Schroders: Mid-year markets review

2017 has been an interesting year for investors so far. Buoyed by a rally in risk assets at the end of 2016 sparked by President Trump's election victory, investors started the year confident that the "Trump reflation rally" could continue. As the first half of the year ends, we look back at recent trends and examine which were the best broad asset classes and markets to be invested in.

29.06.2017 | 14:49 Uhr

What happened to the Trump reflation rally?

The Trump reflation rally initially continued at the start of 2017, but has faded away slowly over the course of recent months. His promise to cut tax, increase infrastructure spending and deregulate industry and banking were music to the ears of investors in US companies. Investors piled in to sectors that were set to benefit from Trump's agenda, like energy, banks and some tech stocks. From a macroeconomic perspective, extra fiscal spending and deregulation could spur faster growth, and with unemployment already at cyclical lows, concerns over inflation had returned.

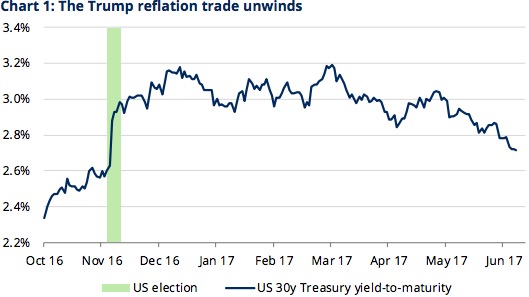

Expectations of higher inflation were reflected by inflation-linked bonds, but also the performance of long-dated US Treasuries bonds. Chart 1 shows the yields-tomaturity of 30-year Treasury bonds, along with the shaded section highlighting the period of the presidential election. The immediate reaction to Trump's victory last November was for investors to sell long-dated Treasury bonds, causing prices to fall and yields to rise. This makes sense if higher inflation is a concern as these fixed income assets do not protect investors from rising inflation.

However, as time has passed, investors have lost some faith in the president's ability to deliver on his promises. The clumsy and combative nature of the administration has seen delays to the reforms promised to the Affordable Care Act, which in turn has delayed progress on budget reforms in the House.

To make matters worse, questions over both Trump and members of his team's conduct before and since the election have raised the possibility of impeachment. While this is unlikely given both the House and Senate are controlled by Republicans, investors' confidence in Trump has taken a blow. As a result, the "Trump reflation trade" has been unwinding as shown in chart 1 above, although this has not stopped equities from performing well, as we will discuss later in this note.

Den Beitrag in voller Länge finden Sie hier zum Download.

Diesen Beitrag teilen: