Morgan Stanley IM: Good Things Come to Those Who Wait: An Argument for Long-term Thinking

Many of us in the developed world live in an instant society where we can get what we want, whenever we want and however we like it.

31.08.2023 | 06:11 Uhr

The weekly food shop is one click away, a new partner one swipe to the right, and in two taps you can book a flight to the other side of the world. In many ways, this immediacy is enormously beneficial: we save time, we stay connected to people and we have access to more information than ever before.

Although this makes our lives easier, there is a cost associated with having everything at our fingertips. The human brain is hardwired to crave dopamine — the happiness hormone. Today, this is easily provided by our smartphones, dubbed "the modern-day hypodermic needle, delivering digital dopamine 24/7" by Dr. Anna Lembke, Professor of Psychiatry and Behavioural Sciences at Stanford University. According to her research, repeated hits of accessible dopamine via smartphones leads to an overuse of our limbic system (the part of the brain involved in our emotional responses) and weaker function of the prefrontal cortex (responsible for controlling impulses, long-term planning and delaying gratification). This overstimulation can lead to feelings of restlessness and impatience. We can also be distracted from more meaningful pursuits requiring patience and perseverance, such as reading an entire book, learning a new skill or investing with a truly long-term mindset. As we shall explain, we would argue that the patient tortoise wins the long-term race when it comes to equity investing.

Indeed, there is evidence to suggest the ability to delay indulgence is linked to greater long-term success. Perhaps the best-known example of this is Walter Mischel’s "marshmallow test", where children were given a marshmallow and told they would receive a second one if they resisted the urge to eat the first for 15 minutes. Subsequent studies found that children who exhibited better impulse control were more likely to enjoy later success in the form of higher exam results, better social and cognitive functioning, and have greater scores in a range of other life measures.1

In the context of investing, delayed gratification could mean resisting the urge to get swept up in the euphoria of a market bubble. For example, avoiding the growthier, more speculative stocks that rallied during the dot-com boom, and instead holding steady with an overweight to consumer staples (which had been significantly lagging), paid off in the ensuing dot-com crash that began in March 2000 and ended in October 2002. The MSCI World Index fell 43% from the peak to the trough, while the more defensive consumer staples sector rose 17% in this same time period, finishing ahead of the index.2 Arguably, enthusiasm around artificial intelligence is testing some investors again today. Our focus on established, quality companies with earnings resilience, and the discipline to resist the urge to chase a short-term rally, has historically resulted in a better long-term outcome.

Innately Biased to the "Now"

Given humans' psychological predispositions, it is of little surprise that people favour the short term. "Present bias" is a widespread phenomenon in which one is more inclined to focus more on imminent benefits and costs as opposed to those that come later. For example, a consumer demonstrating present bias is likely to have less favourable financial habits, including excessive borrowing, spending and a lack of savings.3 Meanwhile, an investor who falls victim to "myopic loss aversion" is overly focused on the short term, reacting negatively to recent losses at the expense of potential long-term benefits.4 This is counterproductive to successful long-term investing and highlights the need to be aware of these biases.

Advocating for long-term thinking

In a world that wants everything now, we are strong advocates of later. It takes discipline and patience to succeed over the long term, as we can attest. Our bottom-up, fundamental high quality approach, long-term investment horizon and valuation discipline have successfully served our clients for more than two decades. A long-term lens requires the ability to supress any instinctive "present bias", as evidenced by our low portfolio turnover and our focus on identifying companies that not only have high returns on operating capital today, but we believe can sustain those high returns well into the future.

Let the compounders compound

At the very heart of our approach is our firm belief in the power of compounding. The challenge is finding companies that can compound. We don’t require excessive growth from companies, but instead look for steady reasonable growth that can be sustained at high returns over a number of years. A company growing at, say, 4% a year, adding another 1% to earnings growth from incrementally improving margins, combined with a free cash flow yield of around 5%, should compound at close to 10% over time. The "Rule of 72" suggests this results in doubling one’s capital every seven years.5 One of our holdings in the information technology sector, a world leader in technology consulting services, is a compelling example of reliable compounding, returning 11% earnings per share growth (USD) per year over the last decade from steady organic sales growth, helped by rising margins and capital allocation, via mergers and acquisitions (M&A) and buybacks.6

At the centre of a high quality compounder is capable management with a long-term mindset. Given the cash generative nature of the high quality companies we invest in, management can — and, in our view, must — reinvest enough cash into areas such as research and development, marketing and innovation to ensure the franchise remains relevant and resilient, and then also make sure that the returns on any inorganic acquisitions are attractive enough to be preferable to returning cash to shareholders. As detailed in our June 2023 Global Equity Observer “To Buy or Not to Buy”, we retain a healthy level of scepticism towards M&A as a good allocation of shareholder capital — though we occasionally identify one of that rare breed: good acquirers.

We require management not to be distracted from the long-term task of building and improving the company's intangible assets by the temptation to meet short-term targets. A key indicator is executive pay. We regularly engage with company management and their boards on their long-term incentive plans, encouraging alignment of incentives with long-term shareholder interests and away from short-term tactics such as increasing debt or making ill-judged acquisitions.

Staying invested as well as disciplined

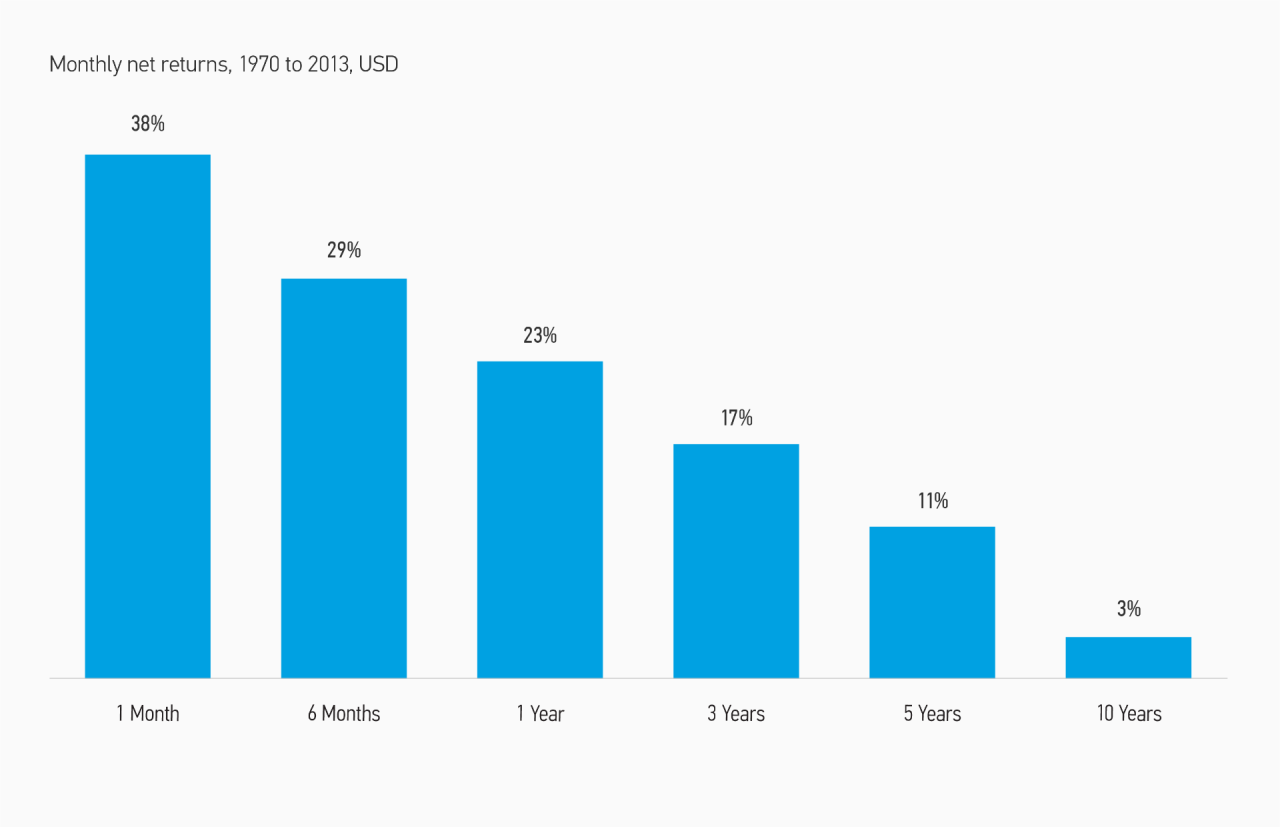

There is evidence that holding investments for the long term reduces the likelihood of losing money: If you were to invest in the MSCI World Index between 1970 and 2023, 23% of months were negative for a one-year investment horizon, whereas the negative return figure drops to 11% on a five-year view and just 3% for 10-year periods (Display 1).7 Trying to time the market is also a fool’s errand. Research from Bank of America found that if an investor missed the S&P 500 Index’s 10 best days in each decade since 1930, their total return would be 30%. Conversely, staying invested throughout all the business cycles would have returned 17,715%.8 In our actively managed, concentrated global portfolios we see ourselves as long-term owners rather than “renters” of stocks; we look for compounders with staying power, which results in low annual portfolio turnover of around 20% per year. Looking at the current holdings for our longest-standing flagship global strategy, as much as one-third of the portfolio has been held for over 10 years, and approximately two-thirds for more than five years.

DISPLAY 1

Probability of Losing Money in the MSCI World Over Different Time Horizons

Source: FactSet. Monthly Net Returns (USD) 1970 to 2023.

An example of keeping our eyes trained on the long-term investment thesis and trying to avoid short-term market noise can be illustrated with one of our software holdings. In 2020, the company pivoted its positioning to the cloud earlier than expected — a decision the market did not initially support, triggering a 25% fall in the share price. We supported this strategic move and added to the position, continuing to hold the stock as a top 10 name despite the market reaction. Our longer-term stance has since yielded benefits; the company has been a top contributor to absolute performance over the past 12 months. We also apply this discipline to our sell decisions. For instance, in the last year we sold out of a world-class beauty company on valuation grounds after the stock bounced sharply on hopes of China’s reopening. Our analysis suggested the company’s valuation fully incorporated the likely benefit, and we took the opportunity to exit.

What does this mean for us?

While society may be driven more by short-term impulses and immediate rewards, when it comes to investing, we would argue that patience leads to enduring results and positive long-term investment outcomes. For over 20 years, our team’s investment approach has focused on identifying high quality companies that can compound, and being patient enough to allow them the time to do so. We scrutinise companies’ quality fundamentals and strong moats and are wise to short-term tactics that are counterproductive to long-term compounding. Instead of emulating the hare that looks to outpace the market in the short term, we prefer the steadily compounding tortoise.

1 "The marshmallow test: Understanding

self-control and how to master it", Walter Mischel, 2014.

2 Source: FactSet. Based on MSCI World sectors, cumulative return

(net) in USD.

3 "Present bias and financial behavior", Jing Jian Xiao

and Nilton Porto (uri.edu), 2019.

4 "The effect of myopia and loss aversion on risk taking: An

experimental test" in The Quarterly Journal of Economics, Thaler, R. H.,

Tversky, A., Kahneman, D., & Schwartz, A., 1997.

5 The Rule of 72 is a formula used to determine how long it would

take for an investment to double in value given a fixed annual rate of

interest.

6 Source: FactSet. Data as of 30 August 2022.

7 Source: FactSet. Monthly net returns (USD) from 1970 to 2023.

8 "This chart shows why investors should never try to

time the stock market", cnbc.com, 24 March 2021.

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy’s assets were invested in a wider variety of companies. In general, equity securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Stocks of small- and mid-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Non-diversified portfolios often invest in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater volatility. ESG strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

Diesen Beitrag teilen: