Ostrum: Beware of complacency risk

Last week in financial markets ended with modest bounce in bond yields as the environment remains favourable to risky assets. The major equity indices gained about 0.5% from a week ago.

17.04.2019 | 10:34 Uhr

Last week in financial markets ended with modest bounce in bond yields as the environment remains favourable to risky assets. The major equity indices gained about 0.5% from a week ago. Volatility is trading at its lowest since September despite reduced trading volumes. Incoming earnings releases have however been lacklustre.

In bond markets, Bund and T-note yields crept higher on profit taking. In the euro area, the yield curve steepened slightly. As Brexit was pushed out, Gilt yields rose above 1.20%. Sovereign spreads have shrunk as did financials’ bond spreads across credit

markets. Valuations keep getting richer in European high yield markets (367bp yield gap vs. Bunds). The iTraxx Crossover is now trading within 250bp, a level that is hard to reconcile with underlying credit quality in the index. Emerging market debt in US dollars (340bp spreads) is well bid as the $12b Aramco bond issue drew large demand thanks in part to high oil prices.

The euro broke above $1.13 but the dollar is globally trendless. In turn, the Japanese yen is towards the cheap end of its recent range near 112.

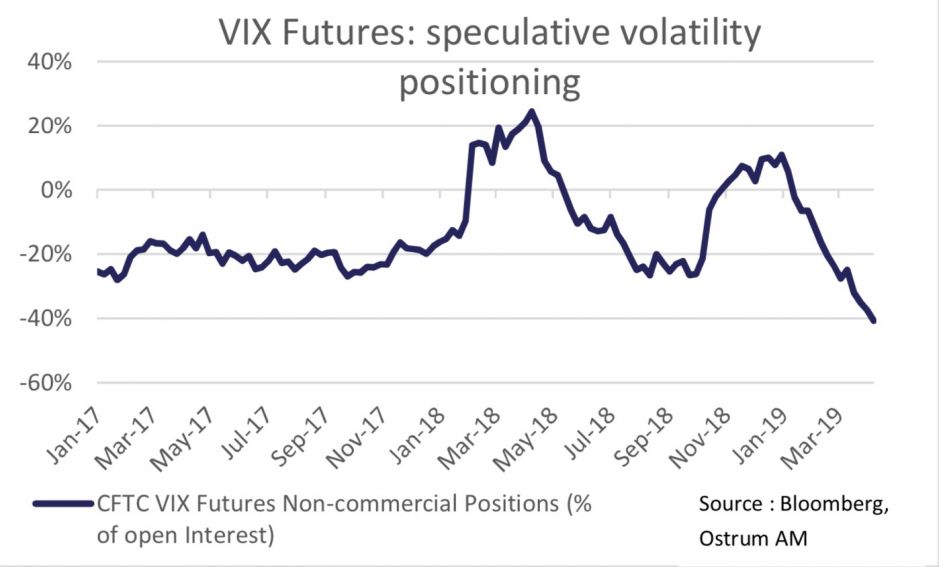

There exists persistent asymmetry in traded volatility linked to investor risk aversion. A fall in volatility tends to be associated with higher stock prices.

Investors can get exposure to volatility using VIX futures.

The change in the Fed’s stance sparked accumulation of short volatility trades. This highlights the risk of investor complacency regarding economic and financial risks. The January 2018 Krach may indeed have been forgotten.

The IMF lowers growth forecasts

The uptrend in financial markets since the start of the year is at odds with the global slowdown pencilled in by the IMF. According to IMF forecasts, global growth will trough at 3.3%ya this year before gathering pace next year (3.6%ya). Europe is the most fragile economic area. The euro area is likely to expand at a 1.3%ya clip in 2019. The forecast may even prove too optimistic given cutbacks in growth expectations in Germany where the government only expects 0.5% for this year. Italy will struggle to emerge from recession. Fiscal projections have indeed been lowered by the Conte government. In China, gradual slowdown continues towards 6%ya by 2021. The protectionist threat has been revived as Trump targets Europe. The EU may retaliate proportionately with tariffs on $10b worth of US goods. The absence of concrete progress in the US- China likely displaced US wrath onto Europe.

The latest batch of data nevertheless gives us some hope. China’s exports rose sharply in March (+14.2%y) and the trade surplus increased to $32b. Capital outflows have moderated thanks to a pickup in foreign direct investment. PBoC easing measures since January have started to bear fruit. New bank loans totalled 1620b CNY in March. Germany’s manufacturing indicators will be of interest (April advance PMI later this week) after factory orders plummeted in February. In contrast, US manufacturing surveys remain well oriented.

S&P near all-time highs

In financial markets, US equity indices have nearly risen back to last September highs. The S&P 500 benchmark index is within index points of all-time record levels. Estimates of share repurchases hover about $225b in the first quarter as monetary accommodation encourages buybacks. With hindsight it may be fair to say that the stock rally costed the Fed 75bp worth of tightening and some credibility capital as the institution acted under pressure from the current Administration. Volatility collapsed as Fed policy turned dovish. The VIX index is now trading below the 13% mark. Current short positioning in VIX futures is comparable to January 2018 excesses. The earnings season is likely to be challenging. Earnings per share may decline by about 3% from a year ago. It is true that corporate guidance may reduce the share of negative surprises but 30-ish releases so far do support the view of declining earnings in the first quarter.

Bond yields have risen somewhat. T-note yields trade about 2.55%, which mainly reflects the 5bp weekly rise in breakeven inflation rates. Most US inflation indicators (including producer prices and import prices)

indeed came in above consensus expectations in March. US CPI inflation was 1.9%y in March. That said, the Fed may soon redefine its price stability definition likely to take account of past low inflation. An average- inflation target would kill off expectations for monetary tightening. A long duration stance on US Treasuries remains appropriate in our opinion despite thin carry. In turn, 10s30s spreads (41bp) have potential to widen further.

Financials outperform

In the euro area economic pessimism is as widespread as market bullishness as equities are up 16% so far this year. Market sentiment towards the euro and beaten- up equity sectors is improving as well. Bank stocks gained 5% last week. That said, as is the case in the US, trading volumes are quite thin across Europe. Foreign investors remain on the side-lines of European stock markets. The modest appreciation of the euro could help revive the interest from non-resident investors for euro area stocks.

The outperformance of financial equities transpired into credit markets. The iTraxx sub financials index trades within 140bp^, which the tightest spread level since the spring of 2018. The average yield premium on financials’ bonds has narrowed to just 11bp vs. non- financials. The decline in risk-free bond yields has spurred investors’ demand for corporate bonds. Credit fund inflows so far this year represent 2% of assets under management. In European high yield, inflows account for 4% of AuM. Spreads in speculative-grade bonds have shrunk by as much as 150bp in 2019.

Bonos briefly breach 100bp threshold

In sovereign debt markets, the slight retracement in Bund yields to 0.05% mostly reflects a knee-jerk reaction to the postponement of Brexit rather than a change in the market environment. The €1b auction of Bund 2044 this week may have caused some selling. Despite some profit-taking, German bond yields will likely stay at low levels. Low Bund yields push investors into peripheral sovereign bonds. Indeed, 10-year Spanish Bonos broke below the 100bp last week. Portuguese bonds also trade tight at 110bp. Italy did participle to the rally despite a deterioration in economic and fiscal projections announced by the Conte government.

In emerging bond markets, the Aramco deal allegedly drew large demand worth $100b. The borrowed amount initially announced at $10b finally was raised to $12b, which did weigh on prices on following days. Oil and Fed rates support most emerging bond markets (340bp), with the notable exception of Turkey.

Diesen Beitrag teilen: