Columbia Threadneedle: Opening Bell 2025 - Will US equities continue to lead the way?

The US economy is set fair but will bond vigilantes present a macro-economic barrier to the new president’s agenda?

03.02.2025 | 11:06 Uhr

More questions than answers, but US economy’s strength is reassuring.

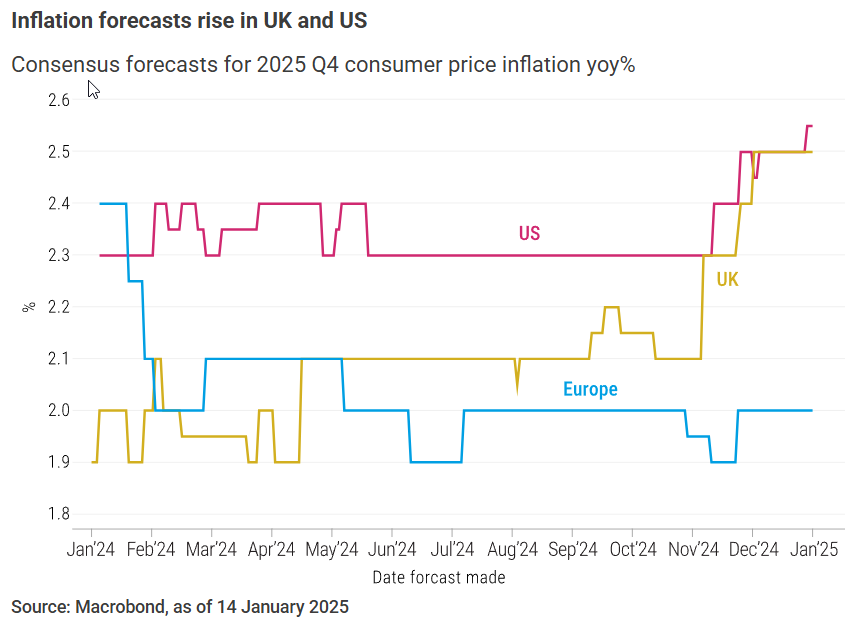

My top three global issues for 2025 are: how radical will the new US president be? Will Chinese and European economies recover? Are rising bond yields set to derail equities? The one thing that I am certain about is that the US economy is set fair, delivering the goldilocks scenario of disinflation without a significant recession or fall in employment. That success can be seen in the inflation forecasts for the end of 2025, which are starting to pick up for the US reflecting the strength of the economy, while Europe remains flat on target as its economy struggles. Meanwhile the signals are going in the wrong direction for the UK, with inflation picking up even as growth is falling.

The clear positive of a strong US economy, the largest in the world, is a supportive backdrop for growth. That encourages me to believe that China and Europe will manage a gradual turnaround this year. While the bond vigilantes threaten the equity market, their real target is the US deficit. I think that the new administration’s desire to keep the economy and stock market buoyant will allow the bond vigilantes to act as a constraint on Trump’s radical agenda, or at least those parts with a significant fiscal cost. That leaves us overweight on US equities, with a positive economic backdrop, falling interest rates and deregulation, even if there’s a lot priced in.

Estimates and forecasts are provided for illustrative purposes only. they are not a guarantee of future performance and should not be relied upon for any investment decision.

Estimates are based on as assumptions and subject to change without notice.

The outlook for the US economy is great but beware the bond vigilantes!

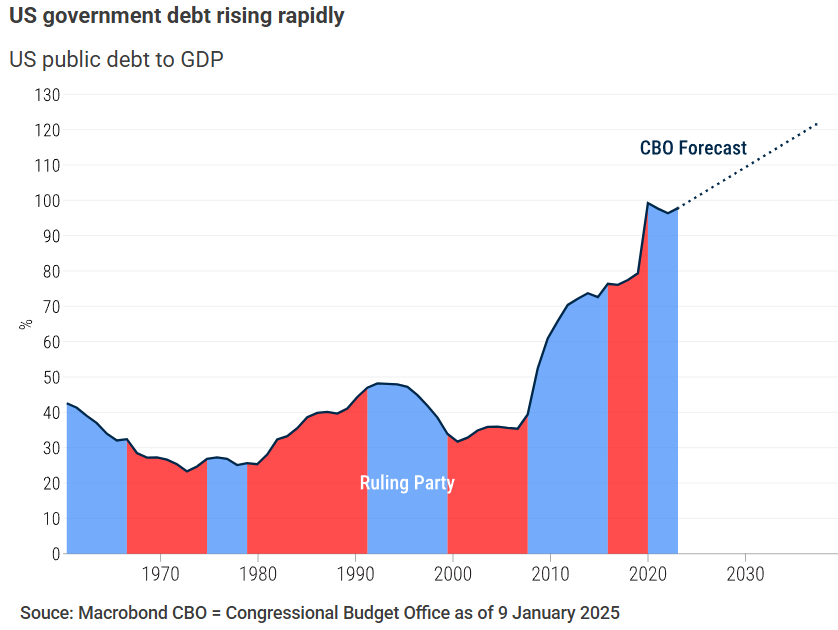

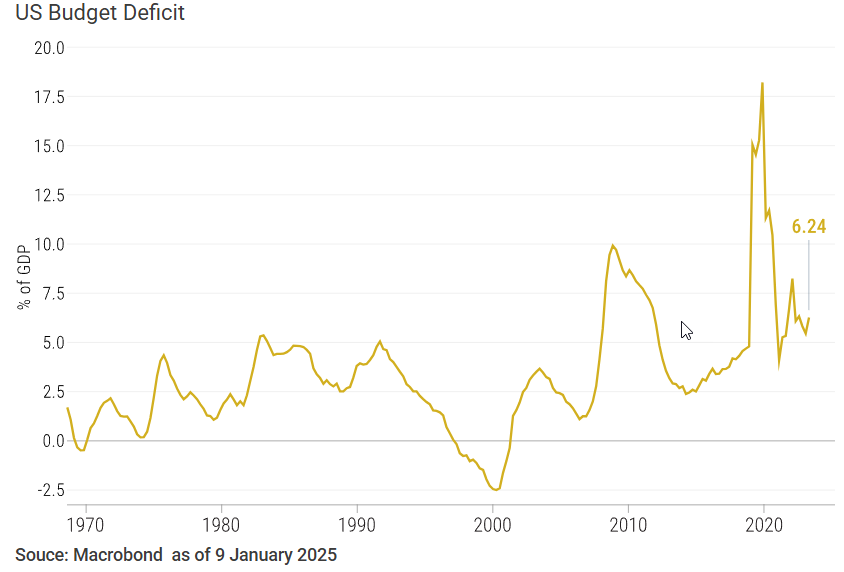

The US economy is set fair, delivering the goldilocks scenario of disinflation without a significant recession or fall in employment. However, one of the factors powering the US economy has been the Federal budget deficit. It’s currently running around 7% of GDP, a very high level for an economy neither in recession, or at war.

Enter the bond vigilantes: if the proper authorities won’t keep control of budget deficits and inflation, then the bond vigilantes will, by pushing up bond yields to levels that would trigger a corrective recession if necessary. We’re already seeing the first effects on the US housing market via rising mortgages.

The bond vigilantes are the biggest macro-economic barrier to Trump’s agenda – in the absence of political barriers. That could be sufficient to curb Trump’s radical agenda, at least in those areas that would increase rather than cut the Federal deficit.

Europe’s economic turnround will be in the face of structural and political headwinds

The structural issues for Germany and European manufacturing from the loss of cheap Russian gas and the shift to electrical vehicles will be a drag on the economy for years. These stresses are also apparent in the political system with governments collapsing in both France and Germany in the face of voter discontent.

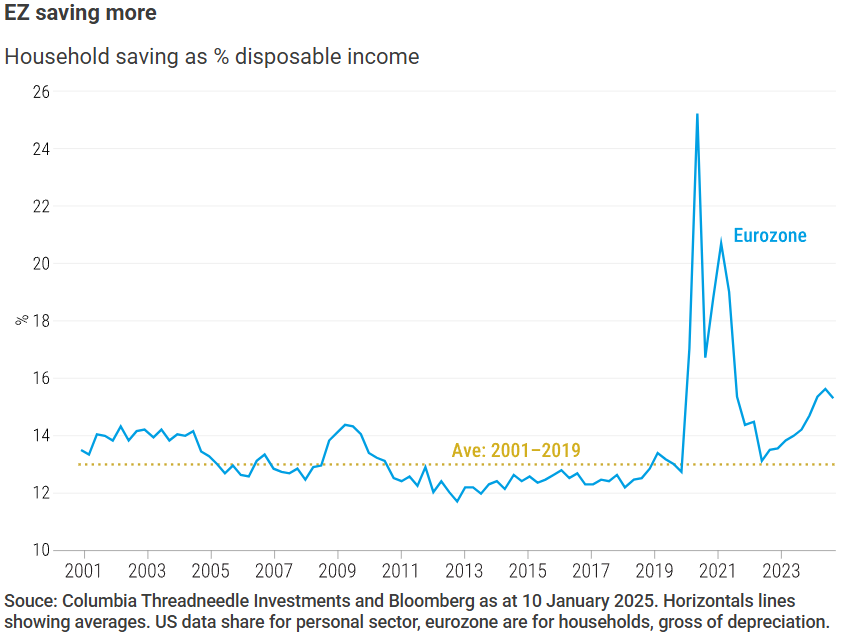

However, there’s still scope for optimism. The economies of Southern Europe, hard hit in the Euro crisis, have restructured and are delivering growth. There is also a huge backlog of consumer savings that means any return of confidence would make consumer spending a driver of growth. We forecast rising economic growth, but not a boom, in Europe.

Another factor that will help Europe is that China’s economy is also in a position to reverse course this year. This will boost exports and especially the depressed manufacturing sector. China’s structural issues are different, focused around its property slump, but there aren’t the same political impediments. I think that Xi Jinping will focus on and succeed at getting China’s economy out of the current slowdown.

UK faces severe fiscal dilemma

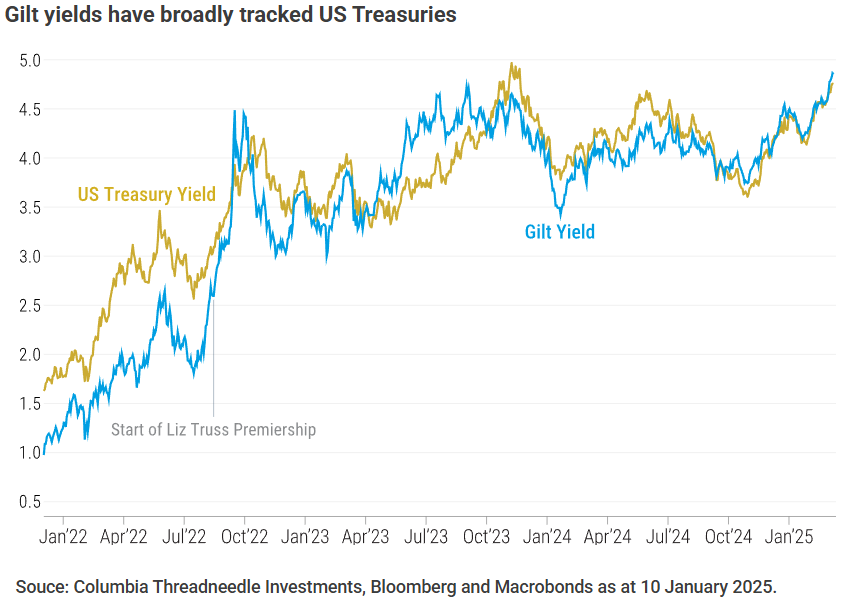

The rise in gilt yields has largely tracked the rise of US Treasury yields due to the actions of the bond vigilantes. That might seem unfair or unlucky, however it has put the focus back on the structural problems of the UK economy.

Rising gilt yields mean that there is now zero leeway in the budget. While it’s far from impossible that the government can squeak through without further tax rises, early action seems likely, if only to forestall risks and underline the Chancellor’s pledges on fiscal responsibility.

A lack of certainty about further tax increases and about the future more generally, leaves the consumer continuing to heap up precautionary savings. Therefore, the fiscal problems need to be resolved to deliver growth instead of further tax hikes. That can be done but requires tough decisions and the risk is further drift as unaddressed problems clog the system.

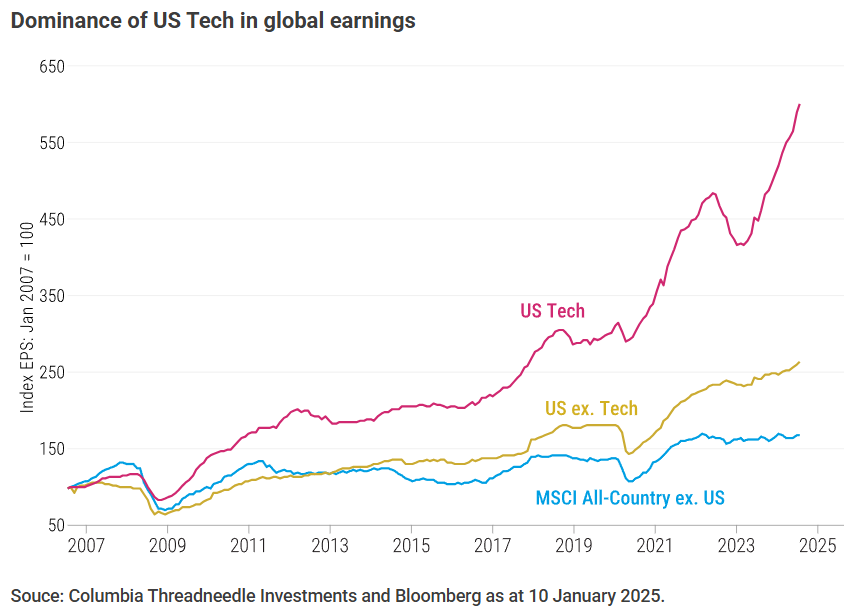

Low inflation and falling interest rates make equities attractive in the US … but there’s a lot priced in

In the face of uncertainty, the scale of our positions in asset allocation are modest. Low inflation and falling interest rates with strong economic growth make equities attractive in the US. Valuations of US equities are expensive, but this high valuation reflects the delivery of superior earnings growth, which is true even if technology-linked companies are excluded.

We do not see high valuations being a constraint on the performance of US equities in the short-term. Recessions are the great leveller of valuations, but we do not see any signs of a recession in the forecastable near-term, so any correction of valuations remains in the future.

We are also positive on high yield bonds, which are set to benefit from the same environment of economic growth and falling interest rates. Bond yields are attractive in general, but the risk is that the bond vigilantes push yields higher in the short term, so we would rather be underweight at this stage.

Diesen Beitrag teilen: