NN IP: The 2018 endgame is about to start

Trade talks, OPEC and Brexit take centre stage in the make-or-break month of December.

29.11.2018 | 13:30 Uhr

The coming two weeks will be crucial for financial markets as several risk events that have dominated sentiment over the past months, or longer, may take a turn for the worse or the better. First, the G20 meeting kicks off in Buenos Aires on 30 November, which will be overshadowed by the side meeting between Trump and Xi to discuss trade issues. Trump looks set to follow his familiar tactical track of talking tough in the run-up and becoming more conciliatory during the meeting. Indeed, on Monday night the focus was on the “likely” increase in tariffs on USD 200 billion of Chinese imports from 10% to 25% early next year and the threat to impose tariffs on an additional USD 267 billion if negotiations do not go well. It is remarkable that the impact on equity markets was very limited after these remarks, suggesting a lot of the trade worries are priced in. Another way to explain this muted market reaction may be the fact that investors have become accustomed to the difference between the US bark and its bite. Of course, this shifts the risk balance to the downside whereby a deal might be less rewarded because it is becoming more of a base case for investors.

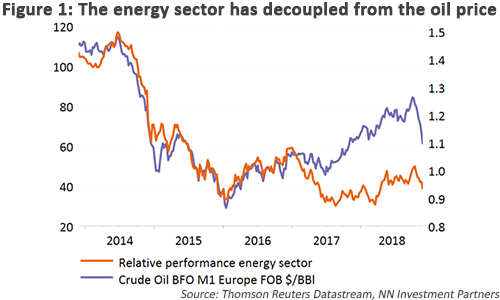

The next big event is the OPEC+ meeting on 6 December. Oil has literally been in freefall this month (-20%). This is due to both demand side and supply side factors along with a sharp reduction in net speculative positions. This is a highly political game given the stakes at play. We think that stabilizing the market would require a cut of more than 1 million barrels/day. In general, supply-side driven price declines act as a tax cut for consumers. However, history has shown that once it becomes a disorderly decline, energy capex (17% of global capex) is reduced and defaults in the sector rise, leading to lower growth. In order for this to happen, Brent oil would need to drop below USD 50/barrel. This would also impact the relative performance of the energy sector. However, as illustrated in Figure 1, the sector has decoupled from the oil price, which should make the sector more resilient to oil price developments.

The next big event is the OPEC+ meeting on 6 December. Oil has literally been in freefall this month (-20%). This is due to both demand side and supply side factors along with a sharp reduction in net speculative positions. This is a highly political game given the stakes at play. We think that stabilizing the market would require a cut of more than 1 million barrels/day. In general, supply-side driven price declines act as a tax cut for consumers. However, history has shown that once it becomes a disorderly decline, energy capex (17% of global capex) is reduced and defaults in the sector rise, leading to lower growth. In order for this to happen, Brent oil would need to drop below USD 50/barrel. This would also impact the relative performance of the energy sector. However, as illustrated in Figure 1, the sector has decoupled from the oil price, which should make the sector more resilient to oil price developments.

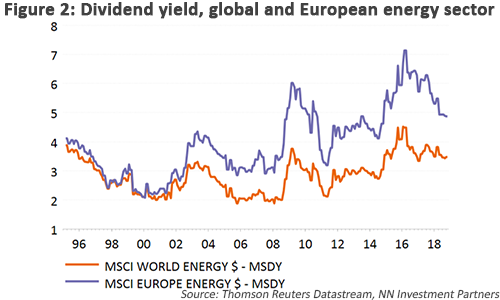

We currently have a small overweight in the energy sector. We will maintain it for the time being in view of this gap with the oil price, 20%+ absolute earnings growth (the highest of the 11 global sectors) continuing positive earnings and dividend momentum (although this is rapidly declining) and a sharp rise in cash flow generation. This is important to enable the sector to maintain its high dividend payments, especially in Europe. However, in the event of a failure to cut oil production and an ensuing further fall in prices, we will probably need to reconsider our overweight stance.

A few days after the OPEC+ meeting, on 12 December, the third event will take place, namely the UK parliamentary vote on the Brexit deal. The outcome is difficult to predict. The government has no majority and even the governing Conservative party is divided. However, the market consensus is moving towards approval of the deal, perhaps not on the first vote but more likely on the second one. The impact on equity markets is not straightforward. The UK market is very much influenced by factors like the oil price, Asia and of course the trend in the GBP. Indeed, a strengthening GBP is negative for the FTSE 100, which consists primarily of large international companies. Therefore, parliamentary approval may initially lead to a higher GBP and hence a weaker UK equity market, perhaps not in absolute terms but relative to global or Eurozone equities.

Important central bank meetings add to the mix

Given these three events, one could almost forget the planned central bank meetings. The Fed will almost certainly hike rates by 25bp. We do not expect any changes in the 2019 trajectory in light of the recent market volatility. While financial conditions have tightened, they are not at levels that would concern the US central bank. We stick to our forecast of three hikes in 2019. These are not fully priced by the market as Fed expectations came down over the past two to three weeks. Meanwhile, the ECB needs to confirm the end of QE at year-end. We believe it will do so, as the hurdle to choose otherwise is high, especially given developments in Italy. The ECB is not expected to make its first rate hike before September 2019.

Diesen Beitrag teilen: