Morgan Stanley: And the Beat Goes On…

The global economy is cruising at just the right temperature for growth…now only if those pesky trade issues would go away! The Global Fixed Income team shares their views and outlook.

04.06.2019 | 10:18 Uhr

Fixed income had a mixed month. Government bonds, both developed and local currency emerging, saw yields rise, which is not a surprising development after their strong rally in March. However, credit-oriented bonds–investment grade, high yield and external emerging market–had a strong month, with yields falling and spreads tightening. What’s behind this?

Economic data turned out better than expected, with a particular emphasis on an improvement in China and the U.S., suggesting the global slowdown that was so evident in the second half of 2018 and the first quarter of this year was coming to an end. U.S. first quarter gross domestic product (GDP) turned out much stronger than expected, although some of the growth was borrowing from the second quarter in terms of inventory buildup. Central banks continued to play their supportive role by not doing anything to suggest policy would not be supportive in the quarters ahead.

With the U.S. economy back in a not-too-hot, not-too-cold mold, the U.S. Federal Reserve (Fed) on hold, other G10 central banks in a bias- to-ease mode and Chinese growth bottoming, the outlook for risky assets looks reasonable. Valuations in most developed government bond markets look a bit stretched with, at the margin, a bit more upside than downside yield potential, reflecting a market bias for easier monetary policy which may not materialize.

In any event, with most economies and policies looking to be on a fairly even keel, we should expect volatility to stay low and risky assets (high yield, emerging markets) to be well supported, at least outside of idiosyncratic factors specific to those companies or countries. In other words, the risks of economic weakness are diminished but not enough to get central banks to worry about too strong growth. And the beat goes on…if only those pesky trade issues would go away!

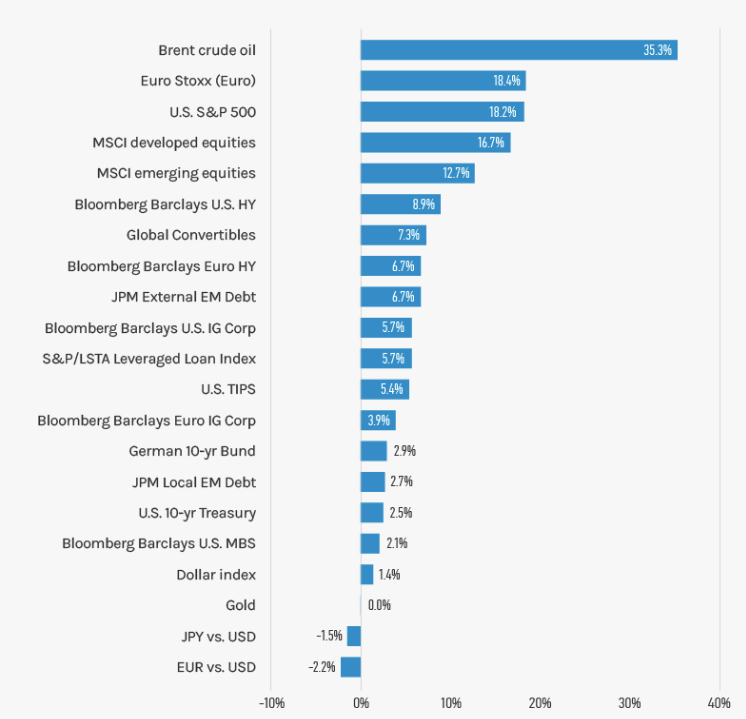

Display 1: Asset Performance Year-To-Date

Note: USD-based performance. Source: Thomson Reuters Datastream. Data as of April 30, 2019. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

Note: USD-based performance. Source: Thomson Reuters Datastream. Data as of April 30, 2019. The indexes are provided for illustrative purposes only and are not meant to depict the performance of a specific investment. Past performance is no guarantee of future results. See below for index definitions.

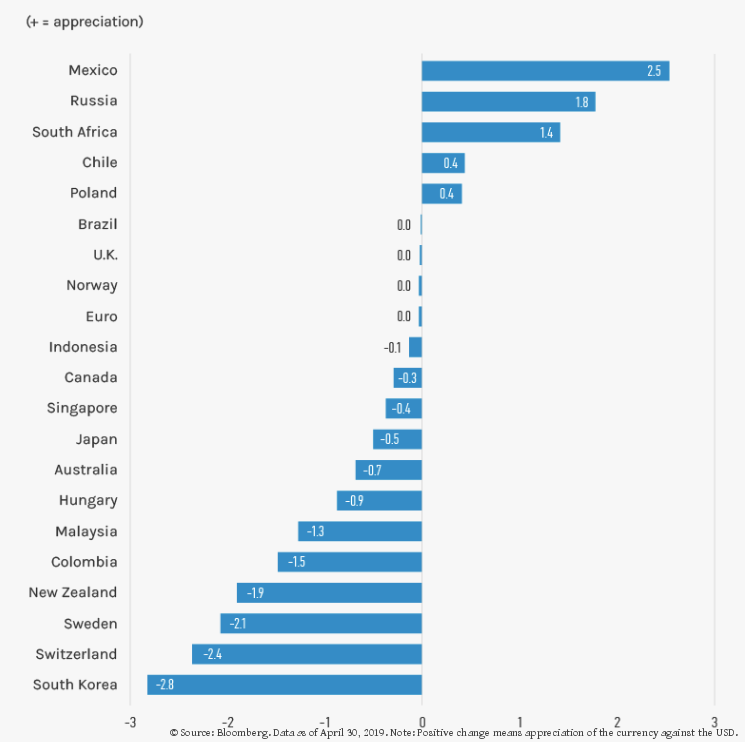

Display 2: Currency Monthly Changes Versus USD

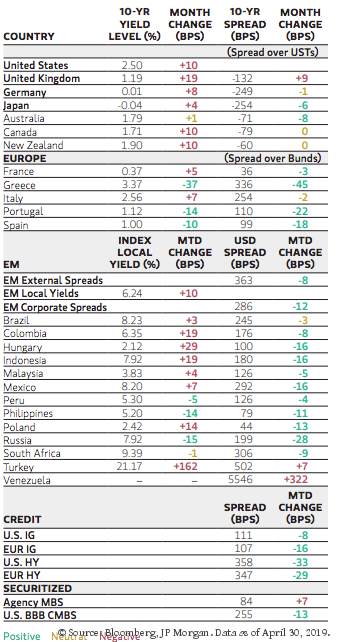

Display 3: Major Monthly Changes in 10-Year Yields and Spreads

Fixed Income Outlook

Data releases, policy adjustments and policy pronouncements all point in the direction of continuity: economic recovery, stable/low inflation, stable to easy monetary policy. We believe the biggest challenge to continued good performance of corporate and securitized credit and emerging market debt is valuation. The markets cannot keep rallying at the pace we have seen so far this year. Our strategy has been to look for opportunities to reduce exposures where we think assets have become fully valued and rotate into markets/sectors/companies where there is still upside potential.

For example, in countries like Australia and New Zealand, there is still a reasonable probability central banks will cut rates this year. This is in contrast to the situation in the U.S., Canada and the eurozone where probabilities of rate cuts are much lower. As a result, we think holding above average interest rate risk in the Antipodean countries as being more attractive than holding it in the U.S. We think relative opportunities such as these are a better way to position portfolios than in taking a lot of outright interest rate risk.

That said, our argument is not about being bearish on rates. It is a more nuanced view that markets are too optimistic (pessimistic?) about central banks willingness to ease. If we are right and global economic conditions turn out to be the right temperature, pressure to dial up easing measures will diminish, pushing government bond yields higher. However, especially given investors may remain worried about future risk events, we are not anticipating a substantial rise in yields and do not view interest rate management as the key to investment success in the months ahead.

What is likely to be key to performance is managing exposure to credit and other nongovernment sectors. In these areas the macroeconomic backdrop should continue to be supportive and if valuations were more attractive we would be a lot more bullish and have portfolios with a lot more risk. However, valuations look average to modestly expensive in many sectors. We have therefore been adjusting portfolios in ways that can benefit from earning a yield advantage without taking on too much systematic risk.

In other words, our risk profile is modestly aggressive and focused on situations, like those in Australia and New Zealand noted above, where specific idiosyncratic factors can justify a meaningful overweight position. Our positions in securitized credit, emerging markets, BBB and high yield exposures are being managed similarly. Carry is your friend, but do not confuse carry with capital gains, the majority of which are probably behind us.

We cannot avoid talking about outstanding risks which remain aplenty, even if they look somewhat diminished. The list is lengthy: unresolved U.S.-China trade talks; upcoming U.S./European Union(EU)/Japan trade negotiations; Brexit; oil; a raft of European elections; and of course the anticipated economy recovery in the second half of the year which is still an expectation rather than a fact. Indeed, the global purchasing manager index (PMI) continues to fall and has fallen continuously for several quarters. Economic surprise indices might be rebounding but on average economic data are still printing weaker than consensus expectations. Stabilization is not the same as a tailwind, suggesting we want to be in a position to take advantage of any reversal of risk appetite and underperformance of risky assets.

Developed Market Rate/Foreign Currency (FX)

Monthly Review: In April, investor confidence continued to rally as markets continued to fare well and volatility declined. U.S. Treasury yields rose across the curve and investors took on more risk, particularly as U.S. Q1 GDP figure beat expectations. Globally, economic data was satisfactory as the “Goldilocks” conditions returned. Government bond yields also rose in other developed markets, while the U.S. dollar (USD) strengthened marginally against the main developed economies.

Outlook: Following a surprisingly strong performance in the first quarter, U.S. growth is likely to be lower for the remainder of 2019, as the fiscal impulse wears off and the lagged effect of higher rates bite, but not collapse. Central banks have become more accommodative, and we expect the lack of inflationary pressures will mean this continues, although both rate cuts and hikes from the main central banks look unlikely at present. Recent speeches from Fed policymakers give us further confidence that the Federal Open Market Committee is committed to being “patient” and “flexible” on future rate hikes.

At this point we do not think it is likely that the Fed will either hike or cut rates in 2019. The European Central Bank (ECB) has also distanced itself from speculation that it would introduce a tiered deposit system, which would open the door to further rate cuts, but it has also indicated very clearly to the market that no rate hikes are likely until well into 2020. Similarly, the U.K. Monetary Policy Committee is likely to remain on hold for as long as Brexit remains unresolved, even though labor market data would support rate hikes.

Emerging Market (EM) Rate/FX

Monthly Review: It was a mixed picture once again for EM fixed income assets during the month. With a few exceptions, EM currencies continued to weaken versus the USD, while local bond and external debt returns were positive. Within the hard currency segment, investment grade outperformed high yield as U.S. Treasury yields edged higher, and corporates outperformed sovereigns. Commodity prices were also mixed during the period, as energy prices rose, while precious metals and agricultural commodity prices declined. The Institute of International Finance (IIF) estimated that portfolio flows into EM were $38 billion for the month, with $14 billion flowing into equities, and $24 billion into debt.

Outlook: Our constructive outlook for EM assets is based on the following factors. First, Q1 real GDP data releases in both the U.S. and China point to stabilization in global growth, which could potentially spill over to other countries, thus boosting risky assets in general. Furthermore, this incipient global growth pickup is taking place amid subdued inflationary pressures, implying that key central banks see no pressing need to lessen their dovish stance and therefore rendering EM yields more attractive versus developed markets. In addition, uncertainty over trade issues may diminish significantly in May provided ongoing U.S.-China trade talks conclude successfully, despite other matters still pending (most notably, potential U.S. tariffs on cars/aircraft from the EU, and obstacles to the United States-Mexico-Canada Agreement (USMCA) ratification by national Congresses).

Additionally, our USD weakness thesis, which has failed to materialize so far this year, could ultimately prove correct, given a dovish Fed and provided that the tentative rebound in Chinese growth can spill over to Europe and EM economies. Finally, to the extent that growth stabilizes and eventually accelerates, it should bode well for EM credit, particularly high-yield sovereigns, which have underperformed investment grade credits over the last year.

Credit

Monthly Review: Supportive economic data, strong earnings and positive technicals all helped drive spreads tighter in April. The Bloomberg Barclays U.S. Corporate Index narrowed by 8 basis points in April to end the month at 110 basis points over government bonds, with financials and BBB nonfinancial credits outperforming.1 European investment grade outperformed the U.S. market again by tightening 14 basis points in April to 107 basis points, as measured by the Bloomberg Barclays Euro-Aggregate Corporate Index.2 High yield bond prices continued to grind higher in April alongside equities amid a better-than-expected earnings season and an accommodative Fed. Spreads tightened 34 basis points to end the month at 380 basis points, while yields decreased by 31 basis points to 6.12%.3

Outlook: Accommodative monetary policy, economic data that is not too hot nor too cold, decent corporate earnings and strong demand for credit are all supportive for the markets looking forward. However, while the backdrop is broadly supportive, valuations are no longer as cheap, with spreads now sitting below long run averages. We therefore continue to de-risk most portfolios by reducing higher beta exposures such as BBBs, high yield and convertible bonds. We still find credit attractive, given the rather benign macro backdrop, but we believe the bulk of capital gains for the year are behind us.

Securitized

Monthly Review: Credit-oriented securitized assets performed well in April, while agency mortgage-backed securities (MBS) underperformed slightly. The Bloomberg Barclays U.S. MBS Index was down 0.06% in April, but still outperformed the Bloomberg Barclays U.S. Treasury Index by 22 basis points.4 The duration of the Bloomberg Barclays U.S. MBS index lengthened 0.33 years to 4.36 years during April.5 The Fed’s MBS portfolio shrank by $10 billion during the month to $1.583 trillion and is now $54 billion lower year to date.6 Non-agency residential mortgage-backed securities (RMBS), European MBS, and U.S. asset-backed securities (ABS) spreads tightened again in April.

Outlook: Mortgage and securitized markets are off to a good start in 2019, benefitting from both lower interest rates and tightening spreads. Going forward, we expect returns to be more a function of cash flow carry, rather than rates or spread changes, as we expect interest rates to remain largely range-bound for the remainder of 2019 and expect spreads to stabilize at current levels. From a fundamental perspective, we believe the U.S. economy is strong with healthy consumer and real estate market conditions, and we remain overweight credit-oriented securitized investments and underweight agency MBS. We expect agency MBS to continue to outperform Treasuries but underperform credit-oriented securitized opportunities.

Here the full report.

Diesen Beitrag teilen: