NN IP: Don't be distracted by political noise

Policy and politics are dominating headlines but may not influence financial markets. We see good fundamentals and supportive market dynamics and have upgraded equities to a small overweight.

18.06.2018 | 09:11 Uhr

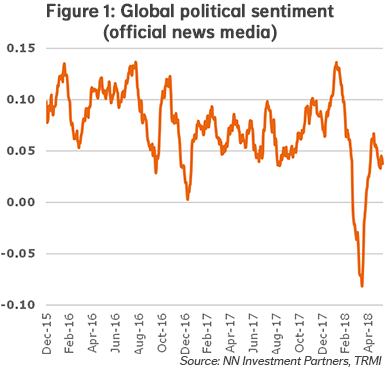

Politics and policy have dominated headlines in the past fortnight and will continue doing so in the coming days. Figure 1 illustrates how global political sentiment has fluctuated over the past 2.5 years. Sentiment still looks weak and has even deteriorated somewhat in the past weeks.

In practice it is often hard to predict how the market will absorb and react to the political news flow. The chaotic ending of the G7 summit in Quebec had hardly any negative impact despite the risk of a further rise in protectionism. On the other hand, the meeting between Trump and Kim in Singapore, which according to both parties went well, did not deliver a positive market response, perhaps due to the lack of detail in the agreement that was signed.

In the Eurozone, however, the political and policy events did not pass unnoticed by the market. First, there was a somewhat surprising speech by Peter Praet, the ECB's "dovish" chief economist, who put discussing the end of QE on the agenda of this week's meeting. This could be a real game-changer. We do not share his optimism on the economy and consider this message as a hawkish shift in the reaction function of the ECB. Probably this is partially a reaction to the Italian developments, whereby the ECB is not willing to bow for a non-compliant government and wants to send a strong signal. But it is not without risk. Second, and not unrelated to the previous point, Italy's finance minister spoke the right words over the weekend to soothe the market. This led to a sharp Monday rally in Italian bonds and equities that spilled over into Tuesday. We remain doubtful whether this move will last, given that his statements conflict with earlier announcements from the respective party leaders. But the market forces and the threat of a rating downgrade may be strong enough to calm the populists down in their rhetoric. To us, Italian politics remain a source of volatility.

Small overweight in equities

Given all the unpredictable political news flow, a focus on what we do know looks appropriate. Overall, the equity fundamentals have improved, based on a number of criteria.

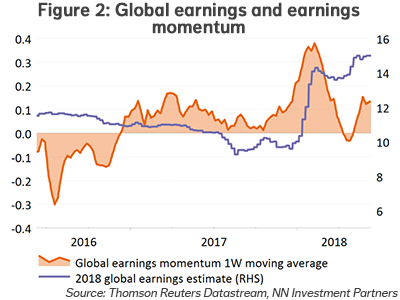

First, the one-month change of our global cycle indicator, which captures a broad set of leading indicators, has turned positive and provides a counterweight to the disappointing data surprises. Second, the earnings outlook is strong. Momentum has turned positive for every developed region. Absolute earnings growth numbers are also grinding higher, currently pointing towards a 15% increase.

Third, market dynamics are supportive for equities. Positioning is low, as measured by CFTC futures positioning and our own dynamic investor positioning indicator. In addition, the latest ML/BofA global investor survey shows a decline in the equity allocation of institutional investors. Finally, price momentum has improved and sentiment indicators also improved.

Given these elements we decided to upgrade equities from neutral to a small overweight and look through the political noise. Within equities we maintain a balance between cyclicals and defensives. Regionally we are overweight EM.

Diesen Beitrag teilen: