Janus Henderson: Anatomy of a sell-off

There has been a sharp sell-off in the markets over the last few days. In the following analysis Ben Lofthouse, Head of the Janus Henderson Global Equity Income Team, examines the effects of the recent equity market sell-off on European cyclical and defensive stocks.

14.02.2018 | 12:10 Uhr

There has been a sharp sell-off in the markets over the last few days. Whilst painful for investors, there have been some interesting technical developments. Despite a market correction being widely expected, it has turned out to be hard to defend against because, in the main, defensive stocks have fallen as much as cyclical stocks.

There has been a sharp sell-off in the markets over the last few days. Whilst painful for investors, there have been some interesting technical developments. Despite a market correction being widely expected, it has turned out to be hard to defend against because, in the main, defensive stocks have fallen as much as cyclical stocks.

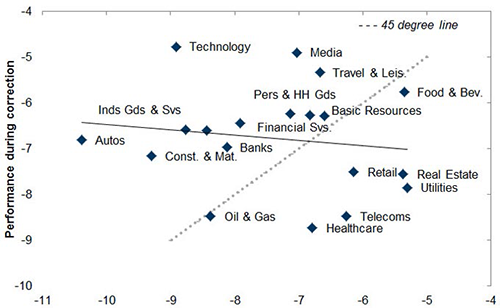

The first chart below, sourced from Goldman Sachs, shows that expected performance based on beta has not been a good predictor for behaviour during this fall. As an example, we would expect utilities to be down -5% and autos down -10% in a market correction (bottom axis), but according to the chart data utilities actually fell 8% and autos slightly less than 7%, so autos outperformed (vertical axis).

Why have defensive stocks fallen as much as cyclicals?

There are lots of reasons being given, such as positioning, funds flows, and a low volatility unwind. But the most obvious is that this sell-off has been triggered by strong economic growth in the US in the form of better-than-expected payroll and wage numbers.

Chart 1: Sector performance in Europe has deviated sharply from the ‘normal’ beta-driven sell-off

Performance of European sectors since 26 January 2018

Expected performance based on 1-year beta

(Source: Datastream, Goldman Sachs Global Investment Research as at 07.02.18. This chart is supplied independently by Goldman Sachs Global Investment Research. The views in this article are those of Janus Henderson portfolio manager Ben Lofthouse.)

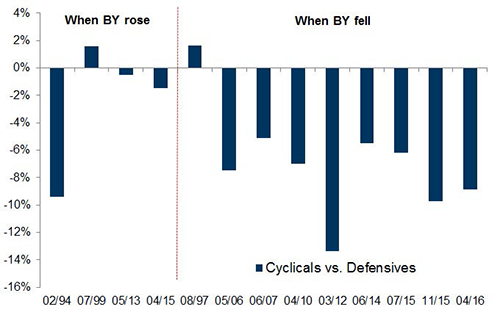

When growth surprises

The second chart shows cyclical underperformance during corrections in two different circumstances, when bond yields fell and when they rose. It shows that when there is real concern around economic growth (bond yields fall) then defensives are defensive, but when it is a growth surprise (bond yields rise) they offer less defence relative to the market.

What happens to cyclicals and defensive stocks when bond yields rise or fall?

(Source: Datastream, Goldman Sachs Global Investment Research as at 07.02.18. This chart is supplied independently by Goldman Sachs Global Investment Research. The views in this article are those of Janus Henderson portfolio manager Ben Lofthouse.)

Key takeaways

We are some way through the cycle, the relative protection an equity portfolio can provide against a real slow down, or even just concerns about one, remains and will be measured by the exposure to cyclical companies. However, in the event of positive growth/higher inflation, this market reaction shows there might still be some over positioning in defensive areas. While we have tried to avoid over-exposure to these areas, especially those that are highly valued, we have still found ourselves exposed in areas such as telecoms (where low valuation has not helped in the short term).

Over the last year we have outperformed some peers who have remained in high yielding, defensive areas, by having exposure to areas like financials and technology, and this period highlights why. Given that bond yields remain very low in Europe and Asia, we would observe that there could be more moments like this, in which traditionally defensive areas within equities do not provide as much cushioning as investors might expect.

In the longer term, what ultimately always concerns us for clients is a permanent loss of capital, not short-term market gyrations. This means not over-paying for companies and not owning bad companies. Nothing in this sell-off concerns us on this front with regard to the portfolio.

We will be watching bond spreads (widening = bad news past a certain point), the money supply and relative valuations to determine when it is a good time to buy back in to defensive areas. The good news is that they are getting cheap again.

Diesen Beitrag teilen: