Morgan Stanley IM: The Haze of Uncertainty Is Lifting

Going into 2021, we expect the haze of uncertainty wrought by COVID-19 and U.S. politics to lift. For the global economy, this could translate into meaningful growth catalysts.

26.01.2021 | 07:20 Uhr

Here you can find the complete article.

GLOBALLY: We believe the most promising of those catalysts is likely to be the introduction of effective and widely available COVID-19 vaccines around the world. Clearly, the eradication of COVID-19 would be a major factor in facilitating a quicker pace of economic normalisation in 2021.

UNITED STATES: Joe Biden is set to become the 46th U.S. president in January, with critical ramifications worldwide. In the near term, we expect the Biden team to provide a credible approach to managing COVID-19, coupled with an increase in fiscal stimulus to soften the ongoing economic impact of the virus. Longer term, we expect to see significant infrastructure spending, tied to innovative green technology, thus aligning the U.S. with the global “Schumpeterian” shake-up of the energy industry.

The Biden administration should ultimately be a boon to both domestic and international policy, in which greater certainty, consistency and co-operation with respect to U.S. global trade policy would be a game changer. This is not to imply that we expect Biden to turn “soft” on China, but more that the “rules of the road” will be clearer, with fewer unpredictable changes in direction, and greater alignment with traditional allies.

CHINA: The New Year will mark the start of China’s new five-year plan, which has a clear “growth” agenda — a reversal of the “deleveraging” goal of the previous five-year plan. While China’s focus is their domestic economy, their plan will nevertheless support global economies that export raw materials and equipment needed by China, helping to fuel growth in many of the world’s cyclical sectors.

As the world gratefully moves into 2021, we see plenty of reasons to be optimistic.

A more synchronised economic recovery

The global economy is likely to see both developed market (DM) and emerging market (EM) growth accelerate in 2021. This has not occurred since 2017, which marked the beginning of a period of divergent economic outcomes due to Chinese financial deleveraging, a manufacturing recession, global trade disruption and tightening financial conditions, as the Federal Reserve raised interest rates and the U.S. dollar surged.

Critically, the world’s two largest economies are both focused on increasing domestic demand and implementing an agenda for structural medium-term investment.

Consumers will reach a crossroads in the spring of 2021

POSITIVES FOR CONSUMPTION GOING INTO 2021, ESPECIALLY COMPARED TO THE 2008-2009 RECESSION:

- VACCINES: The distribution of vaccines should coincide with spring, thus providing a healthy backdrop for the pace of economic activity to pick up in late Q1 2021.

- PENT-UP DEMAND AND EXCESS SAVINGS: Forced lockdowns and generous government support programmes have resulted in consumer savings rising substantially above the historical average. As at the end of September, U.S. personal income was still 3.9% above pre-COVID-19 levels.1 However, the follow-on fiscal stimulus from the U.S. may need to be greater than it has been so far to keep income high enough to sustain spending levels.

- STRONGER HOUSEHOLD BALANCE SHEETS: Household balance sheets are considerably more robust than in the 2008/2009 recession, and there is evidence of consumers reducing leverage ratios in 2020, by using excess savings to pay down debt, particularly credit card debt.

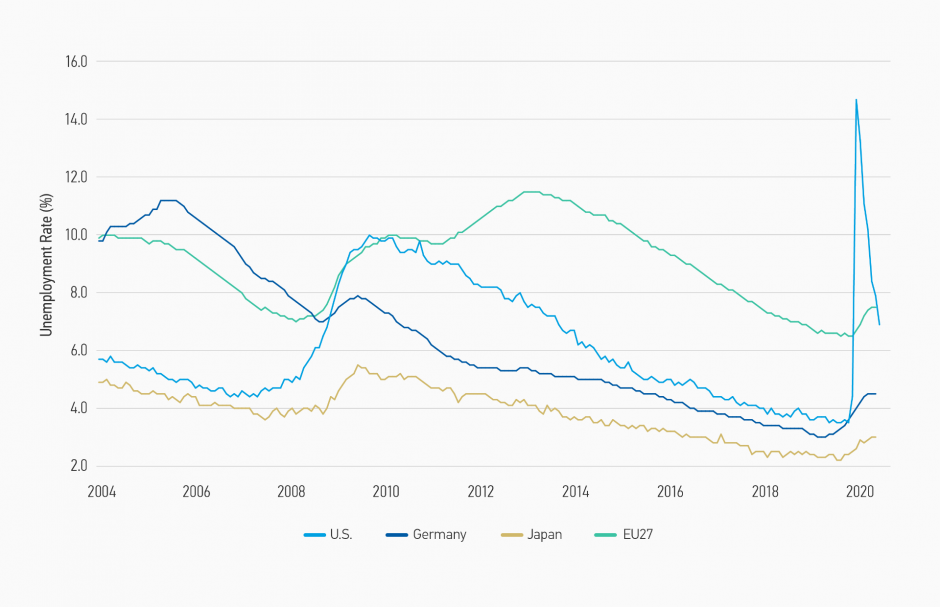

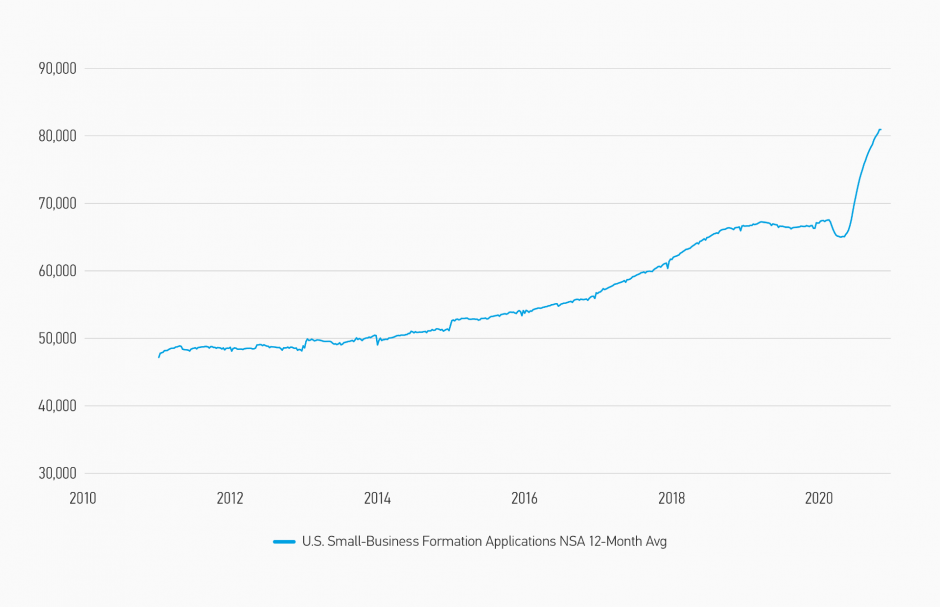

- SURGE IN NEW BUSINESS FORMATION IN 1H 2020: While further job losses are unavoidable (especially as the crisis accelerates trends towards automation), current unemployment is less broad-based and less sticky than during the previous global recession (Display 1). Moreover, new business formations in the U.S. surged in 1H 2020, and despite a pull-back in Q3, remain elevated relative to recent history, a trend that bodes well for the employment outlook in the U.S. (Display 2).

DISPLAY 1: Unemployment has been maintained well below 2009 highs

Source: Haver, 20 November 2020.

DISPLAY 2: A 2020 surge in U.S. small-business formations bodes well for the 2021 employment outlook

Source: Bloomberg, Macrobond, US Census Bureau. Data as of 3 December 2020.

NEGATIVES FOR CONSUMPTION GOING INTO 2021

Surging cases of the virus in western developed nations, combined with a lack of further fiscal stimulus in the U.S., may reverse the positive trends for consumers, especially as unemployment remains elevated.

A more intangible variable is consumer sentiment or, as Keynes put it, “Animal Spirits.” After the initial shock from the virus in March and April, U.S. consumer sentiment remained robust as people saw continued improvement in the economy and enjoyed massive income support from the government. The question is whether the recent surge in the virus and Donald Trump’s loss in the U.S. presidential election are weakening these spirits. The latest Michigan Consumer Survey data showed a sharp drop in expectations among Republicans and only a negligible rise in expectations among Democrats. Since the country is roughly evenly split, a deterioration in sentiment among Republicans—if it results in less robust spending—could lead to a softening in U.S. consumer spending.

Business activity and capex to pick up in 2021

As with the consumer, there are a number of reasons why we expect both manufacturing and capex activity to accelerate in 2021.

- INVENTORY REBUILD POINTS TO ONGOING MANUFACTURING: Unlike during previous cycles (2000, 2008, 2014), both inventories and new orders had been slowing well ahead of the COVID-19 crisis. Businesses did not have a large buildup of excessive inventories, as would have been the case in a booming economy, because growth momentum had already been softening in 2019. The combination of a lower inventory starting level, combined with unexpectedly robust post-lockdown demand, meant that businesses found themselves short of stock that was in high demand. With new orders for durable goods and inventories now moving in opposite directions, the restocking of warehouses should continue into 2021.

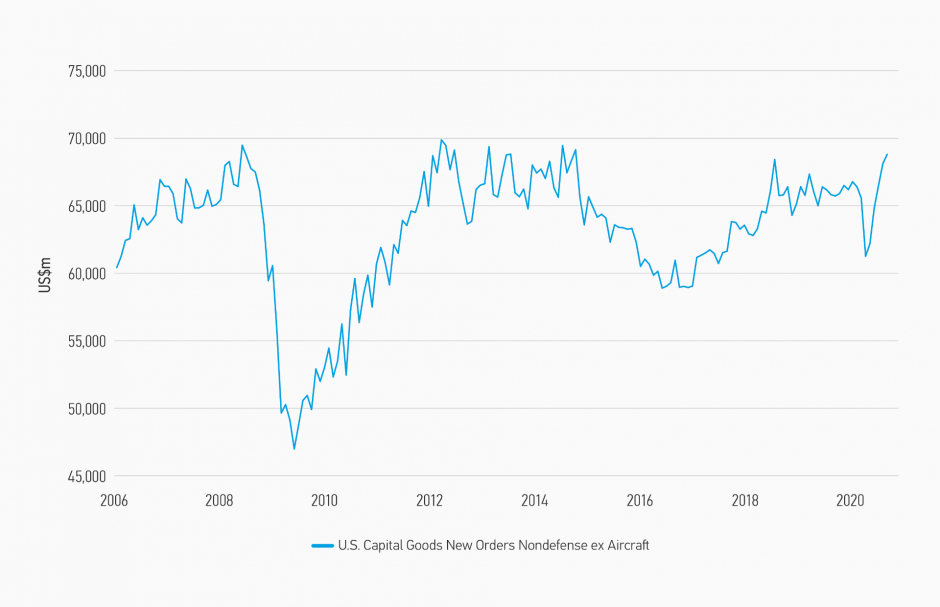

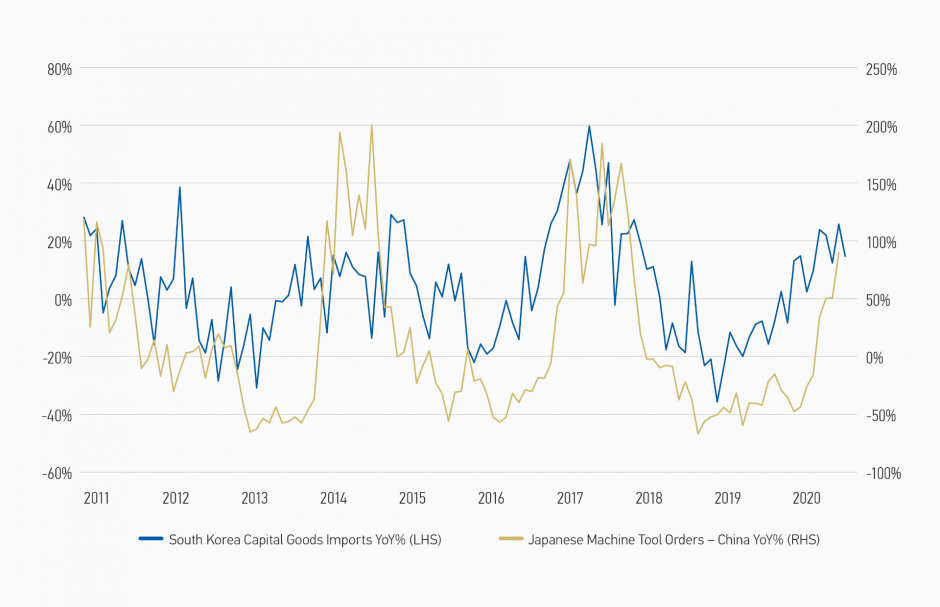

- CAPEX RECOVERY EXPECTED IN 2021: There are already clear signs of a capex recovery playing out. Chinese orders for machine tools from Japan were up 20% YoY in September; the last time growth was at similar levels was in March 2019.2 In the U.S., core capital goods orders have surged in recent months and are not only above pre-COVID-19 levels, but are back at highs last seen in 2014 (Display 3). A similar positive trend can be observed in capital goods orders in Korea, whose economy is considered a bellwether for world trade (Display 4).

DISPLAYS 3 AND 4: Capital expenditures at strong levels across the U.S., Japan and South Korea

Source: Datastream, MSIM, Bloomberg. 3 December 2020.

Here you can find the complete article.

Risk Considerations

There is no assurance that the strategy will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Accordingly, you can lose money investing in this portfolio. Please be aware that this strategy may be subject to certain additional risks. There is the risk that the Adviser’s asset allocation methodology and assumptions regarding the Underlying Portfolios may be incorrect in light of actual market conditions and the portfolio may not achieve its investment objective. Share prices also tend to be volatile and there is a significant possibility of loss. The portfolio’s investments in commodity-linked notes involve substantial risks, including risk of loss of a significant portion of their principal value. In addition to commodity risk, they may be subject to additional special risks, such as risk of loss of interest and principal, lack of secondary market and risk of greater volatility, that do not affect traditional equity and debt securities. Currency fluctuations could erase investment gains or add to investment losses. Fixed-income securities are subject to the ability of an issuer to make timely principal and interest payments (credit risk), changes in interest rates (interest-rate risk), the creditworthiness of the issuer and general market liquidity (market risk). In a rising interest-rate environment, bond prices may fall and may result in periods of volatility and increased portfolio redemptions. In a declining interest-rate environment, the portfolio may generate less income. Longer-term securities may be more sensitive to interest rate changes. In general, equities securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks, such as currency, political, economic and market risks. Stocks of small-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds ETFs and other Investment Funds, the portfolio absorbs both its own expenses and those of the ETFs and Investment Funds it invests in. Supply and demand for ETFs and Investment Funds may not be correlated to that of the underlying securities. Derivative instruments can be illiquid, may disproportionately increase losses and may have a potentially large negative impact on the portfolio’s performance. The use of leverage may increase volatility in the Portfolio. Diversification does not protect you against a loss in a particular market; however, it allows you to spread that risk across various asset classes.

Diesen Beitrag teilen: