Schroders: MSCI to include China A-shares

Index operator MSCI has announced on Tuesday its decision to include China A-shares in its benchmark indices after three previous rejections. The market expects that the inclusion will bring US$10-15 billion of inflows to China A-shares from passive and active funds benchmarked against MSCI indices.

23.06.2017 | 10:00 Uhr

Index operator MSCI has announced on Tuesday its decision to include China A-shares in its benchmark indices after three previous rejections. MSCI has assigned a 5% inclusion factor for 222 qualified A-share listed stocks. This inclusion factor is the number that is applied to the free float-adjusted market capitalisation of these eligible stocks.

The timetable for implementing inclusion will be in two stages; the first step being in May 2018 and the next in August 2018. The market expects that the inclusion will bring US$10-15 billion of inflows to China A-shares from passive and active funds benchmarked against MSCI indices.

Albeit a small initial step, the significance of inclusion does not lie in the immediate capital inflows.

Instead it marks a larger symbolic milestone that highlights the size and significance of China’s domestic stockmarket. Longer term, it is now inevitable that China A-shares will play an increasingly integral role in asset allocation for global investors.

Stock Connect as a framework

he Shanghai- and Shenzhen-Hong Kong Stock Connect (‘Connect’) programmes, which launched in November 2014 and December 2016 respectively, are already available to international investors as a gateway to invest into China A-shares. The Connect scheme currently operates with certain features and restrictions around daily quotas, and can be expected to continue to evolve as China carries on its path of capital market liberalisation.

Connect provides access to over 1,400 China A-share names and many more interesting names not available in MSCI China. The accessibility of the China A market through the Stock Connect programme is a key positive factor that has brought about the inclusion. In fact, MSCI’s inclusion is being based on a “Stock Connect Access” framework and will be based only on large cap companies that are accessible via the Stock Connect programmes. In December 2016, with the inclusion of the Shenzhen Connect (along with the already-existing Shanghai Connect), it was thought this was a strong pre-cursor to leading index providers announcing the inclusion of China A shares into their broader mainstream indices.

The evolution of China A-shares

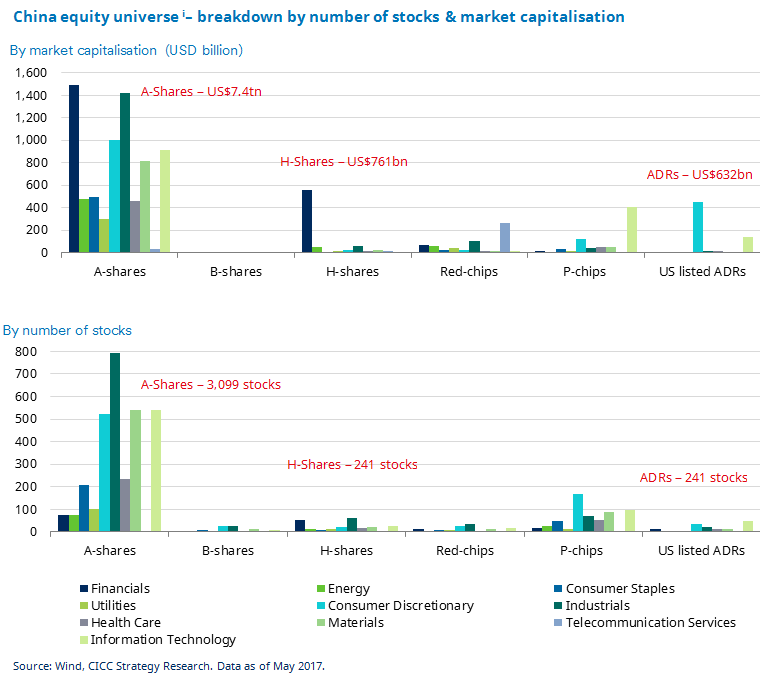

From the early days of investing in A-shares, via the Qualified Foreign Institutional Investor (QFII) programme, to the more recent Shanghai-/Shenzhen-Hong Kong Stock Connects, access for foreign investors to China’s sizeable US$ 7.4 trillion A-shares market has continued to advance. The A-shares universe itself, both by number of listed stocks and market capitalisation, dwarfs those that are found offshore. This will allow investors to access a market that has some of China’s most innovative and fast-growing companies.

As Chinese companies move up the value chain, opportunities will be forthcoming and we are already seeing this with, for example, certain technology manufacturers that are globally competitive. The market is also home to many of the companies most aligned with China’s exciting structural growth stories, residing in the consumer and service industries.

Diesen Beitrag teilen: