Janus Henderson: Amazon’s customer focus should pay off

Alison Porter, Global Technology equities portfolio manager, comments on Amazon’s most recent quarterly results, which continue to demonstrate the company’s strong position in its cloud infrastructure and paid subscription businesses, as well as growth opportunities in other areas such as advertising.

04.05.2018 | 12:15 Uhr

Amazon’s latest quarterly results highlighted the multiple growth avenues that the company has as a brand and not just as an ecommerce business. Amazon is well known for its focus on investing for the long term, therefore it would be wrong in our view to extrapolate too much from each quarterly earnings report.

The quarter did highlight that Amazon is seeing the fastest growth in its highest margin businesses:

• Cloud infrastructure

Amazon Web Services (AWS) saw continued acceleration of growth. While this division represents only around 10% of total company sales, it constituted more than 70% of Amazon’s operating income for this quarter. Chief Executive Officer and Founder Jeff Bezos put this down to the fact that Amazon has had a seven-year head start on the competition in this space.

The strong results from Amazon will be analysed alongside the also solid results from Microsoft and Intel. The common theme being the acceleration of demand for cloud infrastructure (ie. large scale industrial data centres where companies rent storage, compute, security, software and analytics). The scale and capital expenditure required for this business has meant that only three credible competitors have emerged – AWS, Microsoft Azure and Google Cloud Platform. AWS is the leader with a market projected annual revenue of c.$20 bn, with accelerating growth of 49% year-on-year in the quarter. Microsoft also reported rising growth; meanwhile Intel’s strong results were driven by data centre acceleration from chips used in these large cloud data centres.

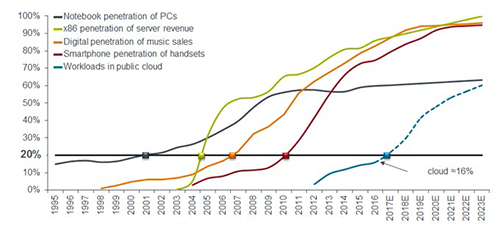

In 2017, the number of US companies adopting cloud infrastructure sat at just under 20%. Typically we see acceleration in adoption as a new technology reaches the 20% level (as was the case for notebooks as a percentage of PCs, digital music downloads etc; see chart 1). The adoption of cloud infrastructure seems to be following that similar pattern.

Chart 1: US cloud: approaching key 20% penetration level

(Source: Morgan Stanley research: Public cloud: what’s it worth? 15 March 2017. E= estimated data 2017-2023. Estimates may vary and are not guaranteed.)

• Online advertising

Advertising revenue for Amazon was reported to be $2bn in Q1 2018 (including trade dollars) and investors have been looking for the emergence of a third major advertising platform aside from Google and Facebook. Amazon is now emerging ahead of Twitter and Snapchat for that title. The company has an opportunity to take share from display advertising, search advertising, television advertising and from trade dollars spent typically in physical retail. It is well positioned to take share in advertising because of its ability to demonstrate clear metrics of return on advertising spend since Amazon’s membership base searches directly for purchases. Other online advertisers do not have that direct view into actual purchases.

• Paid subscription services

Amazon Prime currently has more than 100m members. The company announced its first price increase in four years with US Prime membership rising from $99 to $119 a year. This should allay concerns on the impact of rising shipping rates by the United States Postal Service (USPS) or on changes to state tax changes for third party goods sold.

Amazon continues to roll out faster delivery times across a wide variety of categories, including Prime delivery from Whole Foods stores (still only available in ten US cities), as well as investing in more Amazon video content and music. The Amazon Prime “flywheel” effect (which is increasing Prime’s momentum and ability to take market share; see chart 2) is that when customers sign up they tend to shop more with Amazon. As a greater number of customers shop more, this leads to more sellers joining to take advantage, a larger number of sellers means broader offerings, ultimately driving additional sales.

Chart 2: Feeding the technology ‘flywheel’

(Source: Janus Henderson Investors.)

Implications for disruption to other retailers

Retailers are not just competing with Amazon’s online offerings but also with Prime. Whole Foods is benefiting from Amazon’s customer reach and focus on operating efficiency. As Whole Foods is incorporated further into Amazon Prime delivery, there is potential for further sales acceleration and disruption to US food retailers. While many brick and mortar retailers are investing more in their online offerings, Amazon is innovating in new physical retail experiences such as Amazon Go where customers can walk in and walk out without checking out. Home assistant Alexa is also making it easier to shop through voice recognition and is moving further into homes with tens of millions of devices sold since last year.

We see the recently announced merger of supermarkets Asda and Sainsbury’s in the UK as a response to an increasingly competitive and disruptive retail landscape in which traditional retailers have to make drastic steps to maintain competitiveness.

International retail continues to be a loss-maker for Amazon as it invests rapidly in overseas markets such as India where Walmart is also trying to acquire to achieve greater scale.

Conclusion

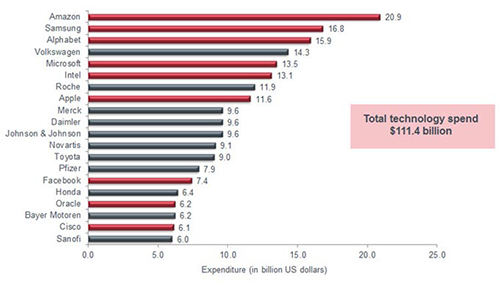

Overall, Amazon continues to demonstrate it is benefiting from a focus on customer centricity and investing for the long term. We expect the company will continue to invest heavily and that profitability this quarter should not be extrapolated in a linear fashion. Amazon spent more on research and development (R&D) in 2017 than any other company globally, spending close to $21bn (chart 3). Since 2011 more than $110bn has been allocated to improve logistics, transportation, fulfilment centres and infrastructure. We are confident that these investments are being used to build sustainable long-term barriers to entry and investing in its own technology ‘fly wheel’.

Chart 3: Amazon the top global spender on R&D in 2017

Source: Janus Henderson Investors, Bloomberg, as at 31 December 2017.

However, investors should not expect a straight line in ramping up profitability. Amazon invests for the long term and could fail in many areas (such as China previously). We expect continued volatility in Amazon’s path of significant profitability while it is also facing some well-resourced competitors in Google and Walmart.

Diesen Beitrag teilen: