NN IP: Eurozone - green shoots or a false dawn?

While macro weakness looks priced in, we don’t believe the environment has improved enough to justify a Eurozone upgrade.

01.03.2019 | 09:51 Uhr

Over the past week we noticed a reversal in the relative performance of the Eurozone versus global equities, and especially versus the US. Could this be the start of a sustainable shift, or is it a false dawn?

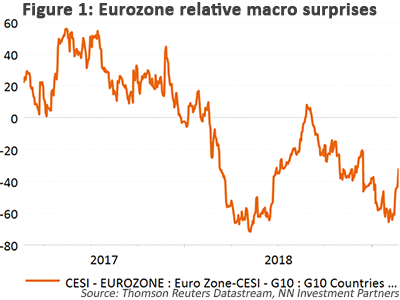

The first point is linked to macro-economic data. Eurozone macro data are not great; in particular, manufacturing data remain sluggish, influenced by the weakness in export demand. This was reflected in the Eurozone flash PMI and the German IFO data. However, this weakness is no longer a negative surprise for investors, as illustrated in the rise in the Citigroup surprise indicators. The reverse is happening in the rest of the world; in particular, data from the US, UK and Japan disappointed relative to expectations.

The Eurozone outlook remains cumbersome, especially given its vulnerability related to trade politics (risk of car tariffs in addition to China/US trade uncertainty), domestic politics (Italy, European elections, rising populism…) and Brexit, which remains a hazardous process. Over the weekend, positive news came out on trade as the March deadline on tariffs was postponed, but the uncertainty on car tariffs remains. Italy was not downgraded by Fitch, and this week the British Parliament will vote on important amendments to the potential Brexit outcome.

The ECB is struggling with the question of whether the macro weakness is due to temporary factors (new emission rules, yellow vest protests, weather-related weakness) or if it is more permanent. At the same time, the ECB stands with its back to the wall, having less ammunition to fight the slowdown. A new targeted long-term refinancing operation (TLTRO) is expected to provide cheap financing to the banking sector, supporting the sector’s profitability. The economic impact of this is less certain, as banks must be willing to use it to provide credit to the private sector. Fortunately, consumers are in good shape, helped by a strong labour market, and we also expect some fiscal easing in Germany, France and Italy.

Prolonged macro weakness largely priced in for Eurozone

The weak macro data do not bode well for the earnings outlook in the Eurozone. The Q4 results were in line (3% sales growth and 2.6% earnings growth) but indicate some pressure on margins, especially in the cyclical sectors and financials. In view of the difficult market environment, the 7% consensus growth figure for 2019 looks too optimistic. We think it will be less than 5%, possibly even close to 0%. Earnings momentum stays firmly below 0, meaning that the number of estimate downgrades is higher than the number of upgrades. Historically, earnings momentum troughs when the Q1 result season starts in April.

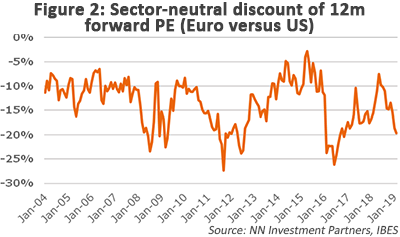

However, much of this sluggish earnings outlook seems priced in. Even correcting for the difference in sector composition, the discount of Eurozone equities relative to US equities is 20%, more than twice the average discount of the past 20 years (8.8%).

As Figure 2 illustrates, we have seen bigger discounts, especially in an environment characterized by growth worries. Based on this, one might say that a prolonged weakness/recession is 75% priced in.

A final observation is linked to the market dynamics. An underweight position on Eurozone equities is consensus among institutional investors.

Based on these elements, we can conclude that the fundamental outlook is weak but is largely priced in. Unless the weakness worsens or has a more permanent character, the Eurozone market could be up for a period of better relative performance. For the time being, we stick to our medium underweight as we are not yet convinced that the environment has changed sufficiently to justify an upgrade.

Diesen Beitrag teilen: