Janus Henderson: Perkins outlook - Staying levelheaded in a heady market

The current bull market seems old and stretched, and things could be significantly worse, judging by historical standards. The real question for investors is how to manage the risk/reward balance in their portfolios, given the possible outcomes.

05.06.2018 | 12:04 Uhr

Author and commentator David Brooks describes in his recent bestseller The Road to Character a cautious Dwight Eisenhower, the product of an upbringing and life emphasising self-restraint. In his now famous final presidential speech to the nation (the one warning about the “military-industrial complex”), Eisenhower (Ike) advised against hubris in favor of prudence and balance. He was a leader who realised that life itself could be difficult, and who ‘used to tell his advisors “Let’s make our mistakes slowly,” because it was better to proceed to a decision gradually than to rush into anything before its time.’ (David Brooks: The Road to Character, 2015, 48–73).

Given that so very much has gone right in the stock market in recent years, and armed with the knowledge that financial markets have not always followed a straight line higher, investors would do well to consider Ike’s advice, in the context of seeking returns from their portfolios. Much is being made of the current US economic expansion (which will reach its ninth anniversary in June) and global growth prospects. Specifically, investors are asking if the good times will last.

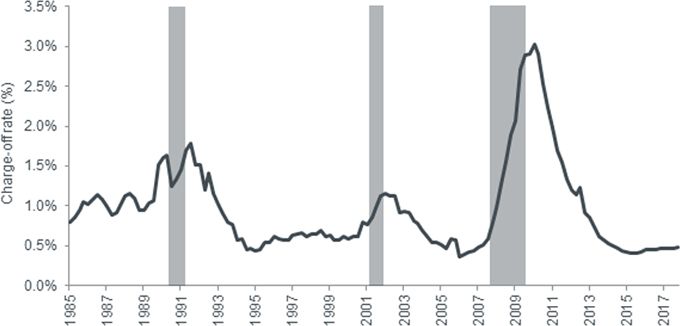

The debate over whether expansions and bull markets die of old age is beside the point. Leave the yield curve analysis to others. Consider, instead, the historical record of economic and financial fluctuations. Bank credit quality, for example, has traversed a wide range through the years, but has been strong for several years (see chart 1). However, today’s incredibly favourable credit experience is unlikely to endure, just as peak losses from the 2009 global financial crisis were never going to persist indefinitely. Business cycles, while not easily predicted or timed, bear careful consideration in the context of investment decisions.

Chart 1: Charge-off rate for US commercial bank loans

Source: Board of Governors of the Federal Reserve System (US), Charge-Off Rate on All Loans, All Commercial Banks (CORALACBS), retrieved from Federal Reserve Bank of St. Louis (FRED); https://fred.stlouisfed.org/series/CORALACBS. Data as at 30 April 2018. Shaded areas indicate US recessions. Note: A charge-off is a debt that a company decides it has no chance of collecting. The value of these loans and leases are removed from the books and charged against loss reserves. Charge-off rates (shown here as a percentage) are seasonally adjusted and annualised, net of recoveries. Frequency of data is quarterly, January 1985–October 2017.

The current bull market seems old and stretched, and things could be significantly worse, judging by historical standards. The real question for investors is how to manage the risk/reward balance in their portfolios, given the possible outcomes. In a world of little obvious value, the notion of proceeding carefully with investment selections, while emphasising a balanced portfolio would seem wise counsel to follow.

Navigating the risks

As value investors, our stock-level analysis seeks to understand cyclical opportunities and their context. An area of concern today, particularly in more economically sensitive areas, is incremental profit margins. We increasingly observe input cost inflation (raw materials, transportation, labour), accompanied with a delay (or perhaps inability) to achieve commensurate price increases, which results in gross margin pressure. Several US industrial companies reported this weakness in the first quarter earnings season, and their stock prices suffered as a result.

Value investment opportunities may exist where there are also secular worries. Consider the global media/communications landscape. After years of fat margins, incumbent distributors beset by competition from new technologies like ‘over-the-top’ (OTT) media streaming are seeing both revenue losses and cost pressures; this is contributing to lower margins. Similar secular stories of margins under assault are playing out in a variety of industries. Competitive analysis (Porter’s Five Forces) is a crucial tool for distinguishing companies that are able to protect their margins. The trend of rising profits has been one of the pillars of the current bull market. Therefore, investing in companies that report weakness in incremental margins may be a mistake to be made slowly, and preferably avoided altogether.

Rising balance sheet leverage is another potential risk worthy of careful consideration. Many companies have availed themselves of wide-open debt capital markets in recent years, in order to finance acquisitions, dividends and stock buybacks. Some management teams will have made smarter (ie, value enhancing) decisions than others, but corporate balance sheets are generally the worse for wear. The increased leverage will likely have at least two impacts for shareholders – outcomes will be magnified, both good and bad, and staying power in the face of unanticipated negative developments will be reduced. Thus, if investors face cyclical risks in future, investments in well-capitalised and liquid balance sheets may serve them better than over-encumbered alternatives.

Quality and diversification

Beyond paying careful attention to the durability of margins and the strength of balance sheets, investors can attempt to avoid or reduce the impact of any mistakes via diversification at a portfolio level. We recognise the length and magnitude of the current cycle, and as we worry about what appear to be significant downside risks, we work to intelligently diversify across many different drivers of alpha. We are focusing on stocks that we view as high quality, maintaining plenty of flexibility should the cycle weaken from its current highs. An additional advantage of a well-diversified portfolio may provide the opportunity to capitalise on potential bargain stock opportunities when they appear.

Eisenhower led the country in a time of great peril and tragedy, a situation wholly different from present day investing, it should be said. Still, having managed through such difficulties and recognising the prosperity that was achieved, the great leader urged a fundamentally cautious approach to managing the nation’s affairs. It is that careful spirit which I believe holds wisdom for the present.

Diesen Beitrag teilen: