NN IP: Positive emerging market equity trend

EM equities have continued to perform well, despite shifting Fed policy expectations. This resilience can be explained by the support of the well-performing markets of China, India and Korea, as well as the increasing share of the IT sector in the MSCI Emerging Markets Index.

10.11.2017 | 12:30 Uhr

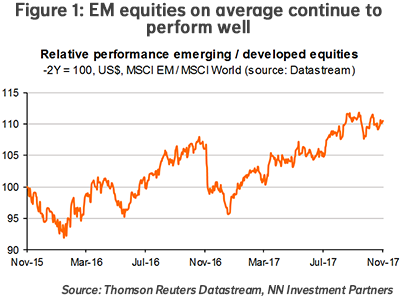

Since the second week of September, when Fed expectations started to change materially, EM assets have been under pressure. This is clearly visible in the local-currency debt segments, where portfolio flows have turned negative and yields have increased by some 25 bps, and eventually also in the hard-currency categories, where spreads have widened by 30 bps in the first days of November alone. Market nervousness has not affected EM equities much on an aggregate level (see Figure 1) but it was reflected in the sharp underperformance of Turkey and Colombia, the EM equity markets with the largest macro imbalances and the highest sensitivity to US interest rates.

It should not be a big surprise that EM equities have held up better in this environment than EM bonds. After all, EM bonds are a more direct play on low US interest rates and have received more portfolio inflows in the past years than EM equities. Also, EM equities are more growth-sensitive and the EM growth recovery remains intact. Of course, a continuous rise in US interest rates would lead to stronger EM capital outflows and could affect EM financial conditions in such way that growth starts deteriorating. But this scenario takes time to materialise and is not concrete enough in this early stage of shifting Fed expectations.

China, Korea and India bolster EM equities

Another important explanation of the relative strength of EM equities vis-à-vis EM debt since September is the strong performance of China, India and Korea. Together these three markets represent 55% of the EM equity index. In EM debt, these markets are less dominant as the centre of gravity lies more in Latin America and EMEA. In China, risk premiums continue to fall thanks to the strengthened focus of the authorities on deleveraging and the reform of state-owned enterprises. The steady growth of private consumption, particularly through e-commerce channels, and the supportive policy initiatives in the field of labour mobility, urbanisation, regulatory and fiscal change, continue to boost the new-economy segments of the Chinese stock market. As a result, Chinese equities have been able to outperform the EM index steadily since May.

The Korean outperformance is more recent. It started early September after the threat of a critical escalation of the North Korean crisis had eased. By now, the sharp underperformance of Korea in July and August has been fully reversed again.

The good performance of the Indian market started in the last week of September and has amounted to some 4 percentage points so far. It can be explained by two factors. First, by the low external financing needs of the Indian economy and corporate sector, which typically help the Indian market relative to the EM average in times of increasing Fed concerns. And second, the Indian government announced a USD 32 billion package to recapitalise the state-owned banks. This capital injection will make the sector’s non-performing-loans problem more manageable and should create room for a credit recovery in the coming years. The balance-sheet problem in the public banks is the principal reason why Indian growth has been disappointing in the past years. The new package clearly strengthens the investment case for India from a growth perspective.

IT represents an increasing share of the MSCI EM index

We mentioned it already in our paragraph about China: the strong performance of the new-economy stocks in the Chinese market. The e-commerce and internet theme has been so powerful that IT in a GEM context continues to rapidly gain importance. Almost 30% of the EM index is already taken by IT (see Figure 2). This development is changing the aggregate sensitivities of the EM equity category. So while EM debt continues to be highly sensitive to moves in US interest rate expectations and swings in commodity prices, EM equity has become more a play on global IT trends and on Chinese consumption.

So what are the prospects for EM equities now? We can explain the recent divergence with EM debt and the resilience in absolute performance. This is likely to continue as the outlook for Chinese consumption remains bright, the excitement about the improving Indian growth prospects has only just started and the recovery in EM credit growth is clearly gaining pace. The outlook for commodity prices is less straightforward as Chinese fixed investment growth continues to slow. And Fed expectations might have to move a bit more, with only one rate hike priced for next year. To us, EM equities look more attractive than EM bonds.

Diesen Beitrag teilen: