NN IP: Four scenarios for a performance reversal in the euro zone

Global equities continue to grind higher, but there are big regional and sectoral divergences. There is potential for a turnaround in Eurozone underperformance; much depends on Italy, global growth and the USD.

07.09.2018 | 11:13 Uhr

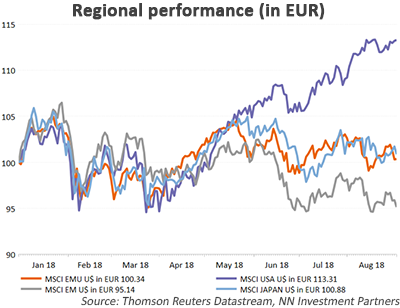

Global equities continued their grind higher over the past couple of weeks. However, the underlying picture is more complicated as we observe big regional and sectoral divergences. From a regional point of view, the US outperformance stands out, being one of the few developed markets realizing a 4% return in August (+13.8% YTD). From a sector point of view, the technology sector excels, up 7.2% in August (+23% YTD). It is safer to be on the side of the disruptor or the bully than on the side of the disrupted or the target of the bully.

Considering the fundamental drivers, we think this divergence may continue for a while. The US economy is outgrowing the other markets by a wide margin. Expected profit growth is at least double the profit growth in the Eurozone or Japan and the US equity market has an important technology component, something the Eurozone in particular is lacking.

Politics also play an important role. The US bullying its trading partners to get better trade deals is, at this stage, hurting the other markets more, because these are more open economies that are considered more vulnerable to trade wars than the US.

In addition, the Eurozone is being hurt by specific political issues. In Italy, budget discussions are creating additional uncertainty. The conflicting messages from the Finance Ministry on the one hand and the party leaders on the other is not helping to appease this.

However, we do not see Italy as a systemic risk for the Eurozone, which is also what the bond market is signalling. Yes, the 10-year spread is back at the highs of May, but the short end is behaving much better. Nor do we see contagion into other peripheral bond markets. Going forward, the projected trajectory of the budget deficit will be key. If this moves towards or beyond the 3% norm, we can expect pushback from Europe and market volatility.

Brexit, and the lack of progress on negotiations, are also elements keeping foreign investors away from Europe. After all, it is very hard to attribute probabilities to the final outcome. Predicting the equity market reaction to either outcome is equally difficult. Keeping a neutral positioning in UK equities looks to be the only solution here.

In the US, political uncertainty is centred around the mid-term elections in November. We will comment more on this over the coming weeks. If history is any guide, the market impact will be more volatility in the run-up to the elections, followed by a positive performance after the event, irrespective of the outcome or the party to which the sitting President belongs. Currently the most likely outcome is that the Democrats will win the House with Republicans maintaining the majority in the Senate. This will not impact the current stance on trade and the conflict could linger on until either the economy or the market worsens.

The Eurozone equity market is also held back by the weakness of the banking sector. This has its roots in the continued low bond yields, which are pressuring the interest margin. Several financial institutions (Spanish and Italian banks look most vulnerable) are also being hurt by the sharp drop in some emerging market currencies (including the Turkish lira and Brazilian real). Here too, contagion risk is very limited. Banks are better capitalized and the amounts involved all look manageable for the individual banks.

Elements that may act as a buffer against further underperformance of Eurozone equities are the low positioning and the relentless stream of outflows. Eurozone equities have witnessed more than 20 weeks of outflows and year-to-date, the fund flow has been USD 55 billion negative. The 1-yr relative performance versus the US has not yet reached extremes but is not far off.

Possible catalysts for Eurozone turnaround

What could act as a catalyst to turn this Eurozone performance around? We see four possibilities. The first is a decline in the Italian political risk. This could happen as soon as the end of this month provided the budget is accepted by Europe. The second would be an acceleration of global growth. This is important as European earnings are more growth-sensitive given the higher operational leverage (more traditional cyclical companies). As we have moved from the acceleration into the consolidation phase, this is not likely to happen.

A third potential catalyst could be an appreciation of the USD, which is positively correlated with the Eurozone earnings outlook. Although it is difficult to have a high conviction on currency trends, the combination of an intensification of trade risks, the fiscal sugar high in the US and Fed tightening could push the currency up. Of course, this USD appreciation must not be caused by a spike in risk aversion.

The fourth would be a rise in bond yields, but this possibility is starting to look like the Samuel Beckett play “Waiting for Godot”. Higher yields have been expected for some time now but the reality is that Eurozone bond yields are still below the levels that prevailed at the beginning of the year, despite an economic recovery and central banks moving towards policy normalization.

Diesen Beitrag teilen: