NN IP: V-shaped risk rally

The base-case macroeconomic scenario for this year assumes that global growth will improve from the current soft patch on the back of a reduction in trade risks and other political risks.

07.03.2019 | 13:23 Uhr

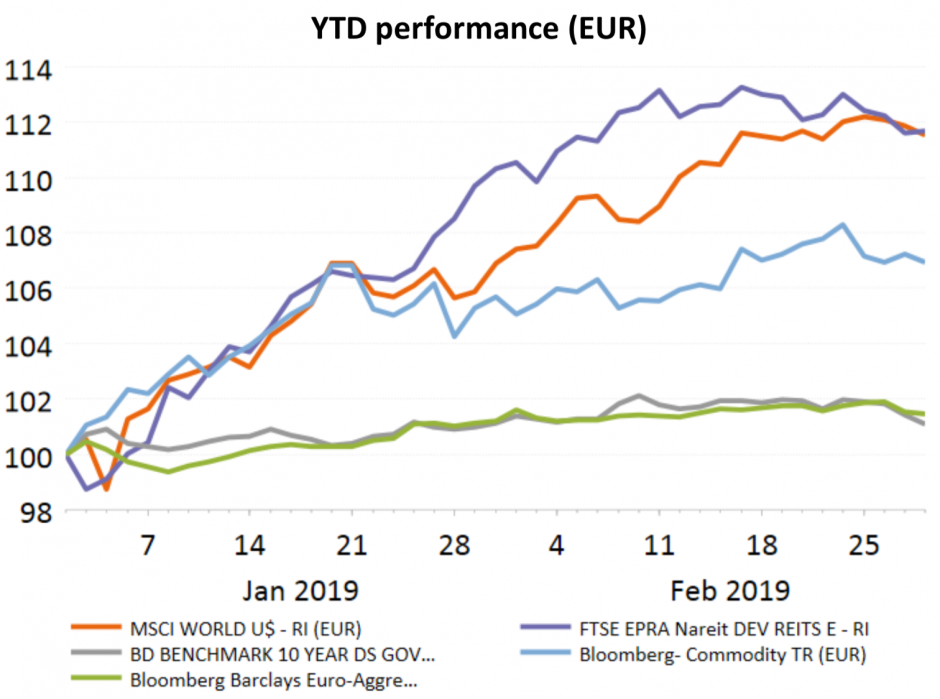

Asset class performance

Equities and real estate continued to perform well in February as the market recovery that started at the end of 2018 added another leg. Although macroeconomic data are not yet improving and the earnings season was mediocre at best, investors cast aside the pessimism that had them in its grips since end-2018. Positive developments on the US- China trade discussions certainly helped, and in Europe the risk of a chaotic no-deal Brexit has diminished. German bond yields rose in the final days of the month, driven by increases in both inflation expectations and real yields. On the other hand, risky credit benefited from the rise in risk appetite.

Source: Thomson Reuters Datastream, NN Investment Partners

Equities

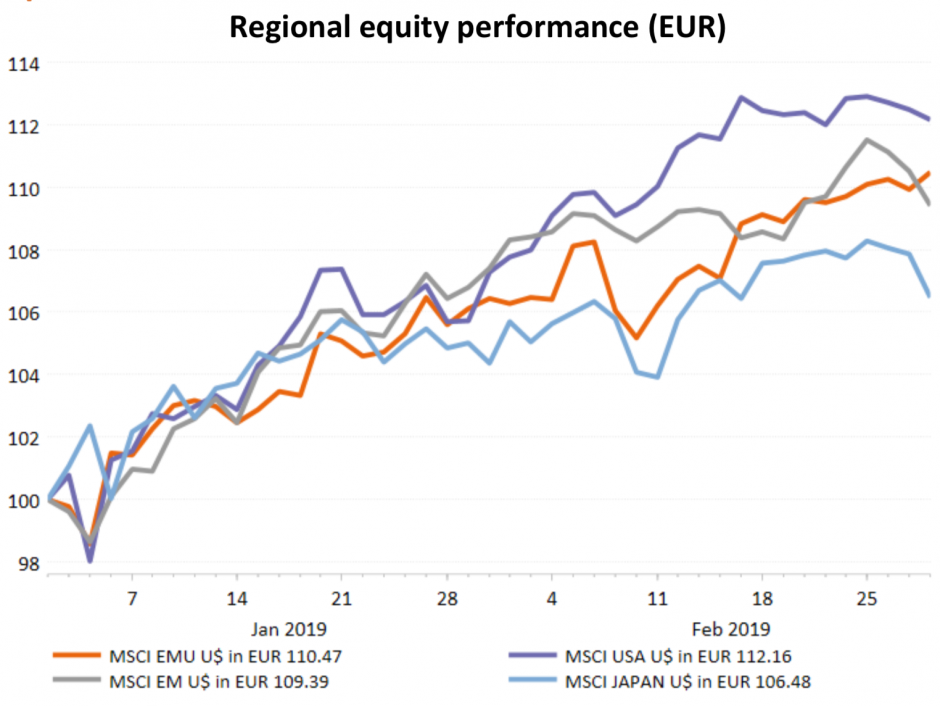

Source: Thomson Reuters Datastream, NN Investment Partners

Divergence picked up in equity markets during February. Emerging

markets stalled but Eurozone equities gained speed. This may be

explained by the observation that Eurozone data are surprising less to

the downside than before. In an environment where many investors

are still underweight on the Eurozone, this may be enough to add

some exposure to the region. Japan was also a laggard, despite the

weakness of the Japanese yen against the US dollar.

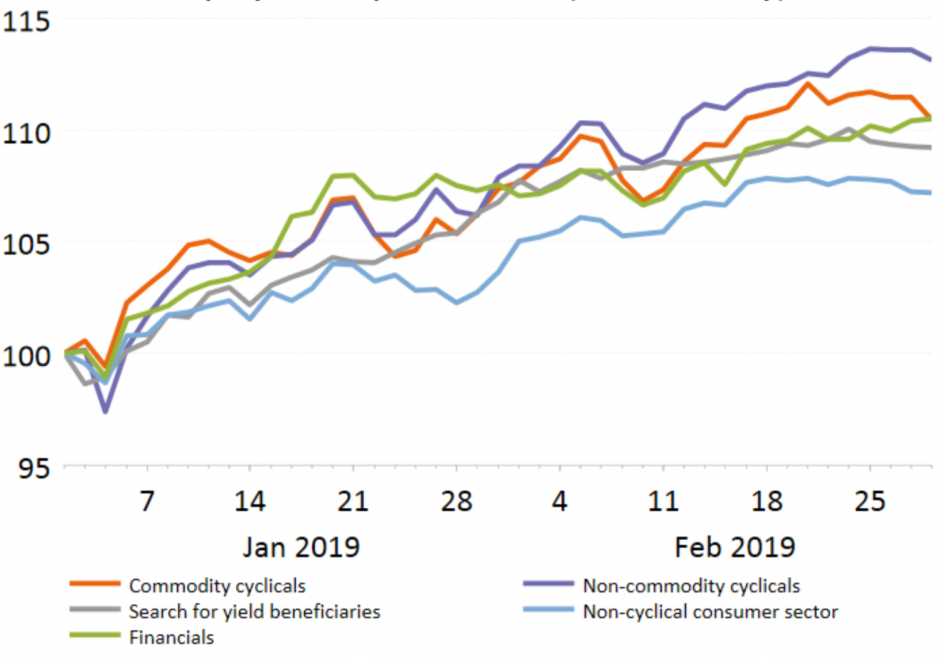

Equity sector performance (local currency)

Source: Thomson Reuters Datastream, NN Investment Partners

All sectors posted positive returns in February, with cyclical sectors doing particularly well. Technology and industrials, the two sectors that look most vulnerable to trade war escalation, soared during the month. This could indicate that the encouraging news flow on trade negotiations has started to affect investor behaviour. Energy and materials benefited from the rise in the industrial commodity prices and oil. Real estate was the laggard, as it received less support from declining bond yields.

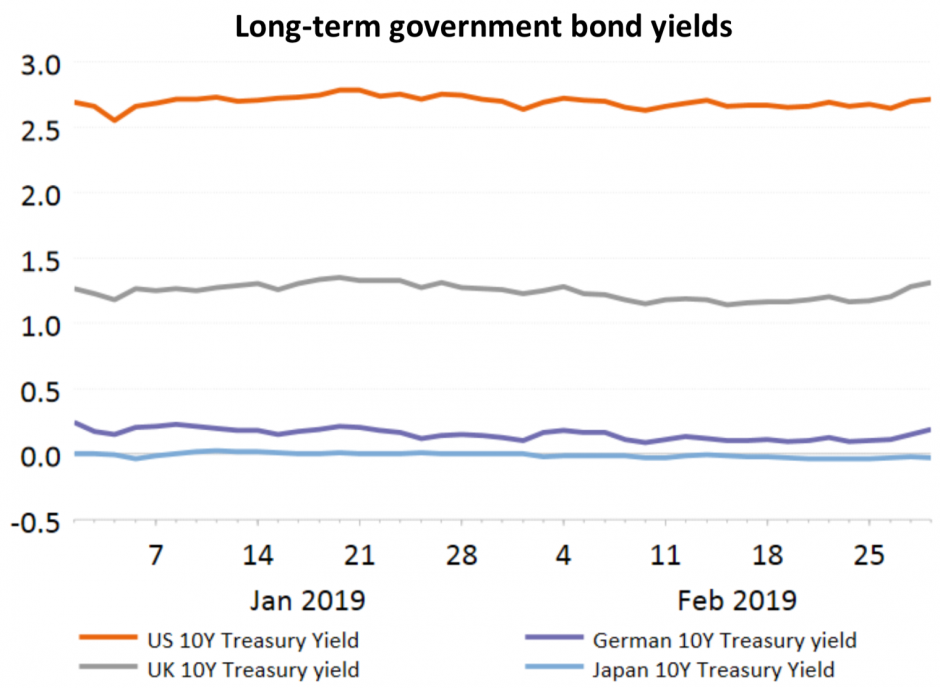

Fixed Income

Source: Thomson Reuters Datastream, NN Investment Partners

Safe government bond yields rose again in February following a period of constantly declining yields, either on growth worries or dovish central bank comments. In the US, the 10-year government bond yield rose by 9 bps in February, while the 10-year Bund yield rose by 3 bps. Other safe government bond yields, such as in Australia and New Zealand, declined further. The Italian 10-year yield rose by 16 bps in February, but the Spanish yield fell slightly (-2 bps).

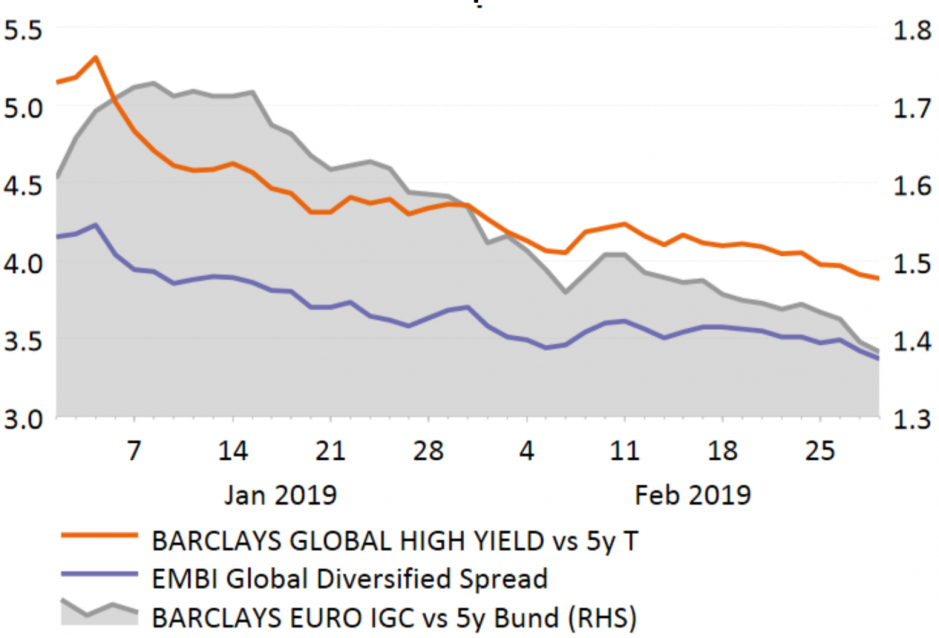

Credit spreads

Source: Thomson Reuters Datastream, NN Investment Partners

Fixed income spreads continued to benefit in February from the search-for-yield theme. We saw a further decline in spreads in both developed market corporate bonds and emerging market debt (EMD). For instance, euro investment-grade spreads fell by 14 bps, while euro high-yield spreads declined by 56 bps. Meanwhile, EMD hard currency sovereign spreads declined by 21 bps.

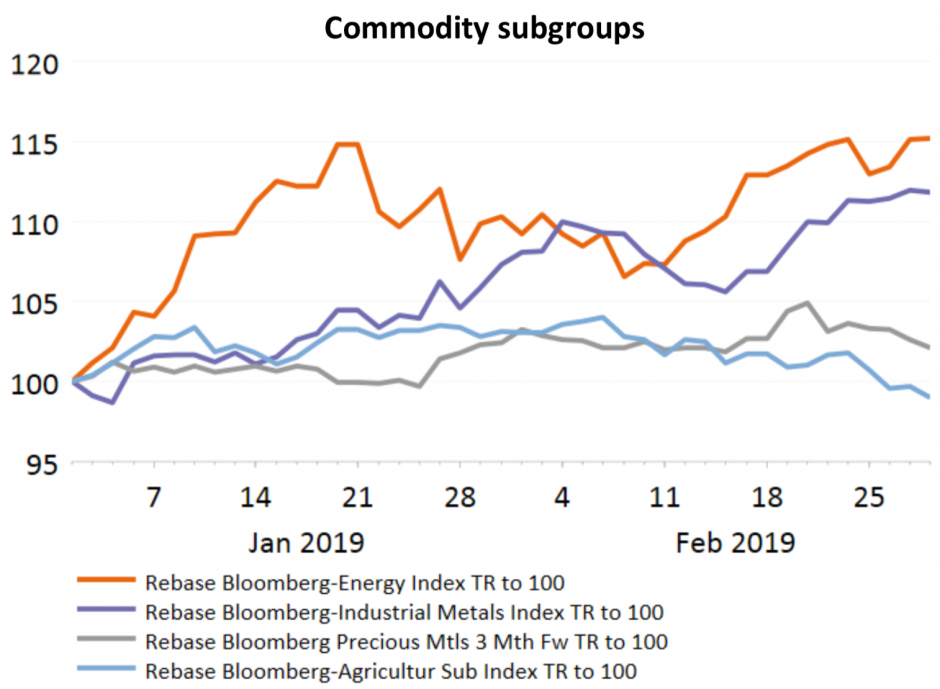

Commodities

Source: Thomson Reuters Datastream, NN Investment Partners

Commodities traded sideways in February after their January rally. With a US-China trade deal looking more likely, the cyclical commodity segments of energy and industrial metals continued to outperform. The outlook for stepped-up Chinese expansionary policies provided a further tailwind. Agriculture was the notable underperformer.

Diesen Beitrag teilen: