Robeco: Graph of the week

2020 will go down in history for many reasons – one of which is likely to be that it was a year of historically large differences between growth and value stocks.

11.01.2021 | 09:47 Uhr

Jack Neele, Portfolio Manager

According to figures from data provider MSCI, the MSCI ACWI Growth Index gained no less than 23.0% last year, while the MSCI ACWI Value Index (both in euro terms including dividends) lost 7.8%.

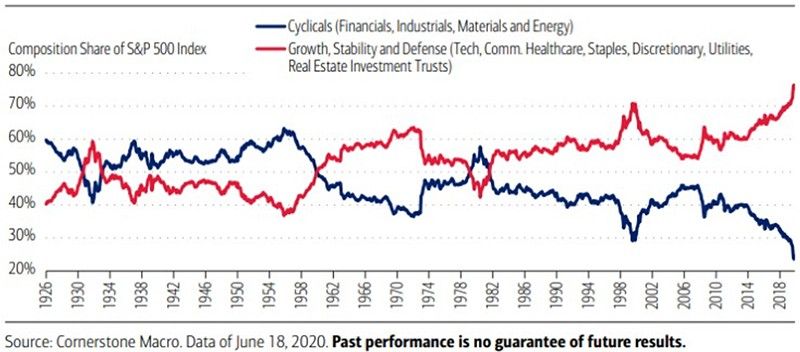

Due to the strong performance of growth stocks – growth companies have outperformed their value counterparts in nine of the last ten years – the weight of such companies in the indices has increased significantly. Growth sectors such as, for example, healthcare and technology now account for more than three-quarters of the total weight in the US S&P 500 Index.

Figure 1: Growth represents an increasingly large part of the index

This year, the difference between growth and value stocks was most evident in the first half of the year. Particularly during the volatile months of March and April, investors favored companies with good prospects for revenue and earnings growth, despite the lockdown and further impact of the pandemic.

Yet, since the summer, there's been almost nothing in it. Initially, growth stocks still had the edge, but thanks to the announcement of various vaccines at the beginning of November, very little difference could be seen between the two from August to the end of December.

Figure 2: Since the summer, growth and value stocks have both risen 14%

Source: Robeco

In that respect, investors are of two minds somewhat. On the one hand, the vaccines offer light at the end of the tunnel. There is a chance that somewhere in 2021, shops, restaurants and gyms will fully reopen. Workers can return to the office and the economy will pick up again. This bodes well for value stocks.

On the other hand, mass vaccination could take a while and more importantly, the virus has been mutating, which means the current lockdowns could be extended and/or tightened first.

The question for 2021, therefore, is whether growth stocks can again outperform after their strong performance of recent years. We remain positive, but also expect the difference we see at the start of this new year to become significantly smaller – because it's better for the underlying strength of the stock market when both growth and value stocks are contributing to its success.

I wish you a healthy and prosperous 2021!

Diesen Beitrag teilen: