NN IP: Powelling ahead

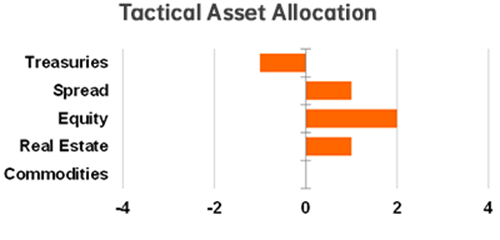

The environment for risky assets is the best in years. We increase the focus on growth by upgrading equities from a small to a medium overweight.

10.11.2017 | 09:44 Uhr

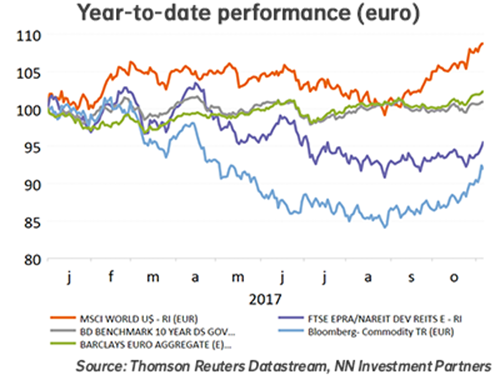

Asset prices continue their upward move. Equities, real estate, commodities (thanks to higher oil and cyclical commodities) and government bond prices all rose in the past week. The main weakness was concentrated in certain fixed income spread products (EMD and Global High Yield). This asset class is currently offering close to historic low risk premiums, in contrast with (non-US) equities or real estate.

At the risk of repeating ourselves: the current environment is probably the best we have seen in many years. The macro economic data point to solid growth and surprise to the upside. Corporate earnings, especially in the US and Japan beat expectations driven by technology and financial earnings. Central banks are on a very gradual hiking path, something which will not change with the nomination of Powell as the next Fed chair. Powell is indeed a choice for continuation of the existing policy.

The BoE delivered a (dovish) hike that was well-digested by the Gilt market, with bond yields actually declining after the announcement. Political sentiment in the Eurozone and the US has improved.

Real estate, although facing headwinds from the structural changes benefitted from lower bond yields, low positioning and good macro data.

Overall, the behavioural data are now positive for all risky assets, which was not the case before and throughout the summer.

We upgrade equities from a small to a medium overweight. We keep our focus on a combination of growth and income, but in view of the macroeconomic environment, we decided to dial up the growth exposure.

Diesen Beitrag teilen: