NN IP: EM equities resume their outperformance

Emerging market (EM) equities have resumed their upward trend, after a mini-correction between mid-November and Mid-December. We believe that the clear recovery in EM credit growth will be one of the key drivers of strong EM equity outperformance.

23.01.2018 | 12:27 Uhr

Early December, we neutralised our long-held overweight in EM equities. This was mainly because IT stocks were correcting sharply and because we saw Fed expectations rising. Despite the downgrade, we kept our positive view about the prospects for EM domestic demand growth, mainly because of the steady recovery in EM credit growth. We can now say that the IT correction did not persist and that the continuous rise in Fed fund futures did not have a negative impact on portfolio investment flows to EM, so far at least. At the same time, the macro and earnings data across the EM universe continue to be good. Investors are increasingly appreciating the improved prospects for domestic demand growth in most EM countries. We feel that this explains primarily why investor sentiment towards EM assets has recovered again since the mini-correction between mid-November and mid-December.

The IT sector continues to be vulnerable because of its very strong performance in 2017 and relevant given its 27% weight in the global EM index. This remains a reason for caution. But with price momentum in IT stocks no longer negative, we probably can afford to focus less on the risks here for the EM equity asset class as a whole. For now, we choose to keep IT-heavy China at a neutral position, while considering a downgrade of the Korean market, to protect ourselves from a potential resumption of the IT correction.

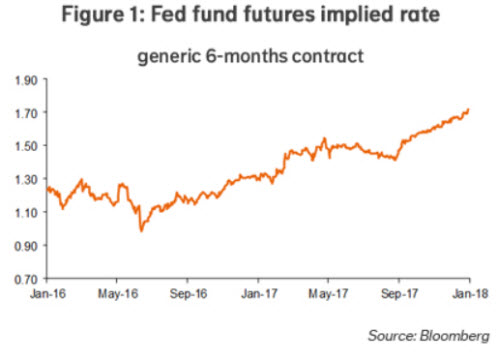

Already we are seeing that the sector leadership in EM has been taken over by financials. This is understandable given the steady recovery in EM credit growth outside of China. But at the same time, it can be called remarkable in the light of the continuous rise in Fed fund futures, the rising DM bond yields and the vulnerability of EM capital flows in such an environment. Apparently, as long as investors continue to believe in a gradual normalisation of US and European monetary policy, they are happy to allocate money to the high-yielding EM fixed income markets. Particularly in local-currency EM debt markets, the yield differential with US Treasuries remains chunky at 3.5 percentage points.

Recovery in EM credit growth will boost EM equities

The widely-held view is that the Fed will hike by not more than 75 bps in 2018. This is almost priced now. From recent data and central bank communication, few people deduct that more will be required. Let’s see how this will play out. We feel a bit uncomfortable about Fed pricing, because the upward trend in Fed fund futures has been so strong in the past one-and-a-half year and particularly since September (see Figure 1). If it continues, at some point, EM assets should be impacted.

In this context it remains important to not only look at the global liquidity environment, but also at the fundamental strength and economic growth momentum in EM. By now we can say that EM flows have remained strong, despite the rising interest rates in DM, because macro imbalances have narrowed and growth momentum has remained positive since mid-2016. And in recent quarters, a key new positive has emerged, something that in the past always coincided with strong EM equity outperformance: the clear recovery of EM credit growth (see Figure 2).

For us, this credit recovery, the first in more than six years, is the main reason why we remain confident that EM growth will keep its positive momentum. And with that, it is the main reason why we believe that EM equities will continue their outperformance trend that started two years ago. Despite the transformation of China to an economy that is less credit-driven and therefore growing at a structurally slower pace.

It has been a while that investors got excited about endogenously-driven, domestic demand growth in EM. The last time was in the period 2004-2007. Now we are seeing that this theme is coming back again. There is room for credit growth to drive domestic demand growth in EM ex-China. Also, the macro adjustment of the past years, with smaller external deficits and cheaper currencies, and in some cases (India, Argentina!) growth-enhancing structural reforms, should help to move fixed-investment and consumption growth in EM higher in the coming years.

This is typically a good environment for EM equities relative to DM equities, but also relative to EM bonds which are less growth sensitive and more dependent on changes in expectations about global liquidity.

Diesen Beitrag teilen: