NN IP: Risks weighing on investor sentiment

Growing trade risks are impacting investor sentiment. The impact on earnings is not yet visible, but watch out for negative guidance by management in second-quarter results.

29.06.2018 | 11:10 Uhr

The adverse impact of trade rhetoric on financial markets is clearly on the rise. Over the past week, equities were down and implied volatility rose. This decline was not disorderly, but follows a logic whereby the potential biggest victims of a trade war are hit the hardest. These were (Asian) emerging markets, which were already facing tightening of financial conditions, as well as the Eurozone.

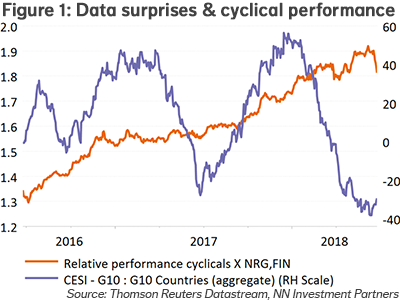

From a sector point of view, there was a clear split between the cyclical and the defensive sectors. Cyclical sectors are not only hurt by trade worries, but also by higher risk aversion. Consequently, the bottoming-out of the economic surprise indicators passed largely unnoticed. However, the inverse was also true earlier in the year, when the rapid deterioration in the macro surprises was ignored by the market as the IT and consumer discretionary sectors continued to pull the cyclical outperformance. This is a good example of the potential pitfalls when just looking at one type of indicators. We must not forget either that cyclicals have recovered and are “over-owned” by investors.

The impact on earnings growth will hardly be visible currently, and we do expect another strong earnings season. The consensus expects 15% global earnings growth this year, and 23% in the US. This makes perfect sense, as the direct trade impact on earnings is a slow-burning issue.

The effect on business confidence is also important. We will pay particular attention to the guidance given by companies when they report their second-quarter earnings. There is already some anecdotal evidence of companies lowering expectations and capex plans because of trade wars.

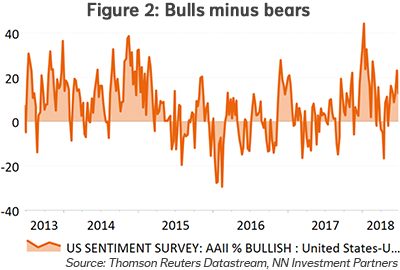

It is difficult to see how this will end, but it will certainly continue to weigh on sentiment. The bull-to-bear indicator shows there is still room for deterioration (see Figure 2).

Downward pressure on valuation metrics is likely

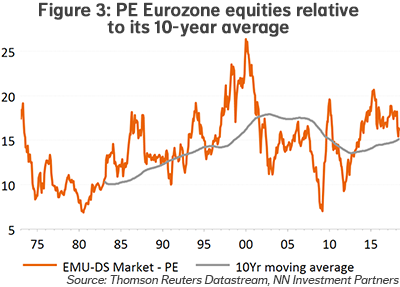

This also implies that the market impact will in a first phase, not through lower earnings but through lower PE ratios. Every region will be impacted, but within developed markets, we see the biggest downside risk in the Eurozone. This region is not only hurt directly and indirectly by the escalation between the US and China on trade, but it is also coping with increased political risk.

For the time being the Italian government is keeping a low profile on the budget and structural reforms, but sentiment may heat up on 20 September, when the budget is presented. In addition, immigration poses a serious challenge to the cohesion of the German government – and on immigration, Italy has been playing the game more fiercely. In the meantime, Italian bond spreads are widening again.

How does the Eurozone valuation compare with its history? It has come down over the past months and is close to its 10-year average (see Figure 3). However, a further worsening of the trade and political environment, combined with a central bank that will phase out quantitative easing in quarter four, could lead to valuation multiples falling below the long-term average. We prefer the US equity market.

Diesen Beitrag teilen: