NN IP: Fed pause leads to outperformance for EM equities

Fed repricing, Chinese stimulus and hopes of a trade deal have improved the environment for EM equities.

25.01.2019 | 10:13 Uhr

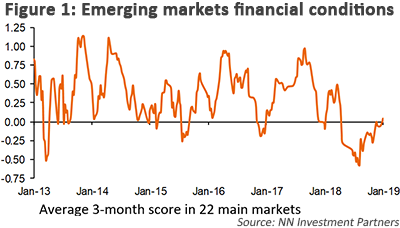

Since 8 October, emerging market equities have been outperforming developed markets, following a sharp underperformance in the preceding six months. This was more or less the time when Fed expectations peaked. The 75 bps of rate hikes that have been priced out since October have been highly beneficial to all EM assets. Suddenly capital started to find its way to EM again, after sharp outflows earlier in the year. The markets with the highest external financing requirements, which struggled so much during the market turmoil (Turkey, Argentina, South Africa and Indonesia), managed to recover somewhat. And across the EM universe, thanks to the improving capital flows, central banks have been able to move away from anticipated interest rate hikes. As a result, financial conditions for the emerging world as a whole have moved rapidly from tightening to easing territory (see Figure 1).

This is an important factor for investors to start adjusting their EM growth expectations. It is still early days, as the current EM growth momentum remains negative. Additionally, the weakness currently lies mainly in Asia, where exports and manufacturing activities have been suffering from the newly installed US tariffs and low levels of business confidence. Before we can expect improvements here, we must see a breakthrough in the trade negotiations between the US and China. For now, we expect that some kind of deal will be struck before 1 March. This will be unlikely to remove the US protectionism risk, but should give at least some temporary relief to emerging equity markets.

Chinese stimulus prompts improved growth outloo

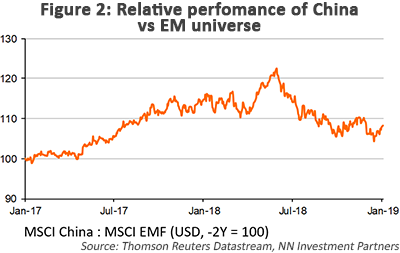

Meanwhile, the Chinese authorities have been stepping up their efforts to bring about a pick-up in domestic demand growth to compensate for the negative impact from the trade conflict. We wrote about the increased Chinese stimulus in the Economic Outlook section of this Houseview. The key point here is that the combination of tax cuts for households and private companies, increased public investment in infrastructure and a likely acceleration in credit growth by a few percentage points should lead to a pick-up in domestic demand growth from Q2. As a result, the outlook for the Chinese equity market is improving, alongside that for the whole EM universe, via better prospects for trade with China.

The easing EM financial conditions thanks to the Fed repricing, the hope for a US-China trade deal and the Chinese policy easing are the main reasons why we are overweight EM equities. Earlier this week, we increased from a small to a medium-sized overweight, owing to the quicker-than-expected easing of EM financial conditions and increasing evidence of further Chinese stimulus in recent weeks. In this context, we view the outperformance of the Chinese equity market since the beginning of the year (see Figure 2) as encouraging.

Diesen Beitrag teilen: