NNIP: Battlefield Europe

Market focus remains on the Brexit, Italy and trade risks, which come together in Europe.

15.11.2018 | 13:35 Uhr

The hoped-for post-election rebound did not last long: one day to be precise. Of course the outcome was fully in line with what the polls predicted. Democrats gained a majority in the House while Republicans retained dominance in the Senate. In practice, this means gridlock and limited scope for new policies seeing the light of day. From a central bank perspective, this may be good news as the prospect of an additional sugar high caused by lower taxes has clearly diminished. This is clearly a medium-term issue. In the short term the market focus remains on the other political challenges: Brexit, Italy and trade. These three issues all come together in Europe and explain why we currently have a medium underweight in Eurozone equities and a medium overweight in US equities.

The final outcome of the Brexit negotiations is still very uncertain. We see three possibilities: a no deal (20% probability; very disruptive), a hard Brexit (40%; somewhat disruptive) and a soft Brexit (40%; limited economic disruption). We believe that in the case of a no deal, we will see a postponement (to buy time) as neither side has an interest in not reaching a deal. Of course we should be aware that this is ultimately a political process and hence anything is possible depending on the willingness of parties to reach/approve a deal. Indeed, the biggest challenge may lie in convincing the UK Parliament to ratify a deal.

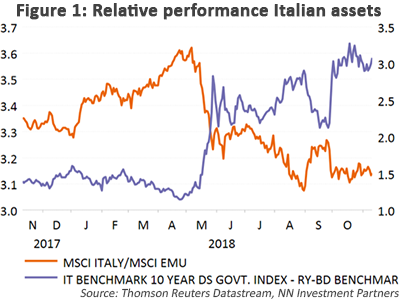

As far as the Italian budget is concerned, the tug of war between the European Union and the Italian government continues. Here, the challenge will be to reach a compromise that allows both parties to save face.

Markets seem to believe that a compromise will be reached as the government bond spread with Germany is stabilizing around 300bp and Italian equities stopped underperforming the broader Eurozone at the end of September. Still, the clock is ticking and the Italian macro data are weakening (the PMI is below 50 and growth expectations are the lowest in the Eurozone), making the budget exercise even more difficult. The longer the bond yield stays high, the greater the pain for the economy and the banking sector through higher funding costs, more expensive loans and higher loan losses.

However, the big elephant in the room is the trade dispute between the US and China. The meeting between Trump and Xi at the end of this month will be key. An agreement to continue talking would already be seen as positive and may ultimately spark that end-of-year rally. Between now and then, headline risk is high as illustrated on Tuesday morning when talk of a preparatory meeting between US Treasury Secretary Mnuchin and the Chinese vice Prime Minister was enough to push markets from negative into positive territory.

In October, the technology sector lost its status as the best performing sector year-to-date. This honour now goes to the health care sector. The FAANG sector was hit very hard, in part because of some doubts that popped up during the earnings season concerning the sustainability of revenue growth combined with the fact that the sector remains very crowded. As a consequence, the one trillion dollar club has lost all its members over the past month.

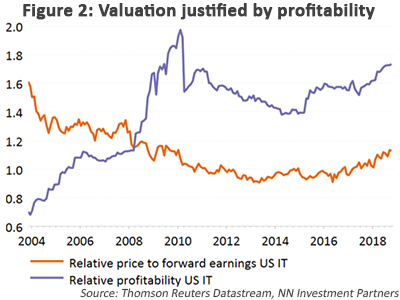

High profitability of US IT sector justifies valuation

The US IT sector is currently trading at a 13% PE premium to the market. This is not exceptional from a historical point of view. Prior to 2008, the sector traded at a 20%+ premium to the market. At the same time the sector’s profitability, expressed as return on equity, is almost 80% higher than the market average.

So it seems that the weakness in IT is not due to its valuation or its profitability. It is more a matter of reducing high investor positioning. The internet segment also faces the risk of stricter regulations and higher taxes. The cyclical semiconductor industry is suffering from the slowdown in China, trade worries and price pressure.

We currently have a neutral stance on the sector. Its superior longer-term growth outlook and healthy, debt-free balance sheets could become valuable in a macro consolidation phase. However, the short term may remain more challenging.

Diesen Beitrag teilen: