Janus Henderson: European secured loans — enticing spreads

Elissa Johnson, Portfolio Manager within the Secured Loans Team, explains the reasons why European secured loans continue to represent an appealing investment opportunity.

26.11.2018 | 13:03 Uhr

European secured loans (European loans) have outperformed the majority of liquid fixed income assets so far this year and we expect the asset class to continue to deliver strong performance owing to fundamental and technical factors.

Attractive returns on a risk-adjusted basis

On a risk-adjusted basis, European loans have provided attractive returns over the past few years. While volatility has hit unprecedented lows across many asset classes, we believe the outlook for loans remains attractive and as a consequence they should represent a part of a diversified portfolio.

However, we acknowledge the concerns on levels of leverage and collateralised loan obligation (CLO) demand in the European loan market, and address below why we think European loans continue to represent an appealing investment opportunity — albeit on a selective basis.

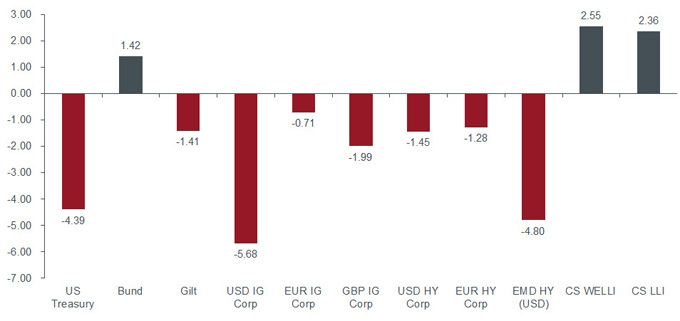

Figure 1 shows total returns for fixed income asset classes at the end of October 2018 (hedged to euro). While US Treasuries and UK gilts have delivered negative returns, hampering the performance of the equivalent investment grade (IG) markets, bunds have actually delivered positive returns year to date, explaining the better performance of the euro IG market versus its peers.

Figure 1: a difficult year for most fixed income assets, % return

Source: Janus Henderson Investors, Bloomberg, Credit Suisse, JP Morgan, as at 31 October 2018.

Note: Returns are total returns, in euro, hedged. Indices shown: ICE BofAML Indices: C0A0, ER00, UN00, H0A0, HE00, EMHB. Credit Suisse Western European Leveraged Loan Index (CS WELLI) and the US Leveraged Loan Index (CS LLI), hedged to euro.

Past performance is not a guide to future performance

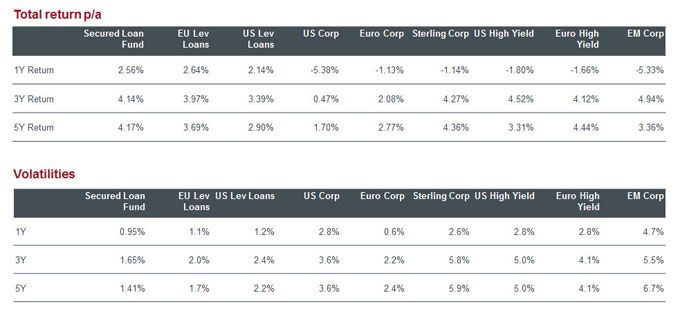

Clients typically wish to minimise risk and enhance risk-adjusted returns. The table in figure 2 shows the performance against risk across a selection of fixed income asset classes. It is clear that European loans have delivered attractive results over time versus other fixed income asset classes, particularly when volatility levels are taken into account. We have used the data for our Secured Loans Fund as an example of what active investment can deliver.

Figure 2: returns and volatilities compared across different asset classes

Source: Janus Henderson Investors, Bloomberg, figures to 31 October 2018. Note: Total returns hedged to euro. Past performance is not a guide to future performance

What could derail loan returns?

Apart from a major global geopolitical event, which would derail all risk assets, we struggle to envisage anything that will materially impact on near-term loan returns.

Much has been made of the late-cycle in credit markets and the rise in mergers and acquisitions (M&A) activity has been a major driver of new loan issuance. While we concur that there are deals coming to market with aggressive leverage and weak structures, we believe it is possible to construct a loan portfolio that is conservative and still offers all the beneficial characteristics of loans (floating rates, borrower diversification, senior and secured).

Hence, we continue to build our loan portfolio with a conservative slant, in line with our long-term strategy. As at the end of October 2018 the average leverage of the borrowers in our portfolio is 4.7x with interest cover of 4.1x and an average loan price of 100 (ie, the borrowers are performing well)*.

*Weighted average loan leverage and loan interest cover based on latest covenant information provided by the borrower, data as at 30 June 2018.

Could CLOs derail loans?

The European loan market is an ‘institutional only’ market. The main buyers are banks, CLOs and real money accounts (typically funded by pension funds, insurance companies and foundations). CLOs are a strong constituent of the European loan buyer base, accounting for up to 75% of the demand for some new deals according to broker feedback. The strength or weakness of the CLO market can therefore be a driver of short-term loan returns.

European CLOs are largely denominated in euros and buy predominantly euro-denominated loan (and floating rate) assets. Figure 3 shows how CLO issuance is up strongly year on year in Europe. Full year 2018 forecasts for this market were €20-25bn. Given the pipeline of deals looking to price this year, we believe the top end of this range is entirely feasible.

Figure 3: strong CLO issuance in Europe YTD, despite increased market volatility

Source: Thomson Reuters, Barclays, JP Morgan, as at 31 October 2018.

CLOs are closed-end vehicles with a typical seven year lifespan. They are cash arbitrage vehicles, which rely on the income stream generated by a portfolio of loans to deliver returns of 8-14% on the 10x leveraged equity tranche of the CLO structure, with lower returns going to the higher rated tranches. Because CLOs need to maintain a stable portfolio of loans they are an important constituent in the European loan market buyer base.

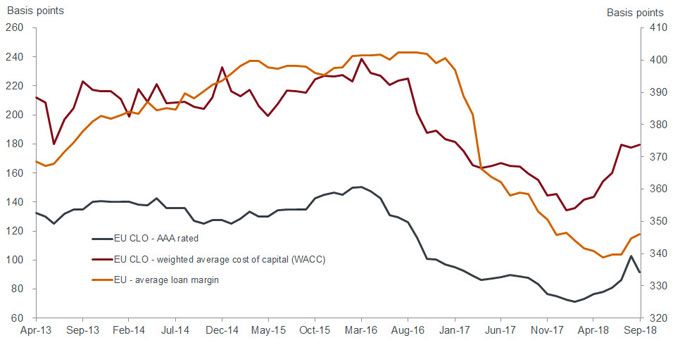

As such, loan margins and CLO liability spreads have tended to be well correlated as shown in the chart in figure 4. We calculate the correlation as 0.74 for AAA spreads and 0.81 for CLO WACC (weighted average cost of capital (funding/debt)).

Figure 4: strong correlation between loan margins and CLO liability spreads

Source: Credit Suisse, Barclays Capital, as at 28 September 2018.

CLO indigestion this year — a healthy development

It is clear that the strong supply of CLO paper this year has caused some indigestion leaving CLO spreads wider since the tights in the first quarter of 2018. We see this as a healthy development. We expect to see CLO warehouse vehicles — which typically hold up to 50% of the assets required for the CLO before it is issued — reduce the pace of their loan purchases until the arbitrage (differential between CLO WACC and loan spreads) becomes more attractive.

Given we have seen three European loans seeking to reprice their debt (lower the margin and hence lower the income return to investors) so far this quarter, we do not see a slowdown of demand for loans from CLOs as a threat to loan returns in the near term — indeed it could actually support loan returns by slowing the pace of repricing activity.

It’s not just about CLOs…

It is not just strong demand for CLOs that has led to strong demand for European loans year to date. The European loan market continues to attract new investors given the attractive risk-return on offer, highlighted earlier. Some of the reasons as to why the European loan market is seen as attractive compared with the US loan market are shown below.

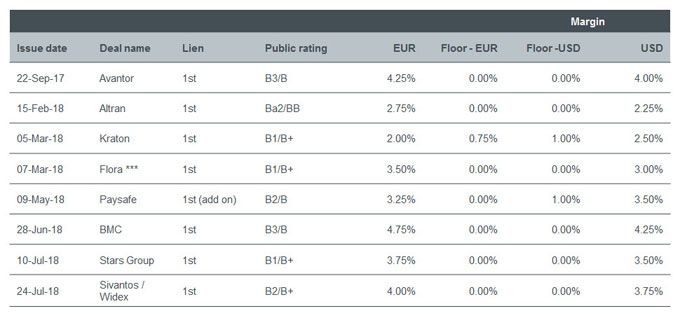

1. Margin premium

Cross-border issuance has been rising since 2014. By this we mean the number of companies issuing loans in US dollar, euro and sterling. These loan tranches are pari passu and are governed by the same loan documentation. However, as figure 5 shows, euro and sterling tranches consistently offer a premium over the equivalent US dollar denominated tranche, particularly when one takes account of the 0% Libor floor applicable to all the euro denominated loans (currently a benefit of roughly 36 basis points (bp) as euro Libor is negative**), which has the effect of increasing the margin by over 12bp assuming a three year life.

** 3-month ICE EUR Libor at 0.3574% at the time of writing, 16 November 2018, roughly 36bp benefit to the lender.

Figure 5: USD v EUR v GBP tranche margins

Source: Janus Henderson Investors, Bloomberg, as at 31 July 2018.

Note: ratings are corporate, issuer, or tranche.***Flora GBP tranche pays 0+4%.

2. FX basis swap costs

Hedging FX risk is not without cost. Currently, US investors can pick up over 30bp by buying euro denominated assets and hedging them back into US dollar. The reverse is obviously true for euro investors — not only do US dollar loans offer lower margins for pari passu credit risk but the FX hedging costs are currently negative, further reducing returns.

3. Investor flows

Both the European and US loan markets have seen strong demand for loans from CLOs this year (with the US loan demand partly influenced by the ending of risk retention requirements for CLOs in Feb 2018).

However, the US and European loan markets are different in the structure of their buyer bases. Banks represent a larger proportion of the European loan market than in the US, and these investors are typically ‘buy and hold’, providing stability to the market. Furthermore, the US loan market allows retail investors to invest, whereas the European loan market is institutional only. Mutual funds account for 15-20% of the US market and hence can be the marginal buyers/sellers. We note that over time there is a tendency for negative mutual fund flows (ie, outflows) to drive negative US loan market returns.

While the US Federal Reserve’s most recent dot plot indicates rates should continue to rise through 2019, concern remains that as fixed rate bonds fully price in the interest rate cycle, and as rate rises come to an end, retail flows into US loans will potentially reverse. This could lead to lower returns in US loans as was seen in the period 2014-16 and is a risk to be considered in our view.

The case for European loans remains compelling

European loans have delivered a strong performance year to date compared with other fixed income asset classes. We do not think this is likely to change. Economic conditions remain benign; fund flows into the asset class remain supportive and the constituent buyer bases remain in buying mode.

While credit terms are undoubtedly weaker than they were even two years ago, credit selection can deliver excess returns above the broader market and will be critical in sustaining returns through the credit cycle when it does eventually turn.

Last year, we predicted returns of 3-4% in euro terms from European loans in 2018, and our outlook for 2019 is similar. We continue to believe European loans offer both attractive portfolio diversification and attractive risk-adjusted returns.

Diesen Beitrag teilen: