BNP Paribas: Positive earnings growth prospects for eurozone equities

The experts from Multi-Asset, Quantitative and Solutions (MAQS) of BNP Paribas AM foresee calmer markets and expect robust global growth. But there also are several reversal themes.

03.07.2018 | 09:47 Uhr

Markets have expirienced some difficult cross currents

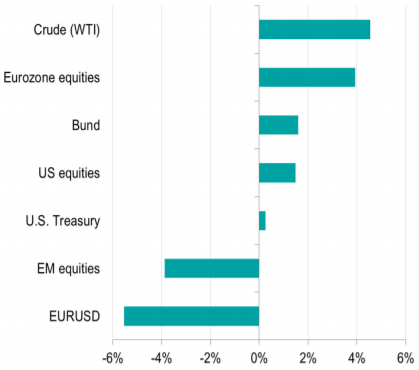

Following a strong performance for risky assets in 2017, markets have experienced some challenging cross currents over the past few months. The market moves over the past three months are a good example of this new and more challenging environment (Figure 1).

Figure 1: Mixed cross-asset performance in the past three months as markets digested various macro risks

Source: Bloomberg, BNPP AM; as of 18 June 2018

The other notable market development over the past three months was the sell-off in EM currencies against the USD. Rising UST yields and the stronger USD hurt the EM complex, notably EM currencies, as investors unwound long positions in EM equities and debt. The external vulnerabilities of economies such as Turkey and Argentina exacerbated the move.

Another reason why markets, notably EM, have been more jittery is the escalation of trade tensions between the US and China. In the last few days, the US announced that it is considering increasing tariffs on USD 200 billion worth of Chinese imports. Chinese authorities have responded that they are ready to retaliate with comprehensive measures.

Macro and risk environment - still constructive

Our central macroeconomic scenario is one where global growth remains robust and inflation contained. We refer to this as a ‘Goldilocks’ environment. This is also consistent with the Fed removing monetary stimulus gradually and other central banks starting to normalise monetary policy, notably the ECB.

We expect risky assets, notably equities, to do well as global economic growth supports corporate earnings growth, while monetary policy remains generally accommodative. Our conviction is mainly in eurozone equities where we see room for earnings growth to catch up with the economic cycle and where demand strength should help profit margins to expand further (see figures 2).

Figure 2: Eurozone earnings growth looks to low compared to activity levels that are still elevated

Source: FactSet, IBES, Markit, BNPP AM, as of 21/06/2018

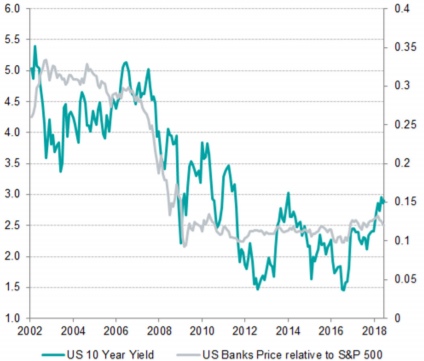

We also have a long equity risk exposure in Japan and in US banks. In Japan, we expect earnings growth to be stronger than the consensus. US banks should benefit from a maturing growth cycle and from higher interest income as we expects interest rates to rise further over the long run (see figure 3).

Figure 3: US banks should benefit from rising yields

Source: Bloomberg, BNPP AM, as of 21/06/2018

As we expect inflation to remain contained in the developed world and central banks to normalise policy, we are underweight fixed income. We express this view by being underweight EMU duration.

The macroeconomic backdrop of robust growth and contained inflation should remain supportive of risky assets, but we are aware of market fragilities that have already been flagged by our analysis of financial market dynamics.

Mid-year reversals

Following a volatile last few months, we see foresee a pause and potentially a reversal in some of the trends that have been prominent in the last few months in markets. In particular, we expect UST yields and the USD to stabilise in the near term.

Our sense is that UST yields have already priced in good news in terms of growth, inflation and Fed tightening. By contrast, the eurozone economy has slowed, but the ECB has signalled its intention to end its asset purchase programme by the end of 2018, even if it does not expect to raise interest rates until well into 2019. After the recent rally in US yields and the US dollar, we think enough news has been priced in that we could see at least more stable UST versus German yields and a firmer USD versus the EUR (see figure 4)

Figure 4: Higher EUR-USD differentials should help stabilise the USD

Source: Bloomberg, BNPP AM, as of 20/06/2018

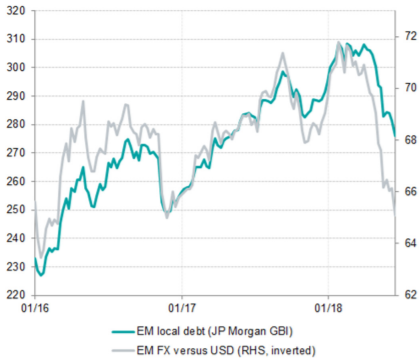

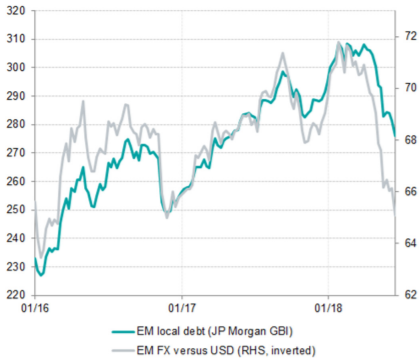

A stronger USD has been the main reason for the underperformance of EM assets since April. A weaker USD should therefore help stabilise EM currencies and EM local debt (see figure 5). Two additional factors that should support EM currencies are the restoration of EM rate differentials as EM central banks raise interest rates or sound more hawkish (see figure 6), as well as the fact that growth and external fundamentals are stronger than five years ago when growth in China was slowing rapidly, commodity prices were in a bear market and countries such as Brazil and Russia were in recessions.

Figure 5: A USD stabilisation should help EM debt local currency

Source: Bloomberg, BNPP AM, as of 15/06/2018

Figure 6: EM central banks are turning more hawkish to defend their currencies

Source: Haver, BNPP AM, as of 12/06/2018

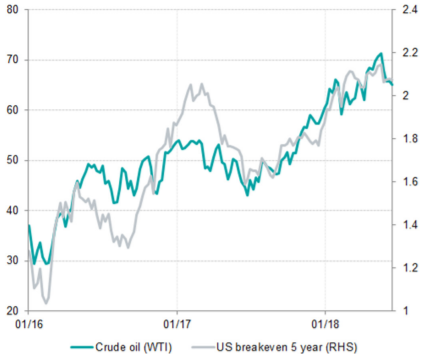

Another trend that is experiencing a reversal concerns crude oil. Crude was one of the few risky assets that were making a 20% plus profit this year. But as we explained in our June Asset Allocation monthly, too much good news on demand, supply and geopolitics was priced in, in our view. We think the reversal has further to run as the OPEC producers cartel is making noises that suggest that it is willing to increase supply following downside surprises in production from Venezuela, Angola and, potentially, Iran. Lower or more stable oil prices should help stabilise US breakeven inflation and therefore UST yields (see figure 7).

Figure 7: US inflation breakevens eased as a result of lower crude prices

Source: Bloomberg, BNPP AM, as of 15/06/2018

Conclusion

Despite trade tensions and more volatile markets than in 2017, our base case scenario remains bullish on equities. We are maintaining our long equity position, with a preference for eurozone equities where we see attractive valuations and earnings growth prospects.

We identified several reversal themes in June:

- Crude oil has likely reached a peak as too much good news on demand, supply and geopolitics was priced in.

- US-German fixed income spreads look stretched as the ECB intends to end its asset purchases by year-end, while US rates are pricing in a robust US economy and a gradual US tightening cycle by the Fed. We expect US rates to rise gradually longer term but we believe euro core rates have more room to surprise to the upside shorter-term. We have recently taken a long UST versus German bonds position via futures to reflect this view.

- EM local debt should find support after the recent selloff triggered by higher US yields and a stronger dollar. We think that a more stable US dollar and stable UST yields should alleviate the pressure on EM local debt. We are now looking for opportunities to add long EM FX exposure, for example by adding to our existing long EM local debt position.

The main risks to our base case scenario stem from an inflation surprise or an escalation of trade tensions that could lead to a global economic slowdown.

Our market dynamics analysis (technical dynamics analysis, financing conditions, market dynamics indicators, liquidity monitoring) had already flagged a change in the environment early in 2018, suggesting a more febrile market. In this context, we are maintaining our positive view on risky assets in the next few months, while we continue to monitor market movements closely.

Diesen Beitrag teilen: