Morgan Stanley: Fishing for Stocks in China

We discuss how we are finding bottom-up stock ideas in China driven by consumption growth and highlight four specific areas where we see vast opportunity: consumer, internet, healthcare and education.

24.08.2020 | 13:10 Uhr

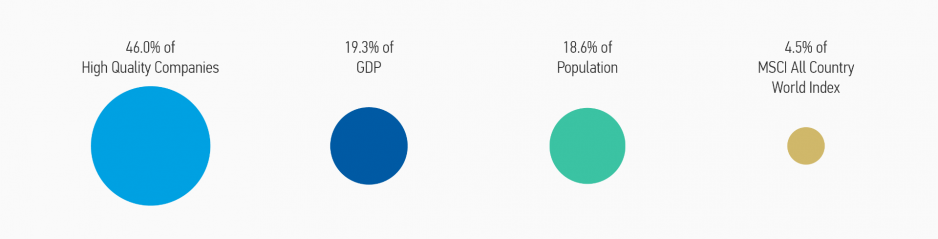

China Stock Market Is Misunderstood

Our location in Hong Kong, extensive research of companies across Asia and significant allocations to China for more than a decade across the Opportunity Strategies give us a unique perspective on the risks and opportunities of investing in China. In recent years, China’s economic transition, rising debt and political risk have raised concerns in the markets. Indeed, it’s hard to go a single week without a major negative article in the press. While we don’t share a belief in the inevitability of the draconian view, if there are large scale policy missteps, China could become one of the more likely sources of financial contagion due to its sheer size and disproportionate share of worldwide economic growth. We are encouraged that consumption growth has been increasing as a driver of China’s economic expansion. That strikes us as more sustainable. Furthermore, we continue to find compelling bottom-up stock ideas in China, a market that surprisingly makes up 46 percent of the global companies that pass our high quality screen—this is an impressive result (Display 1).1

Source: Morgan Stanley Investment Management/FactSet, United Nation Population Division, IMF and MSCI. GDP is on a PPP basis. Data as of January 2020.

It means that investors should not ignore China regardless of their macro view. Let’s examine together the transformation we are seeing first-hand in China to present a different side of the story, one where ignoring China can mean a large risk of missing out on what we believe to be some of the greatest bottom-up stock ideas of the next decade.

We believe that China is ripe with opportunity for bottom-up stock picking. Whereas historically China’s stock market was primarily comprised of state-owned enterprises (SOE), non-SOEs now represent more than half of the market capitalization of the MSCI China Index at 52 percent in 2020 versus just 5 percent in 2005.2 An increasing number of private companies concentrated in the consumer, healthcare and technology sectors are now accessible to international investors via the Hong Kong Stock Connect program for China A shares listed in Shanghai and Shenzhen.

China Is Under-Represented by Equity Indices

China offers vast opportunity to investors willing to extend their time horizon and take a long-term view. Regardless of the consensus view that short-term real gross domestic product (GDP) growth is slowing, China represents nearly 1/5 of the world’s economy an population; yet is under-represented by global equity indices at less than 1/20 (4.5 percent) of the MSCI All Country World Index (Display 1). In the years ahead, we expect that gap to narrow as China’s economy evolves and innovative companies address China’s growing demand for consumption and services, thus necessitating an increase in index weightings for China. Maybe the Chinese economy doesn’t grow at 6 percent anymore and that’s perfectly ok. Let’s assume for the sake of argument that China only grows at 4 percent over the next decade. Isn’t that still better than the zero to 2 percent that most of the developed world has been growing at for the last decade and likely into the future?

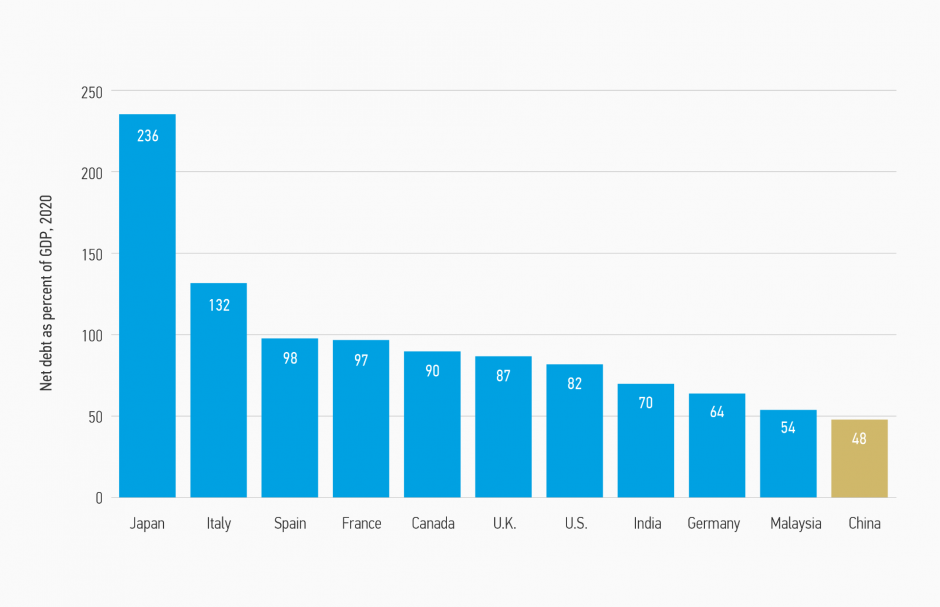

China’s Net Debt Is Lower Than Advanced Economies

Pundits have noted China’s rapid increase in leverage to nearly 300 percent of GDP over the last decade, as well as declining profitability and excess investment capacity. Although unforeseen political developments and trade protectionism also present risks, a key leading indicator to watch going forward, in our view would be any rise in non-performing loans in consumer sectors outside of heavy industries.

We believe, however, that the risk of a financial blow-up in the next three years is, although still possible, perhaps overstated at this time by the media. Nearly half of China’s leverage is contained within the financial system and government-owed debt, which is controllable in a command economy. Further, after taking into account the high savings rate in China, the ratio of net debt in China is only 48 percent of GDP, which is far lower than that of Japan, the U.S. and other major economies (Display 2).

Display 2: Net debt as percentage of GDP

Source: Bloomberg. Data as of June 2020.

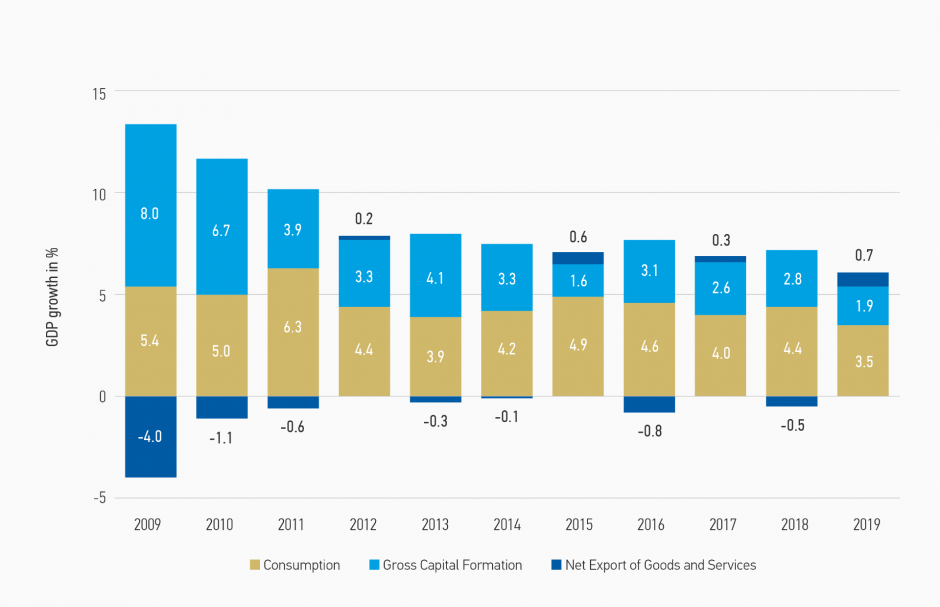

Consumption Growth Now Drives China’s Economy

China’s economy is undergoing a massive transition from fixed asset investment in heavy industry and manufacturing to growth in consumption and services. The contribution to GDP from consumption has averaged 4.6 percent over the past decade (Display 3). China’s consumption growth provides investors with a baseline to expect from the economy going forward: even without the benefit of growth in investment or exports, the world’s second-largest consumer will likely continue to grow faster than the developed world in the years ahead based on consumption growth alone.3

Display 3: Contribution to China GDP growth, 2009-2019

Source: Morgan Stanley Research, as of December 2019.

A Billion Consumers Want What We Want

Over 800 million people have emerged from poverty in China since market reforms were introduced in 1978.4 This emerging middle class wants what those in developed markets have long enjoyed and perhaps take for granted: higher quality consumable products such as food and beverages, internet services to share experiences with family and friends, access to healthcare and better education opportunities for their children.

Consumption upgrade demand across food, beverages, household products and personal care continues to outpace that of developed economies. We are attracted to the defensive characteristics of domestic staples categories and specifically of companies with demonstrated competitive advantages sustained through strategies of brand differentiation and cost leadership. Two areas we find particularly compelling are beverages, in which the domestic market appears to be consolidating as leaders capture share in the beer and baijiu spirits markets by leveraging strong brands through superior distribution and execution; and food, where nimble players in niche categories such as soy sauce are delivering stable growth through market consolidation and product premiumization. Over the long-term, household consumption in China is expected to shift from basic necessities to increased discretionary spending as a burgeoning middle class emerges.

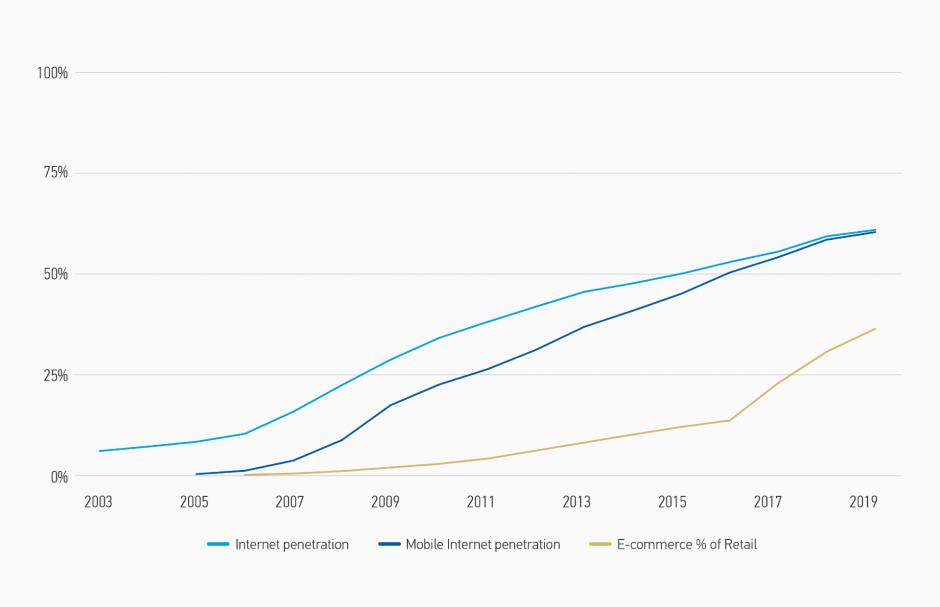

Internet

Chinese internet users now total 854 million, more than 61 percent of the overall population, with 99 percent accessing via mobile,5 yet there remain over 540 million people without access to the internet in China (Display 4). The accompanying changes in consumer behavior benefit domestic social networking, e-commerce, gaming and online travel platforms. The USD 55 billion online advertising market has grown at a 26 percent compound annual growth rate over the last five years.6 Advertising on social networks is growing its share of the pie driven by increased monetization. Meanwhile, e-commerce as a percentage of retail is over 36 percent in China, higher than the U.S., as online leapfrogs offline retail in China which has not developed modern offline retail at scale.7 We believe that continued growth in engagement of the China internet population which now spends over six hours per day on digital media,8 will continue to benefit businesses that leverage the internet as a distribution platform.

Display 4: Internet penetration in China, 2003-2019

Source: China Internet Network Information Center (CNNIC), eMarketer. Data as of August 2019.

Healthcare

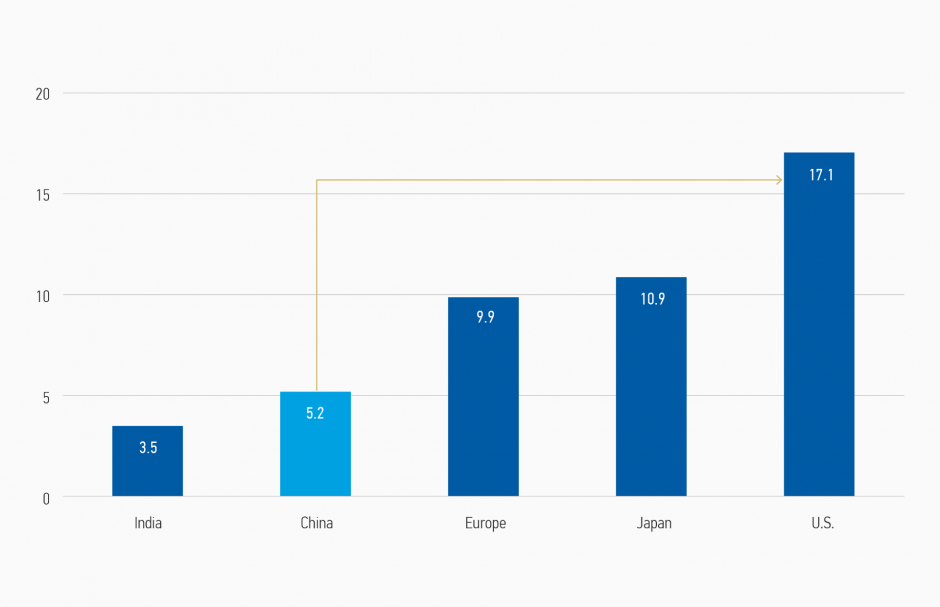

China’s healthcare spending totals 5.2 percent of GDP, compared to over 10 percent in Europe and Japan, and over 17 percent in the U.S. (Display 5). As China’s population ages and increases in wealth, we expect healthcare spending to rise. Two areas we find particularly compelling include healthcare equipment and services and pharmaceuticals, where the emergence of domestic players with advanced research and development capabilities in oncology, infectious diseases and generic medications is expanding China’s healthcare industry.

Display 5: Health expenditure as percentage of GDP

Source: Morgan Stanley Research, World Development Indicators, EuroStat. Data as of December 2017.

Education

Education is a high priority for Chinese families, particularly in foreign languages, mathematics and science, which are key to passing the gaokao (高 考) national higher education entrance examination. Top Chinese universities accept students at half the rate of leading U.S. institutions intensifying competition for university entrance and driving a surge in demand for high quality private educational services. Thus, we are attracted to the private educational market. It has experienced strong enrollment growth and should further benefit from the growth in disposable income and favorable demographics with more children following the end of China’s one child policy in 2015.

High Quality Stocks in China

After three decades of rapid real GDP growth driven by fixed asset investment in heavy industry, China is adjusting to a more moderate pace driven by consumption and services. Rebalancing the world’s second-largest economy is not without its well-known challenges, but as bottom-up investors we look through the short-term macro noise and have been finding plenty of high quality stocks in China. Therefore, we believe that if you want to find some of the best bottom-up stock ideas of the next decade, then look to China because as Charlie Munger, Warren Buffett’s long-time partner said about China, “It’s a happier hunting ground.”9

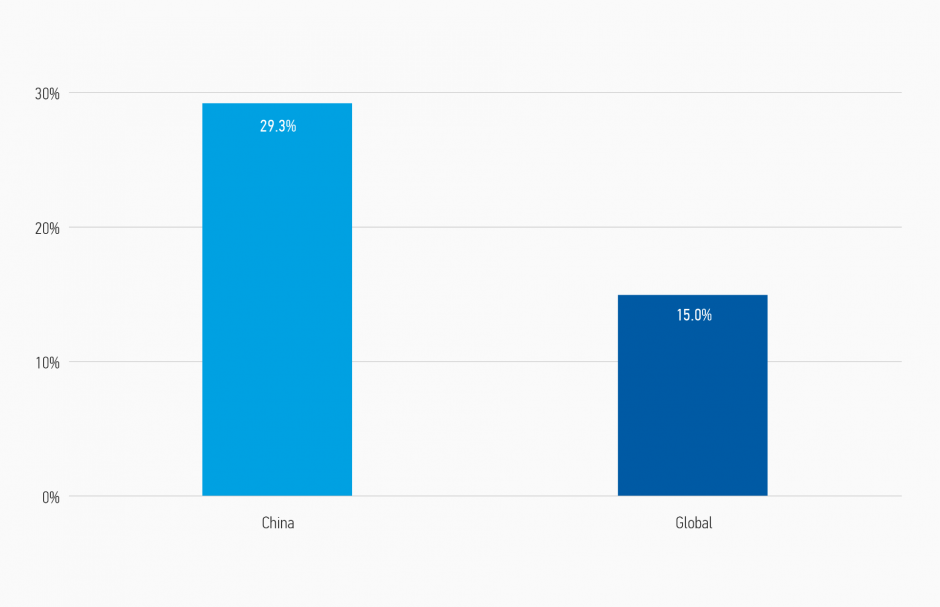

Display 6: High quality screen: Percentage of non-financial companies with both 15% sales growth and return on invested capital (ROIC)

Source: Morgan Stanley Investment Management/FactSet. Data as of Jan, 2020. Dataset is 6,211 non-financial companies above U.S. $1 billion market cap. 1. High-quality screen is defined by: a) historical three-year revenue CAGR above 15%; and b) ROIC above 15%. 2. While representative, regional domicile is not the same as economic exposure in revenue terms. 3. High-quality companies typically have a higher percentage of sales from outside their home country than the index.

Here you can find the complete article

1 Morgan Stanley Investment Management/FactSet. Data as of January 2020. High-quality screen is defined by: a) historical three-year revenue CAGR above 15%; and b) ROIC above 15%. Refer to Display 6.

2 Morgan Stanley Research, as of June 2020.

3 Morgan Stanley Research, as of December 2019.

4 World Bank, China Overview as of March 2017.

5 China Internet Network Information Center (CNNIC), as of August 2019.

6 China Internet Network Information Center (CNNIC), as of March 2019.

7 eMarket, as of June 2019.

8 eMarket, as of May 2019.

9 Charlie Munger, Vice Chairman of Berkshire Hathaway; 2017 Annual Meeting, as of May 2017.

RISK CONSIDERATIONS

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market values of securities owned by the portfolio will decline and that the value of portfolio shares may therefore be less than what you paid for them. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in these portfolios. Please be aware that these portfolios may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact these portfolios to a greater extent than if these portfolios’ assets were invested in a wider variety of companies. In general, equity securities’ values also fluctuate in response to activities specific to a company. Exchange traded funds (ETFs) shares have many of the same risks as direct investments in common stocks or bonds and their market value will fluctuate as the value of the underlying index does. By investing in exchange traded funds (ETFs), the portfolio absorbs both its own expenses and those of the ETFs it invests in. Supply and demand for ETFs may not be correlated to that of the underlying securities. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Asia market entails liquidity risk due to the small markets and low trading volume in many countries. In addition, companies in the region tend to be volatile and there is a significant possibility of loss. Furthermore, because the strategy concentrates in a single region of the world, performance may be more volatile than a global strategy. Privately placed and restricted securities may be subject to resale restrictions as well as a lack of publicly available information, which will increase their illiquidity and could adversely affect the ability to value and sell them (liquidity risk). Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. To the extent that the Fund invests in a limited number of issuers (focused investing), the Fund will be more susceptible to negative events affecting those issuers and a decline in the value of a particular instrument may cause the Fund’s overall value to decline to a greater degree than if the Fund were invested more widely. China Risk. Investments in China involve risk of a total loss due to government action or inaction. Additionally, the Chinese economy is export-driven and highly reliant on trade. Adverse changes to the economic conditions of its primary trading partners, such as the United States, Japan and South Korea, would adversely impact the Chinese economy and the Fund’s investments. Moreover, a slowdown in other significant economies of the world, such as the United States, the European Union and certain Asian countries, may adversely affect economic growth in China. An economic downturn in China would adversely impact the Portfolio’s investments. Risks of Investing through Stock Connect. Any investments in A-shares listed and traded through Stock Connect, or on such other stock exchanges in China which participate in Stock Connect is subject to a number of restrictions that may affect the Portfolio’s investments and returns. Moreover, Stock Connect A shares generally may not be sold, purchased or otherwise transferred other than through Stock Connect in accordance with applicable rules. The Stock Connect program may be subject to further interpretation and guidance. There can be no assurance as to the program’s continued existence or whether future developments regarding the program may restrict or adversely affect the Portfolio’s investments or returns.

Diesen Beitrag teilen: