NN IP: Continued weakness in fixed income spreads

Spread products have weakened in Europe recently while remaining little changed in the US. Market dynamics appear supportive for investment grade in both regions.

30.05.2018 | 09:22 Uhr

Inhaltsseite

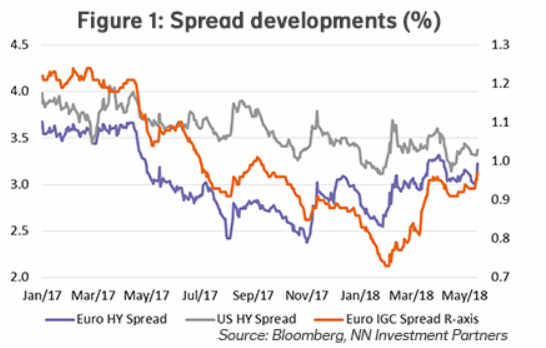

European fixed income spread markets have weakened recently while US fixed income spread markets have been broadly stable. After a strong start of the year, European spread markets started to show some widening as of February, particularly in investment grade (see Figure 1). The widening was driven by a combination of factors, including the wider US Libor-OIS spread and heavy supply.

Some stabilisation took place in April but did not last long, and spreads started to widen again this month. Recent headlines from Italy about the potential formation of an anti-establishment government and the choice of an independent prime minister led to a sell-off in Italian bond and equity markets and have contributed to the widening in Euro IG spreads this week. Despite last week’s sharp rise in US Treasury yields, US spread markets changed little, possibly due to supportive 1Q earnings.

Emerging market debt was holding up quite well earlier this year, but weakness has been feeding through into this asset class as well this month. Contributing factors include a stronger USD, higher US Treasury yields, high oil prices and some positioning risk arising from the steady inflows that have benefited EMD for some time now.

Supportive fundamentals

The fundamental picture looks still supportive for spreads. Economic growth is positive and default rates should stay low for the time being. The strong 1Q earnings also support fundamentals. The recent widening in spreads has improved the valuation of the spread categories somewhat, but valuations are still very tight. Valuations in Euro high yield are still unattractive, both in a historical context and relative to the spread universe.

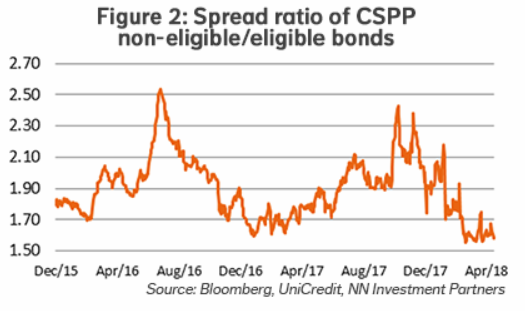

With upside potential limited and monetary policy makers slowly moving towards the exit, fixed income spreads are vulnerable. Figure 2 shows that securities eligible for the Corporate Securities Purchase Program (CSPP) outperformed the non-eligible ones following the initiation of the program and the Brexit vote, but since the beginning of this year, non-eligible bonds have outperformed the CSPP-eligible ones, making it difficult to discern a CSPP premium. Given the ECB’s intention to continue reinvesting maturing securities, there is little reason to think the end of the QE program will cause spreads to widen sharply.

Another current theme is how US companies will treat their repatriated cash following the US Tax Cuts & Jobs Act implemented in December. Stock buyback activity has accelerated, but a number of US firms have reduced their bond issuance as a result of the repatriated cash. Should this trend continue, investment grade bonds will benefit.

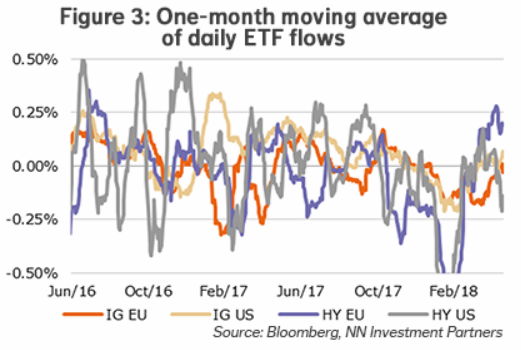

Market behavior has become a bit more supportive for IG and HY recently (see Figure 3). European IG and HY funds and ETFs registered an inflow after successive weeks of outflows at the beginning of the year. US HY funds and ETFs recorded an outflow this week. Overall, fundamentals are still supportive but political risks and market dynamics may create headwinds for fixed income spreads.

Changes in regional treasury allocation

Within our regional treasury allocation, we upgrade Australia to a small overweight, based on a recent set of disappointing macro data and currency strength. At the same time we cut Canada from neutral to a small underweight, due to strength in macro data, the impact of higher oil on CPI and the increased likelihood of a July rate hike. We keep US Treasuries as a small underweight.

Diesen Beitrag teilen: