NN IP: A sour apple

Although the market started on a very weak note, it managed to crawl back and show a positive return in its first week.

14.01.2019 | 09:52 Uhr

Although the market started on a very weak note, it managed to crawl back and show a positive return in its first week. Several factors contributed to this. The most important was the Fed communication in which Powell reminded investors not to be blind to market developments and to be flexible. The Fed’s symmetric approach has morphed back into managing the downside risks. In other words, the market believes again in the existence of a Fed put.

For 2019 as a whole, our expectations have been reduced from three to two rate hikes and we currently do not expect the next rate hike before May/June of this year. However, the market is even more dovish. In addition, a very positive job report came out on Friday, which acted as something of a counterforce against a previously published batch of disappointing data. Finally, on the trade issues, face-to-face talks between China and the US have started. The final outcome is difficult to predict, but as long as they talk, the market may see it as positive. The parties will probably come to an agreement, but it remains to be seen whether this will cover all the issues at stake.

Sentiment remains bearish, although less so than in mid-December, and it is no longer in contrarian territory. Implied volatility is above 20 and the bull-to-bear ratio is negative.

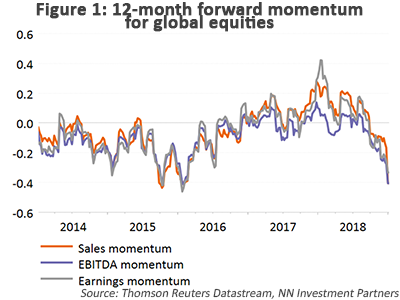

An element that has not improved is the trend in earnings momentum. This is still very negative, not only on the earnings but also on the sales side. Momentum has fallen to the lowest level in three years. The last time it was this low, at the end of 2015, investors were also worried about developments in China and the Fed was expected to hike rates several times (which ultimately did not materialise).

Earnings growth slowdown is likely to continue

Next week, the earnings season will kick off in the US. As estimates have been lowered aggressively, the actual numbers could be a positive surprise. Currently, the consensus estimate stands at +13.4%, a marked deceleration relative to Q3, but this is no surprise and we expect the slowdown in earnings growth to continue in 2019 as the impact of tax reform fades.

We are especially eager to know the corporate outlook, as Apple took the market by surprise in announcing lower-than-expected revenue growth. The company blames the negative impact of the trade war, but the decline could also be linked to the saturation of the mobile phone market. So, we should be careful not to read too much into the warning. More guidance from more companies is needed. That said, part of the IT sector (hardware and semi-conductors) is vulnerable to trade barriers, given their global supply chains. This week, we reduced our exposure to the sector from neutral to a small underweight.

Our other sector allocation calls are based on two assumptions. The first is a rise in the oil price, which supports the energy sector and the materials sector. The second is a gradual rise in bond yields, which explains our preference for financials over utilities.

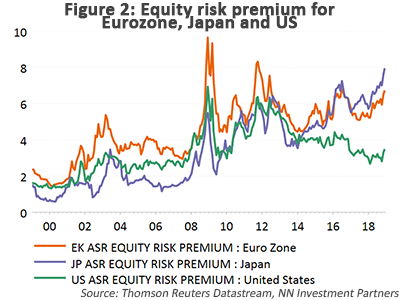

The normalisation of US earnings growth leading to regional growth convergence, in combination with very different valuation and positioning metrics, has convinced us to move another notch further away from the US market into the Eurozone and Japan. We nevertheless keep a small underweight in the Eurozone. This is linked to the political challenges the region is facing, most notably Brexit. In addition, the macro data are surprising more to the downside in the Eurozone than in Japan.

According to institutional holdings, the US market is the most overweight region as at the end of 2018. Emerging markets on the other hand are the biggest underweight. In view of diminishing headwinds coming from Fed policy and the US dollar, further targeted stimulus in China and a big valuation discount relative to developed markets, we currently have a small overweight on emerging markets in our regional equity allocation.

Diesen Beitrag teilen: