UBS AM: US equity outperformance - Should investors mind the gap?

Asset market divergence between the US and the rest of the world has been driven by de-synchronized global growth, escalating trade tensions and regional sector compositions.

10.10.2018 | 13:37 Uhr

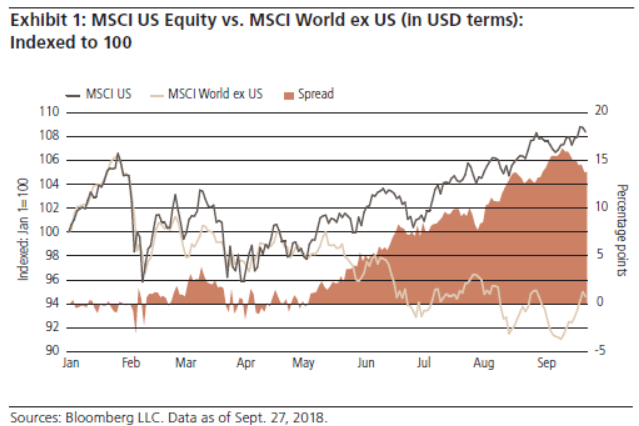

2018 has been a year of stark divergence in asset performance for the US versus the rest of the world (RoW). Year to date, the MSCI US equity index has outperformed the MSCI ex US by 13% in dollar terms (exhibit 1). The spread between 10-year nominal Treasury and bund yields has widened by 60 bps and now hovers near 30-year highs. And the dollar staged a powerful counter-trend rally, contributing to widespread weakness across emerging markets asset classes. In this Macro Monthly, we examine what is behind this widening asset divergence, what history tells us about these kinds of divergences, and and what we believe will be the likely drivers of relative performance over coming quarters.

The simplest explanation for US equity outperformance this year is economic divergence that has translated into equally divergent corporate earnings profiles. The synchronized global growth of 2017 ended abruptly earlier this year, with economic data disappointing in much of the rest of the world, in part driven by the lagged effects of Chinese deleveraging. Meanwhile, US economic growth accelerated on late-cycle fiscal stimulus (Exhibit 2). Against this backdrop US company profits have grown strongly – beating even upbeat expectations over the past few quarters – while corporate earnings outside of the US have stuttered and in the case of Europe, disappointed.

You con download the full report "US equityoutperformance: Should investors mind the gap?" here.

Diesen Beitrag teilen: