Janus Henderosn: Global equities - removing the guesswork amid Brexit uncertainty

While Brexit remains one of the key political and economic uncertainties for investors in Europe, Steve Weeple, Portfolio Manager on the Edinburgh-based Global Equities Team, believes that company fundamentals are the best thing to focus on for long-term investors.

01.03.2019 | 12:15 Uhr

As March 29 approaches, the day when the UK is scheduled to leave the European Union unless an extension is agreed, it is no surprise that we have been getting more questions on what our view of Brexit is. Probably disappointingly for some, we do not really have a ‘view’, nor has it meaningfully influenced our investment decisions. Quite frankly, we do not think we have the ability to forecast macroeconomic conditions, market sentiment or geopolitical outcomes with any degree of reliability.

Investors have shied away from the UK

With abundant uncertainty, however, it is no surprise that fund management surveys have shown consistent underweights to UK equities and that, since the Brexit referendum vote, investors have generally shied away from exposure to the UK market. Taking an entirely bottom-up approach, as we do, and focusing on what we believe to be more predictable trends and outcomes, can lend a different perspective. High-quality companies benefiting from secular growth have, in our view, the potential to outperform even amidst a weaker market or economic backdrop. It sometimes takes a look beyond the ‘taint’ of their country of listing to find such opportunities and this is something we have done in our portfolios, maintaining exposure to five UK-listed companies in 2018.

There has been particular distaste for domestically-exposed UK-listed companies. The point blank aversion to businesses based on a narrative surrounding ‘domestic economic weakness’, for example, does involve opportunity costs. It ignores the potential changes resulting from long-term secular trends that businesses may be exposed to. The truth is that long-term secular growth trends often progress independently of the political or economic issues of the day. This is particularly true when the trend, product or service is filling a need, making something easier or transforming industries.

Internet transformation

Take two of the UK-listed holdings within the Janus Henderson Global Equities Strategy as examples: Rightmove and Auto Trader are focused on the domestic UK market and yet comfortably outperformed the UK market in 2018. Auto Trader delivered a total return of 30.7% and Rightmove -2.7% versus -9.5% for the FTSE All-Share Index and -3.4% for the MSCI AC World Index, in sterling terms.*

*Source: Bloomberg, 29 December 2017 to 31 December 2018, in sterling terms.

Rightmove and Auto Trader have driven the trend in the UK from print advertising of residential real estate and second-hand cars, respectively, to online. This has transformed the way consumers go about buying and selling property and cars, creating a very profitable enterprise for both companies. Now, our guess is likely as good as yours regarding the outcome of Brexit. Regardless, however, what we can be more certain of, due to it being more observable and predictable, is that consumers will increasingly use online classified advertising sources as they go about buying and selling property and cars.

Looking beyond the country of listing

It is perhaps ironic that our weakest performing UK-listed company – Elementis – is the least economically exposed to the UK, with less than 5% revenue exposure. Elementis is a global specialty chemicals business and in 2018 it experienced a share price fall of 30.9%* following an acquisition. This is in stark contrast to the performance of Whitbread, a multinational hotel and restaurant company that we also hold, which is almost entirely UK-focused and saw its share price rise by 14.5% in 2018* after selling its Costa Coffee business to Coca-Cola at a very attractive price. The overall performance last year of our domestically-focused UK holdings is, in our view, a strong endorsement of the potential that can be gained from taking a long term, selective approach based on company fundamentals as opposed to broader macro political and economic factors.

*Source: Bloomberg, 29 December 2017 to 31 December 2018, in sterling terms.

Avoiding UK equities entirely would also ignore the broader make-up of the UK equity market which, as one of the largest and broadest stock markets in the world, contains many truly global companies, some of which have very little to do with the UK economically. In the fourth quarter of 2018, we acquired a position in InterContinental Hotels Group (IHG), the operator of hotel brands Crowne Plaza, Intercontinental and Holiday Inn, which is headquartered in Buckinghamshire, England. IHG might be listed on the London stock market but more than half of its revenues come from North America, a substantial portion also comes from emerging markets, while very little is actually generated in the UK itself. If we were to assess IHG based on the country where it is listed and then made a decision that we do not want UK exposure, given the economic backdrop, we would be missing out on the opportunity to own what is a high-quality, cash-generative company with an attractive portfolio of hotel businesses.

Economic exposure

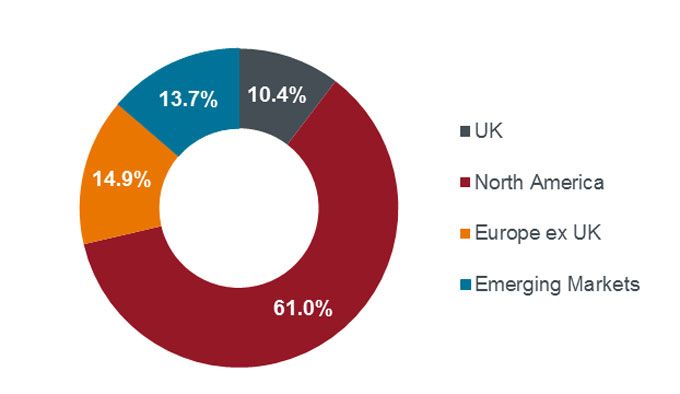

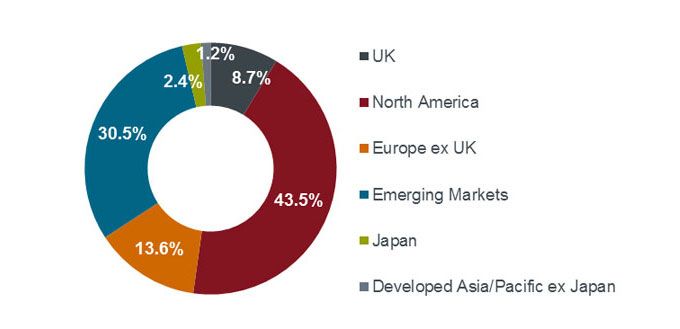

Simply viewing companies based on where they are listed can risk fundamentally misunderstanding them; the same can also be said of investment funds when not analysing the detail. We often encourage our clients to consider a portfolio’s economic exposure. For those who want to consider country or regional weightings, looking at a portfolio’s economic exposure, in our view, gives a better idea as to the geographic drivers behind the businesses that make up the portfolio rather than country of listing. Quite regularly the economic exposure of the portfolio can look very different to the listed exposure, reflecting the global nature of many businesses today, as the two charts below demonstrate.

Janus Henderson Global Equities Strategy exposure by region based on country of listing (ex-cash)

Source: Janus Henderson Investors, as at 31 January 2018, based on a representative portfolio.

Janus Henderson Global Equities Strategy exposure by region based on revenue (ex-cash)

Source: Janus Henderson Investors, FactSet as at 31 January 2019, based on a representative portfolio.

Selective approach

The fact that the strategy’s UK holdings have, in aggregate, contributed positively to the performance in both absolute and relative terms (in sterling terms) over the past year shows just how important and relevant a bottom-up approach is. We think that by taking a long-term view and looking beyond their country of listing, the prospects for the likes of Rightmove, Auto Trader and InterContinental Hotels Group look promising and provide investors with the potential to benefit regardless of theoretical outcomes of Brexit. It is our aim to continue to invest in these types of high-quality, secularly growing and resilient businesses rather than constructing and adjusting our portfolios based on forecasted assumptions based on macroeconomics, market sentiment or geopolitics. For us, this would amount to guesswork and quite simply, we do not think our clients would like us to be guessing when allocating their capital.

Diesen Beitrag teilen: