NN IP: 10-year yields slide with dovish central bank commentary

The 10-year Bund yield continues to grind lower as the active duration underweight shows striking stability.

01.02.2019 | 09:36 Uhr

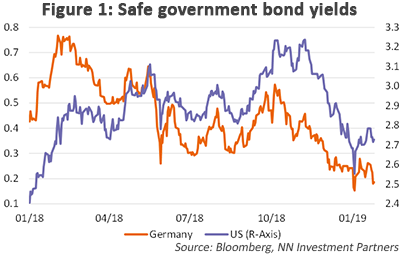

The 10-year yield on Bunds and Treasuries slid further this week after a small rebound at the beginning of 2019. In general, the more upbeat sentiment in risky assets has not really led to a rise in safe government bond yields. This is not particularly surprising, as one of the main drivers of the turn in market sentiment has been a more dovish turn in central bank commentary. In other words, the market expects a more dovish central bank stance (for the Fed, a pause in hiking or even rates that have already peaked; for the ECB, a delayed rate hike cycle), which would help the economy and risky assets. Lower expectations for central bank rates keep bond yields low. Also, the evolution of sluggish macro data is weighing on yields.

Several factors support our neutral duration stance: weakness in macroeconomic fundamentals, the dovish stance of central banks, Bund yields touching two-year lows and a significant reduction in duration underweight from European fixed income investors.

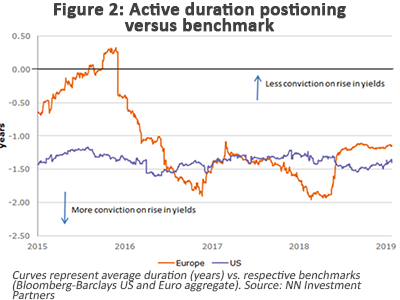

Underweight duration’s stability appears striking

European fixed income investors sharply reduced their active duration risk around July 2018, reflecting a lower conviction in rising yields amid slowing economic momentum (Figure 2). The stability of the underweight duration since then appears striking at first glance, especially with regard to market turbulence over the past months and the strong rebound early this year. This could be explained by two offsetting factors. The end of QE was expected to put upward pressure on Bund yields. This effect was counterbalanced by the deteriorating macro-economic fundamentals and negative economic surprises.

From this point, material improvement in macroeconomic data and easing of geopolitical uncertainties would be needed to significantly increase investor conviction on upward movement in Bund yields. Improvement in data is also important for changes in the central bank stance. Therefore, it could take a while until we see a change in the positioning again, which would support a rise in Bund yields.

Diesen Beitrag teilen: