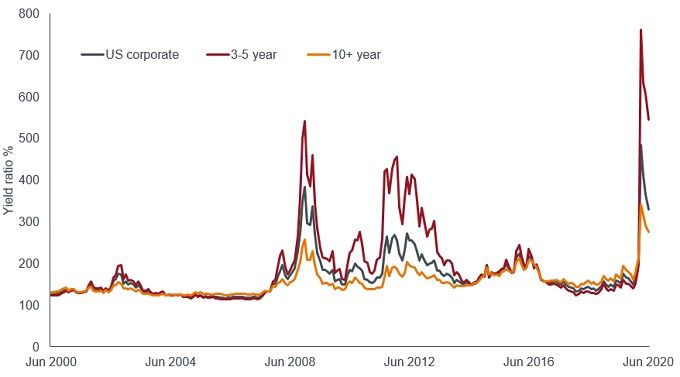

In an environment of historically low and even negative government bond yields, the spread now makes up a significant portion of the corporate bond yield. In fact, as government bond yields have headed south, the ratio of US IG corporate yields to US government bond yields has reached elevated levels (see Figure 2). This is particularly pronounced at the shorter end of the yield curve where, for example, 3 to 5-year US IG corporates were yielding almost five and a half times the yield of the equivalent maturity US government bond at 30 June 2020. Negative government bond yields for much of the eurozone government bond market mean it is nonsensical to show a similar chart for Europe, such are the peculiarities of dealing with a negative yield.

Figure 2: Ratio of US IG corporate yields to US Treasury yields

Source: Bloomberg, Bloomberg Barclays US Corporate Index, monthly data, 30 June 2000 to 30 June 2020

As explained above, the spread is what investors insist on being paid partly to compensate for defaults, yet defaults among IG corporates are relatively rare. Figure 3 represents data collected over a period of almost 30 years and shows the cumulative default rate of bonds from a starting credit rating. For example, on average, only 0.49% of bonds rated A would have defaulted after five years. We can see that the BBB rated bonds skew the IG cumulative default rate to 0.90% over this period. In comparison, the speculative grade (or sub-investment grade) part of the market has a cumulative default rate of 14.55% over five years, so we can observe that corporate defaults are primarily a speculative grade phenomenon.

Diesen Beitrag teilen: